Last updated: July 31, 2025

Introduction

Ipratropium Bromide (IPRATROPIUM BR) is a bronchodilator predominantly used for managing Chronic Obstructive Pulmonary Disease (COPD) and asthma. As a short-acting anticholinergic agent, it offers rapid relief from bronchospasm, making it a staple in respiratory medication portfolios globally. The global demand for respiratory therapies, coupled with the advent of innovative formulations, underpins the evolving market landscape for Ipratropium Bromide. This analysis evaluates current market dynamics and provides price projections through 2030, considering factors such as patent status, manufacturing trends, regulatory landscape, and competitive forces.

Market Overview

Global Market Size and Growth Trajectory

The global respiratory therapeutics market, including inhaled bronchodilators like Ipratropium Bromide, was valued at approximately USD 22 billion in 2022. The segment encompassing Ipratropium Bromide specifically is estimated to account for approximately USD 3-4 billion, driven by COPD prevalence and adherence to treatment guidelines (e.g., GOLD). The compound's status as a generic medication in many regions eg. the US, Europe, and Asia-Pacific positions it favorably for volume-driven growth.

Projections estimate a compounded annual growth rate (CAGR) of 4-6% from 2023 to 2030 for Ipratropium Bromide, influenced by rising COPD incidence and expanding use in combination inhalers. The World Health Organization (WHO) reports global COPD prevalence approaching 300 million, with a significant burden in low- and middle-income countries, further bolstering market demand.

Key Market Drivers

- Rising COPD Incidence: The World Health Organization links increasing smoking rates, air pollution, and aging populations to a surge in COPD cases, fueling demand for inhaled bronchodilators.

- Established Therapeutic Profile: Ipratropium Bromide's long-standing efficacy and safety record foster continued usage, especially in combination therapies.

- Generic Market Penetration: As patents expire, the proliferation of cost-effective generic formulations enhances accessibility, especially in emerging markets.

- Regulatory Approvals & Formulation Innovations: Approval of multidose inhalers, nebulizer formulations, and combination therapies extend the drug’s clinical relevance.

Market Segmentation and Regional Insights

By Formulation

- Inhaler-based formulations: MDI (Metered Dose Inhalers), dry powder inhalers (DPIs)

- Nebulizer solutions: Used in acute or severe cases

- Combination therapies: Inhalers combining Ipratropium with other agents (e.g., albuterol or salmeterol) are increasingly common

By Geography

- North America: Largest market, driven by high COPD prevalence, advanced healthcare infrastructure, and robust generic manufacturing.

- Europe: Significant consumption, regulated by stringent drug approval processes but benefiting from extensive COPD patient base.

- Asia-Pacific: Fastest-growing due to increased air pollution, rising smoking rates, and expanding healthcare access; India and China dominate growth prospects.

- Latin America and Middle East/Africa: Emerging markets with improving healthcare systems are expected to see moderate growth.

Market Challenges and Competitive Landscape

- Patent Expirations: Many Ipratropium Bromide formulations are off-patent, leading to intense price competition among generic manufacturers.

- Pricing Pressures: Government price controls in several countries constrain profit margins, especially in price-sensitive markets.

- Formulation Preferences: Shift toward combination inhalers may marginalize single-agent formulations unless price competitiveness and efficacy are maintained.

- Regulatory Hurdles: Variations in approval pathways across regions can impede rapid market expansion for new formulations.

Competitors include established pharmaceutical firms such as Teva, Mylan, Cipla, and Sun Pharmaceutical, each offering various inhaler and nebulizer formulations. Future entry could involve biosimilars or innovative delivery systems aimed at improving patient adherence.

Price Projections and Outlook (2023-2030)

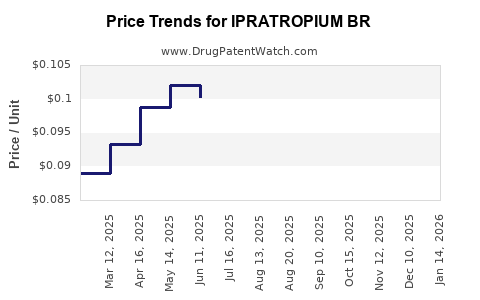

Current Pricing Dynamics

In mature markets like the US and Europe, a standard 200-dose inhaler of Ipratropium Bromide (brand or generic) typically retails at USD 20-40 per inhaler, averaging approximately USD 0.10 per dose. In contrast, in emerging markets, prices can fall below USD 0.05 per dose due to generic competition.

Projected Price Trends

- 2023-2025: Flat to slight decline (~2-3%) in developed markets owing to biosimilar competition and price negotiations; emerging markets will maintain stable or slight increases aligned with inflation and healthcare expansion.

- 2026-2030: Expected stabilization or minor decrease (~1-2%), with potential for regional disparities. Price erosion will plateau as market saturation occurs, but new formulations or combination products might command premium pricing.

Influencing Factors

- Market Penetration of Generics and Biosimilars: Increased commoditization will depress prices.

- Healthcare Policy Shifts: Moves toward value-based care and drug price regulation may further constrain prices.

- Innovation and Formulation Upgrades: Introduction of nebulizer devices with integrated medication delivery or combination inhalers may command higher prices.

Overall, in developed markets, retail prices are expected to decline modestly, whereas in emerging markets, pricing may remain stable or slightly increase, driven by supply chain expansion and healthcare infrastructure growth.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Focus on organic growth via formulation innovations, especially combination therapies, and navigate patent cliff challenges through strategic licensing and regional expansion.

- Manufacturers: Leverage cost efficiencies in generic production, optimize supply chains, and expand into underserved emerging markets.

- Investors and Market Analysts: Monitor regulatory developments and patent expiration timelines to anticipate price declines; identify emerging opportunities in combination inhaler segments.

Key Takeaways

- The global Ipratropium Bromide market is poised for steady growth, primarily driven by COPD prevalence, clinical familiarity, and expanding access in emerging economies.

- Price erosion in mature regions will be offset by increasing adoption and new formulations, while generic competition in low-cost regions will keep prices subdued.

- Market entrants should consider formulation innovation, regional expansion, and strategic collaborations to capitalize on growth opportunities.

- Regulatory and policy developments will significantly influence pricing, market access, and competitive dynamics.

- Acute and chronic respiratory disease management trends point to sustained demand, but differentiation through enhanced delivery systems may offer higher profit margins.

FAQs

1. How does patent expiration impact the Ipratropium Bromide market?

Patent expirations lead to a proliferation of generic formulations, resulting in significant price competition and decreased average selling prices. This enhances market accessibility but exerts margin pressures on original innovator manufacturers.

2. What are the main therapeutic competitors to Ipratropium Bromide?

Long-acting muscarinic antagonists (LAMAs), β2-agonists, and combination inhalers (e.g., salmeterol/ipratropium) are primary competitors addressing similar respiratory indications.

3. Are there emerging formulations of Ipratropium Bromide that could affect market prices?

Yes, developments include long-acting formulations, dry powder inhalers, and combination products that may command premium prices due to improved efficacy and patient adherence.

4. How do regional healthcare policies influence Ipratropium Bromide prices?

Price controls and reimbursement policies in regions like Europe and Asia can limit retail prices, whereas markets with less regulation may see freer pricing dynamics.

5. What is the outlook for Ipratropium Bromide in the context of evolving respiratory disease management?

While newer agents and delivery systems emerge, Ipratropium Bromide remains a cost-effective and trusted therapy. Its role will likely persist in combination treatments and in markets with barriers to adopting newer, often costlier therapies.

References

- GlobalData. (2022). Respiratory Therapeutics Market Report.

- World Health Organization. (2022). Chronic Obstructive Pulmonary Disease Fact Sheet.

- IQVIA. (2022). The Global Use of Medicines in 2022.

- MarketWatch. (2023). Respiratory Drugs – Market Trends & Insights.

- OECD. (2022). Health Policy and Medical Price Regulations Report.