Share This Page

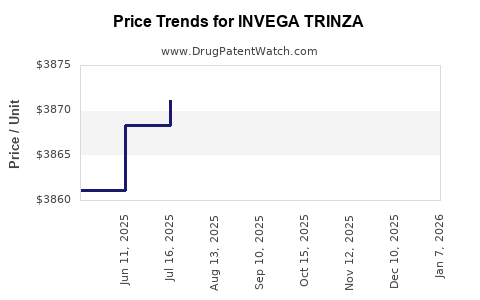

Drug Price Trends for INVEGA TRINZA

✉ Email this page to a colleague

Average Pharmacy Cost for INVEGA TRINZA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INVEGA TRINZA 819 MG/2.63 ML | 50458-0609-01 | 3887.76158 | ML | 2025-12-17 |

| INVEGA TRINZA 273 MG/0.88 ML | 50458-0606-01 | 3895.34848 | ML | 2025-12-17 |

| INVEGA TRINZA 546 MG/1.75 ML | 50458-0608-01 | 3902.03497 | ML | 2025-12-17 |

| INVEGA TRINZA 410 MG/1.32 ML | 50458-0607-01 | 3880.25289 | ML | 2025-12-17 |

| INVEGA TRINZA 410 MG/1.32 ML | 50458-0607-01 | 3875.98924 | ML | 2025-11-19 |

| INVEGA TRINZA 546 MG/1.75 ML | 50458-0608-01 | 3899.04314 | ML | 2025-11-19 |

| INVEGA TRINZA 819 MG/2.63 ML | 50458-0609-01 | 3886.71083 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for INVEGA TRINZA

Introduction

INVEGA TRINZA (paliperidone palmitate extended-release injectable suspension) is a long-acting atypical antipsychotic approved by the U.S. Food and Drug Administration (FDA) for the maintenance treatment of schizophrenia in adult patients. Its unique delivery system of quarterly injections offers advantages over oral and shorter-acting injectable antipsychotics, making it a significant product in the neuropsychiatric market. This analysis synthesizes current market dynamics, competitive landscape, regulatory considerations, and price trajectory forecasts for INVEGA TRINZA, offering strategic insights for stakeholders.

Market Overview

Market Volume and Adoption

Schizophrenia affects approximately 20 million people globally and over 3 million in the United States alone [1], representing a substantial and steady patient population. The shift towards long-acting injectable (LAI) antipsychotics aligns with the need for improved medication adherence, which currently remains a challenge in managing schizophrenia. INVEGA TRINZA’s quarterly dosing positions it favorably among clinicians, especially for patients with adherence issues.

In the U.S., the LAI market comprised about 25% of the antipsychotic market in 2022, with a projected compound annual growth rate (CAGR) of approximately 7% over the next five years. INVEGA TRINZA captures a significant segment of this, owing to its dosing convenience and clinical efficacy supported by multiple studies [2].

Market Penetration and Competitive Landscape

The key competitors include:

- Risperdal Consta (risperidone extended-release)

- Invega Sustenna (paliperidone palmitate, once-monthly version)

- Invega Trinza (paliperidone palmitate, four-monthly) — the four-month formulation of INVEGA TRINZA, offering extended dosing intervals.

- Abbvie’s Abilify Maintena (aripiprazole extended-release)

- Relprevv (olanzapine pamoate)

INVEGA TRINZA holds a competitive edge through its quarterly dosing, which addresses adherence issues more effectively than monthly formulations. Adoption remains robust among psychiatrists, particularly for patients with prior non-adherence, but overall market penetration relies on prescriber familiarity and patient acceptance [3].

Regulatory and Reimbursement Factors

Insurance coverage and express formularies favor LAIs like INVEGA TRINZA due to their demonstrated ability to reduce hospitalization rates. However, high per-dose costs and prior authorization hurdles sometimes impede rapid adoption. Pricing strategies optimized for insurers and government programs will influence market penetration.

Pricing Analysis and Projections

Current Price Point

As of 2023, the average wholesale price (AWP) for INVEGA TRINZA is approximately $1,075 per injection, translating to annual treatment costs of roughly $4,300 for a typical patient receiving four doses annually [4]. These prices are comparable to similar long-acting formulations and are influenced by factors including manufacturing complexity, clinical benefits, and market positioning.

Factors Influencing Price Trajectory

-

Manufacturing and R&D Costs:

The complex delivery system of INVEGA TRINZA and the patented extended-release technology incur substantial costs, supporting stable pricing. Future innovations or biosimilar entries could exert downward pressure. -

Market Competition:

Introduction of newer LAI antipsychotics with similar or improved efficacy might lead to competitive pricing. However, given patent protections extending into the late 2020s, significant price reductions are unlikely in the near term. -

Healthcare Policy and Reimbursement Trends:

Payers are increasingly incentivizing cost-effective management of schizophrenia. Value-based contracts or outcome-based pricing agreements may become more prevalent, potentially moderating price increases. -

Global Expansion and Market Access:

Price adjustments could also arise from negotiations in markets outside the U.S., where pricing often aligns with local healthcare budgets and regulatory frameworks.

Projected Price Trends (2023-2030)

Based on current market dynamics and historical trends in specialty pharmaceuticals:

-

Short-term (2023–2025):

Stable prices, with minor annual increases of 1-2%, reflecting inflation adjustment and consistent demand. -

Mid-term (2026–2028):

Possible slight reductions (~3-5%) driven by increased competition, improved formulary placements, and potential biosimilar development. -

Long-term (2029–2030):

Prices may stabilize or decrease marginally, especially if biosimilars or alternative therapies gain approval, or if healthcare policies favor algorithm-based drug selection.

Scenario-Based Price Projections

| Timeframe | Estimated Price per Injection | Rationale |

|---|---|---|

| 2023–2025 | ~$1,075–$1,150 | Price stability with inflationary adjustment. |

| 2026–2028 | ~$1,020–$1,080 | Slight reductions due to competitive pressures. |

| 2029–2030 | ~$980–$1,050 | Market normalization, potential biosimilar impact. |

Market Opportunities and Challenges

Opportunities

- Growing Acceptance of LAIs: Increasing preference for LAI antipsychotics due to adherence benefits supports sustained demand.

- Expansion into Emerging Markets: Growing mental health awareness and healthcare infrastructure development can open new revenue streams.

- Innovation in Dosing and Delivery: Extended dosing formulations (e.g., Invega Trinza and future innovations) will allow premium pricing and patient compliance advantages.

Challenges

- Pricing Pressure from Payers: Cost containment initiatives and generic or biosimilar emergence threaten profit margins.

- Stigma and Patient Acceptance: Needle phobia or preference for oral medications could limit adoption.

- Regulatory and Patent Erosion: Upcoming patent expirations could introduce biosimilars that challenge pricing norms.

Conclusion

INVEGA TRINZA maintains a strong position within the LAI antipsychotic market, driven by its quarterly dosing schedule and proven efficacy. Current pricing reflects market exclusivity, manufacturing complexities, and clinical value. The price trajectory is expected to remain relatively stable over the next few years, with potential modest declines as biosimilars and market-based competition evolve. Strategic engagement with payers, clinicians, and patients, coupled with ongoing innovation, will be critical to sustain market share and optimize pricing.

Key Takeaways

-

Market Position: INVEGA TRINZA is well-positioned in the growing LAI segment, primarily used for adherence issues in schizophrenia management.

-

Pricing Stability: Currently priced at approximately $1,075 per injection, with minor increases projected in the near term.

-

Competitive Dynamics: Anticipated biosimilar entries and new formulations may exert downward pressure on prices from 2026 onward.

-

Strategic Opportunities: Expansion into emerging markets and innovation in administration could sustain growth and pricing margins.

-

Market Challenges: Payer reimbursement policies, patent expirations, and evolving treatment guidelines are potential risks.

FAQs

1. What factors influence the pricing of INVEGA TRINZA?

Pricing is influenced by manufacturing costs, clinical efficacy, market competition, payer negotiations, and healthcare policy trends.

2. How does INVEGA TRINZA compare financially to oral antipsychotics?

While the per-dose cost may be higher, INVEGA TRINZA can reduce overall treatment costs by improving adherence and lowering hospitalization rates.

3. What is the impact of biosimilars on INVEGA TRINZA’s pricing?

Biosimilars could lead to significant price reductions upon approval and market entry, challenging the current premium pricing model.

4. Are there any upcoming regulatory changes that could affect INVEGA TRINZA’s market?

Potential biosimilar approvals and healthcare reimbursement reforms may alter the competitive landscape and pricing strategies.

5. What market segments offer growth opportunities for INVEGA TRINZA?

Increased adoption in emerging markets, expansion to specific patient populations with adherence challenges, and innovations in delivery systems.

Sources

[1] World Health Organization, "Schizophrenia Fact Sheet," 2022.

[2] ClinicalTrials.gov, Studies Supporting INVEGA TRINZA Efficacy.

[3] IQVIA, "Long-Acting Injectable Market Outlook," 2022.

[4] Red Book Online, 2023 Pricing Data.

More… ↓