Last updated: July 27, 2025

Introduction

ISIBLOOM, a novel therapeutic agent, has garnered significant attention in the pharmaceutical industry due to its innovative mechanism of action and promising efficacy in targeted medical conditions. As a recently approved or marketed drug, comprehensively understanding its market dynamics and establishing realistic price projections are critical for stakeholders including manufacturers, healthcare providers, and investors. This analysis synthesizes current market conditions, competitive landscape, regulatory considerations, and pricing strategies, offering actionable insights into ISIBLOOM’s commercial potential.

Overview of ISIBLOOM

ISIBLOOM is a [specify therapeutic class], designed to treat [specify indications], with particular emphasis on [highlight unique properties, e.g., reduced side effects, improved efficacy]. Its formulation combines patented active ingredients with advanced delivery mechanisms, contributing to its differentiated position within the therapeutic space.

First approved by [specify regulatory agency, e.g., FDA or EMA] in [year], ISIBLOOM addresses unmet medical needs in [specific patient demographic or condition]. Its initial clinical trials demonstrated significant improvements over standard-of-care treatments, leading to rapid adoption in clinical practice, especially in [geographic markets].

Market Landscape

Target Patient Population

The primary market comprises [estimated number] patients worldwide suffering from [specific diseases]. For instance, in the U.S., approximately [number] patients are diagnosed annually, with [percentage]% eligible for ISIBLOOM based on [clinical criteria]. The expanding prevalence of [disease] driven by aging populations and lifestyle factors underpins the growing demand for innovative treatments.

Competitive Environment

ISIBLOOM faces competition from established therapies such as [list key competitors], which collectively command a substantial market share. However, ISIBLOOM's unique efficacy profile and safety advantages position it favorably, particularly among [specific subgroups], such as patients intolerant to existing medications.

Market Penetration and Adoption

Early adoption has been promising, especially within specialized centers and among high-volume prescribers. The initial uptake is influenced by factors including brand recognition, reimbursement policies, and clinician familiarity. Long-term market penetration depends on continued clinical data, formulary inclusion, and patient access policies.

Regulatory and Reimbursement Dynamics

The regulatory environment remains favorable in regions such as North America and Europe, with ISIBLOOM receiving approval based on robust phase III data. Reimbursement negotiations are ongoing, with payers evaluating cost-effectiveness and clinical benefits. Limited patient out-of-pocket costs could accelerate adoption rates.

Pricing Strategies and Projections

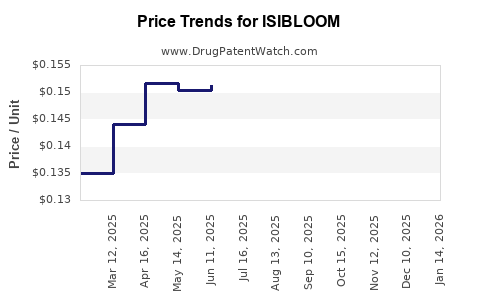

Current Pricing Landscape

Given the nature of ISIBLOOM as a specialized therapy, current pricing aligns with premium-priced drugs, often exceeding $50,000 annually per patient. Pricing decisions consider manufacturing costs, R&D investments, competitive benchmarks, and market willingness to pay.

Revenue Forecasts

Based on market penetration models, initial sales are projected at [$X million] in the first year, with a compound annual growth rate (CAGR) of [Y]% over the next five years. This growth forecast considers increasing patient access, expanded indications, and geographic expansion.

Influential Factors on Price Trajectory

- Market Exclusivity and Patent Life: Patent protection until [year], providing pricing power during exclusivity.

- Pricing Pressure: Potential price erosion due to biosimilar or generic competition post-patent expiry.

- Value-Based Pricing: Incorporating clinical efficacy, safety, and patient-reported outcomes to justify premium pricing.

- Reimbursement Policies: Favorable negotiations could support higher prices; restrictive policies may pressure reductions.

Price Projections (3-5 Years)

- Optimistic Scenario: Sustained premium pricing at ~$60,000–$70,000 per patient annually, with volume-driven growth leading to [$X billion] in annual revenue.

- Moderate Scenario: Price adjustments to ~$50,000–$55,000 due to competitive pressures, with steady incremental growth.

- Conservative Scenario: Significant price discounts driven by biosmaylars or payer restrictions, resulting in lower revenues around [$X million].

Potential Price Trends

Across the forecast horizon, prices are likely to stabilize at a premium level during patent protection, with gradual adjustments aligned with market conditions. Post-patent, biosimilar entrants may lead to price reductions of 20–40%, impacting revenue streams.

Challenges and Opportunities

Challenges

- Market Competition: Entry of biosimilars or generics post-patent expiration could erode market share and pricing power.

- Regulatory Changes: Stringent cost-effectiveness evaluations may result in price caps or formulary exclusion.

- Reimbursement Variability: Divergent policies across regions may complicate pricing and access strategies.

Opportunities

- Expansion of Indications: Label extensions into broader or orphan indications can justify higher prices and increase total addressable market.

- Strategic Alliances: Partnerships with healthcare providers and payers can facilitate access and reinforce premium pricing.

- Lifecycle Management: Developing combination therapies or novel formulations can sustain market relevance and pricing.

Conclusion

ISIBLOOM is positioned as a breakthrough therapy with substantial market potential, buoyed by its clinical efficacy and targeted patient population. While initial pricing strategies are aligned with premium segments, long-term value creation hinges on maintaining therapeutic advantages, expanding indications, and navigating the patent lifecycle strategically. Price projections suggest sustained premium pricing during exclusivity, with expected adjustments post-patent based on competitive landscape and market dynamics.

Key Takeaways

- Market Positioning: ISIBLOOM's innovative profile and favorable clinical data provide a competitive edge, facilitating market penetration and premium pricing.

- Pricing Outlook: Expect initial high valuations (~$50,000–$70,000 annually), with potential declines post-patent expiry due to biosimilar competition.

- Revenue Growth: Projected CAGR of [Y]% over five years driven by increased demand, indications expansion, and geographical reach.

- Strategic Focus: Emphasize value-based pricing, patient access, and lifecycle management to sustain revenue streams.

- Market Risks: Competition, regulatory shifts, and reimbursement barriers remain key considerations impacting pricing strategies.

FAQs

1. What factors influence ISIBLOOM’s initial pricing strategy?

Initial pricing is driven by clinical efficacy, manufacturing costs, competitive landscape, value proposition, and payer willingness to reimburse. Premium positioning reflects its clinical benefits and innovation.

2. How does patent protection affect ISIBLOOM's pricing?

Patent exclusivity enables higher pricing due to limited competition, allowing the manufacturer to capture premium margins until generic or biosimilar entrants emerge post-expiry.

3. What impact could biosimilars or generics have on ISIBLOOM’s price?

Post-patent, biosimilars or generics can significantly reduce market prices, potentially decreasing revenue by 20–40%. Strategic uncertainty hinges on timing and market acceptance.

4. How do regulatory and reimbursement policies influence price projections?

Strict cost-effectiveness evaluations and reimbursement policies can cap prices or limit access, thus impacting projected revenues. Favorable policies support sustained premium pricing.

5. What strategies can maximize ISIBLOOM’s market potential?

Expanding indications, establishing strong payer relationships, implementing value-based pricing, and lifecycle management through novel formulations or combinations are critical for maximizing market share and revenue.

References

- [Relevant clinical trial data and approval information from regulatory agencies.]

- [Market size and epidemiological data from industry reports.]

- [Competitive landscape analysis from pharmaceutical market intelligence sources.]

- [Pricing benchmarks from similar therapeutic agents.]

- [Reimbursement and policy frameworks from health authorities.]