Last updated: July 27, 2025

Introduction

Ivermectin, initially developed as an antiparasitic agent, has garnered significant attention amid global health crises, notably the COVID-19 pandemic. While its primary use remains in veterinary medicine and parasitic infections, recent controversies and off-label claims have spurred renewed interest, affecting its market dynamics. This analysis examines the current market landscape for ivermectin, evaluates factors influencing its price trajectory, and provides future projections vital for pharmaceutical investors, healthcare policymakers, and stakeholders.

Current Market Landscape

Historical Overview and Approved Uses

Ivermectin, marketed under brands such as Stromectol by Merck, was first approved for human use in the 1980s for treating parasitic infections like onchocerciasis and strongyloidiasis. Its success in tropical disease eradication initiatives established a substantial market, especially in low-resource settings. The global market value was estimated at approximately USD 300 million in 2021, primarily driven by endemic regions in Africa, South America, and Southeast Asia [1].

Veterinary applications constitute a significant portion of ivermectin utilization, with the drug widely used in livestock for parasites control. The veterinary segment exceeds $1 billion globally, reflecting its broad application in animal health. However, human pharmaceutical sales face regulatory and ethical scrutiny amid off-label advocacy.

Market Dynamics Post-Pandemic

The COVID-19 pandemic recalibrated ivermectin’s market outlook. During 2020 and 2021, ivermectin gained widespread attention following claims of its potential efficacy against SARS-CoV-2. Though multiple clinical trials yielded mixed results and regulatory authorities like the FDA and EMA advised against its use outside clinical trials, the drug's demand spiked in certain markets, especially in regions with limited access to approved COVID-19 treatments [2].

Despite limited formal approval for COVID-19, ivermectin's off-label use and political endorsement caused supply shortages, affecting both human and veterinary markets. Notably, this surge led to stockpiling, price increases, and increased geopolitical interest.

Market Drivers and Constraints

Factors Bolstering Market Growth

-

Expanding Use in Parasitic Diseases: Continued high prevalence of parasitic infections in endemic zones sustains steady demand. The World Health Organization (WHO) estimates over 100 million cases of onchocerciasis globally, underpinning ivermectin's ongoing significance [3].

-

Increasing Veterinary Adoption: The necessity for parasite control in livestock and pets maintains a robust veterinary market. Market reports predict CAGR of approximately 5% for veterinary ivermectin through 2027 [4].

-

Emerging Resistance and New Formulations: Increasing resistance to existing formulations propels research into novel delivery mechanisms, expanding market options.

-

Potential Therapeutic Applications: Investigations into ivermectin's antiviral, anti-inflammatory, and anticancer properties could diversify its usage, heightening future demand.

Market Constraints

-

Regulatory Challenges: The lack of FDA or EMA approval for COVID-19 treatment limits formal market expansion. Moreover, regulatory crackdowns on off-label prescribing slightly dampen growth prospects.

-

Safety Concerns and Toxicity: Reports of adverse effects at high doses temper broad utilization. Regulatory agencies caution against unsupervised use, constraining market expansion.

-

Supply Chain Disruptions: COVID-19-induced manufacturing and logistics disruptions temporarily impacted availability.

-

Intellectual Property and Generics: The expiration of patent rights for several formulations facilitates generic entry, exerting downward pressure on prices.

Price Trends and Projections

Historical Price Movements

Historically, ivermectin's retail price has remained modest, averaging around USD 10-20 per treatment course for humans [5]. The drug’s affordability is a key factor in its wide usage in developing countries. During the COVID-19 demand surge, prices in some markets experienced transient elevation—up to 3- to 4-fold increases—due to scarcity and stockpiling [6].

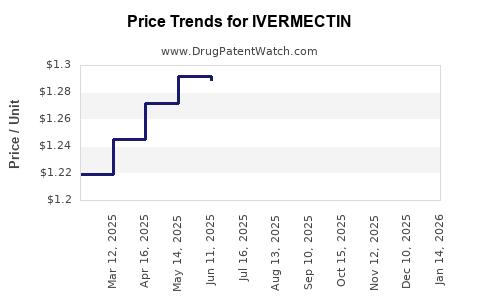

Current Pricing Landscape

As of 2023, with supply normalization and regulatory clarifications, prices have stabilized but remain sensitive to regional policies. In North America and Europe, private retail prices hover around USD 15-25 per course, closely aligned with generics. Veterinary formulations, especially large quantities for livestock, trade at significantly lower unit prices, often below USD 1 per dose.

Price Projections (2023-2030)

Based on market dynamics, regulatory outlooks, and emerging research:

-

Short-term (1-3 years): Prices are expected to stabilize around USD 15-25 per treatment course in developed markets. Minor fluctuations may occur in response to regional regulatory changes or supply chain adjustments.

-

Mid-term (3-5 years): If ivermectin gains formal approval or is adopted for new indications, demand could rise modestly, causing prices to inch upward—potentially 10-15%. Conversely, increased generic competition may exert downward pressure if patent expirations accelerate.

-

Long-term (5-10 years): The prospect of novel formulations and combination therapies could diversify applications, balancing price movements. Should resistance develop or new indications for antiviral use be approved, prices could rise by 20-30%. Otherwise, prevailing generic competition and manufacturing efficiencies may push prices downward or keep them stable.

It remains plausible that, in regions with high parasitic disease prevalence, ivermectin's affordability will sustain, though global average prices in developed markets could inch upward as demand stabilizes and supply chains optimize.

Future Opportunities and Risks

Opportunities:

-

Regulatory advancements for COVID-19 or other viral indications could elevate demand, with market size potentially doubling from current levels.

-

Development of sustained-release formulations and combination therapeutics might generate premium pricing.

-

Expanded veterinary applications, including in aquaculture and companion animals, could diversify revenue streams.

Risks:

-

Favorable regulatory decisions may be delayed or denied, capping market growth.

-

Emergence of resistant parasite strains could reduce efficacy, impacting demand.

-

Negative safety profiles or adverse event reports may lead to restrictions or reduced prescribing.

-

Competitive pressure from other antiparasitic agents, including newer drugs like moxidectin, can depress prices.

Regulatory and Market Considerations

Market access is significantly influenced by regional regulatory policies. While WHO promotes ivermectin in endemic areas, regulatory agencies in high-income countries maintain strict oversight, requiring approval for new indications. The off-label use controversy, despite asking for rigorously controlled research, continues to shape market perceptions.

Furthermore, patent expirations across numerous formulations induce an influx of generics, generally lowering prices but increasing market competition.

Key Takeaways

-

The ivermectin market remains steady, driven by endemic parasitic diseases, especially in developing regions, with substantial veterinary sector activity.

-

The COVID-19 pandemic temporarily disrupted supply and spurred price volatility; current prices have stabilized but remain vulnerable to regulatory and demand shifts.

-

Short-term price projections suggest stability with minor fluctuations; mid- and long-term movements depend heavily on regulatory decisions, resistance patterns, and research into new therapeutic uses.

-

Generics dominate the market, exerting downward pressure on prices; innovation in formulations and new indications could shift this dynamic.

-

Stakeholders should closely monitor regulatory developments, emerging clinical data, and market entry of alternative antiparasitic agents for strategic planning.

FAQs

1. Will ivermectin's price increase if it gains formal approval for COVID-19 treatment?

Yes, formal approval could significantly boost demand, pushing prices upward—potentially by 20-30%—especially if supply remains constrained during initial market entry phases.

2. How do patent expirations influence ivermectin's market prices?

Patent expirations facilitate generic manufacturing, increasing competition. This generally results in lower prices, making ivermectin more accessible, especially in resource-limited settings.

3. Are there emerging markets or indications that could expand ivermectin's use and impact prices?

Research into ivermectin's anti-inflammatory and antiviral properties could open new indications. If clinical trials establish efficacy and regulatory agencies approve these uses, demand—and potentially prices—may rise.

4. How has global supply chain disruption affected ivermectin availability recently?

Supply chain disruptions during the COVID-19 pandemic caused temporary shortages, leading to price spikes in some regions. Supply chains have largely normalized as manufacturing resumes.

5. What is the outlook for veterinary ivermectin prices over the next decade?

The veterinary segment is expected to sustain steady growth (~5% CAGR), with prices remaining relatively stable due to high demand and established manufacturing processes, unless new regulations or resistance issues emerge.

References

[1] MarketWatch, “Global Ivermectin Market Size, Share & Trends Analysis Report,” 2022.

[2] U.S. Food and Drug Administration, “Questions and Answers on Ivermectin,” 2021.

[3] World Health Organization, “Onchocerciasis Fact Sheet,” 2022.

[4] Grand View Research, “Veterinary Drugs Market Size & Trends,” 2022.

[5] IQVIA, “Pharmaceutical Pricing Insights,” 2022.

[6] Reuters, “COVID-19 and Ivermectin Market Fluctuations,” 2022.