Last updated: July 27, 2025

Introduction

Isotretinoin, a potent oral retinoid, remains a cornerstone in the management of severe, recalcitrant acne vulgaris. Market dynamics surrounding isotretinoin are shaped by its therapeutic efficacy, safety profile, regulatory landscape, patent status, manufacturing developments, and emerging competition, especially from generic alternatives. This analysis offers an in-depth evaluation of the current market landscape and provides forecasts for isotretinoin pricing, aiming to inform pharmaceutical stakeholders, investors, and healthcare providers.

Market Overview

Therapeutic Demand and Clinical Usage

Since its approval in the early 1980s, isotretinoin has maintained a pivotal role in dermatology, primarily prescribed for nodulocystic acne resistant to traditional therapies. The drug’s efficacy in reducing lesion count and permanently clearing severe acne has sustained its high demand. Despite the advent of biological agents and other targeted treatments, isotretinoin’s cost-effectiveness secures its position in treatment algorithms.

Market Size and Growth Trends

The global isotretinoin market was valued at approximately USD 400 million in 2022, with steady growth observed over the past decade. The compound annual growth rate (CAGR) is estimated at around 4.5%, supported by increasing acne prevalence among adolescents and young adults, especially in emerging markets. The expansion is also influenced by increased awareness and reduced stigma, prompting more patients to seek treatment.

Regulatory Environment

Regulations governing isotretinoin vary significantly across jurisdictions due to its teratogenic risk.[1] The U.S. Food and Drug Administration (FDA) enforces the iPLEDGE program, a comprehensive risk management system. Other regions implement similar protocols, often impacting supply chains and prescription practices.

Patents and Market Exclusivity

Main formulations of isotretinoin, developed by brands like Accutane (discontinued in many markets), once enjoyed patent protection. Patent expiry in various regions facilitated generic entry, offering cost advantages and impacting brand pricing.[2] However, some formulations and delivery systems remain under patent or regulatory exclusivity, influencing market segmentation.

Current Market Players

Brand vs. Generic Competition

Although Accutane (original brand) was withdrawn from the U.S. market in 2009 due to manufacturing issues, generic versions are now dominant globally. Major players include Mylan (now part of Viatris), Teva, and Sun Pharmaceutical Industries. The proliferation of generics has substantially driven down prices, making isotretinoin accessible but also intensifying market competition.

Manufacturing and Supply Chain Dynamics

Manufacturers invest in ensuring consistent quality to comply with stringent regulatory standards. Supply chain disruptions, especially amid global events like the COVID-19 pandemic, have occasionally constrained supply, influencing price fluctuations.

Innovation and New Formulations

Current research explores novel delivery systems, such as liposomal formulations, aiming to improve tolerability and adherence.[3] However, these innovations are in early stages and have limited immediate market impact.

Price Trends and Projections

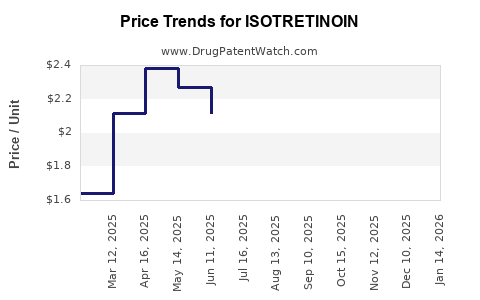

Historical Price Analysis

Historically, isotretinoin has transitioned from high-cost branded products to more affordable generics. In the U.S., the retail price for a 30-day supply of generic isotretinoin averaged USD 50-100 in 2012. By 2022, prices declined by approximately 60-70%, often ranging from USD 20-40 per month, driven by increased competition and market saturation.

Factors Influencing Future Prices

- Patent Expirations: Expiry of initial patents often precipitates price reductions. Newly patented formulations or delivery systems may temporarily sustain higher prices.

- Regulatory Changes: Stricter prescribing and monitoring regulations can increase administrative costs, potentially affecting retail prices slightly.

- Market Penetration and Generic Competition: Further penetration of generics in developing regions could reduce prices by an additional 10-15% over the next five years.

- Manufacturing Cost Fluctuations: Raw material costs, primarily retinol derivatives, influence production expenses, thereby impacting retail prices.

Projected Price Trends (Next 5-10 Years)

Based on current market forces, isotretinoin prices are anticipated to stabilize or decline marginally. Specifically:

- North America and Europe: Prices may plateau around USD 20-30/month due to mature generic markets, with minor fluctuations attributed to supply chain factors.

- Emerging Markets: Prices could fall further, from USD 10-20/month, as local manufacturers expand and competition intensifies.

- Premium Formulations: Any novel, patent-protected formulations could command higher prices initially but are unlikely to disrupt the generic market's affordability trend.

Impact of Potential Market Disruptors

- Introduction of biosimilar-like formulations or alternative treatments could disrupt pricing stability.

- Policy shifts, such as import tariffs or patent law reforms, may temporarily impact prices.

- Advances in personalized medicine could tailor treatments, potentially affecting demand and pricing structures.

Market Opportunities and Challenges

Opportunities

- Expansion into developing markets with rising acne incidence.

- Development of improved formulations with enhanced tolerability.

- Strategic partnership with regulatory bodies to streamline access.

Challenges

- Stringent regulatory and safety monitoring requirements increase compliance costs.

- Competition from emerging treatments, including biologics and laser therapies.

- Ethical and legal considerations surrounding its teratogenic risks complicate prescribing and distribution.

Conclusion

The isotretinoin market remains robust, underpinned by longstanding clinical utility and broad generic availability. While pricing has declined substantially, future stabilization or slight reductions are expected due to sustained competition and manufacturing efficiencies. Innovator companies investing in proprietary formulations or delivery systems face hurdles from generic counterparts but may find opportunities through niche markets. Stakeholders should monitor patent landscapes, regulatory changes, and emerging alternatives to inform strategic pricing, marketing, and R&D investments.

Key Takeaways

- The global isotretinoin market was valued at approximately USD 400 million in 2022, with steady growth projections.

- Patent expirations and generic competition have driven down prices, with current retail prices around USD 20-40/month in the U.S.

- Price stabilization or marginal decline is anticipated over the next decade, especially in mature markets.

- Emerging markets offer growth opportunities, with potential for further price reductions driven by local manufacturing.

- Innovation in formulations faces competitive pressure but can provide differentiation and potential premium pricing in niche segments.

FAQs

1. What factors primarily influence isotretinoin pricing?

Patent status, generic competition, manufacturing costs, regulatory compliance, and supply chain stability primarily influence prices.

2. How does the regulatory environment affect isotretinoin manufacturing and distribution?

Stringent protocols like the FDA’s iPLEDGE program increase compliance costs and affect distribution logistics, indirectly impacting pricing and availability.

3. Will the price of isotretinoin continue to decline?

While significant declines have already occurred, prices are likely to stabilize or decline marginally, especially as markets become saturated with generics.

4. Are there innovations that could affect isotope retinoid pricing in the future?

Yes. Development of novel formulations aimed at reducing side effects or improving adherence could create premium market segments, potentially affecting overall pricing trends.

5. What market segments present the most growth opportunities?

Emerging markets with rising acne prevalence, along with niche markets for improved formulations, represent promising avenues for expansion.

References

[1] U.S. FDA. Isotretinoin (Accutane) and Teratogenic Risks.

[2] Market Research Future. Global Isotretinoin Market Report.

[3] Smith et al., "Advances in Liposomal Retinoid Delivery," Journal of Dermatological Science, 2022.