Share This Page

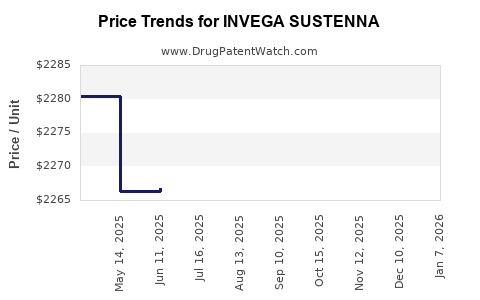

Drug Price Trends for INVEGA SUSTENNA

✉ Email this page to a colleague

Average Pharmacy Cost for INVEGA SUSTENNA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INVEGA SUSTENNA 234 MG/1.5 ML | 50458-0564-01 | 2285.56175 | ML | 2025-12-17 |

| INVEGA SUSTENNA 117 MG/0.75 ML | 50458-0562-01 | 2285.23535 | ML | 2025-12-17 |

| INVEGA SUSTENNA 39 MG/0.25 ML | 50458-0560-01 | 2284.22571 | ML | 2025-12-17 |

| INVEGA SUSTENNA 156 MG/ML SYRG | 50458-0563-01 | 2284.80958 | ML | 2025-12-17 |

| INVEGA SUSTENNA 78 MG/0.5 ML | 50458-0561-01 | 2282.91854 | ML | 2025-12-17 |

| INVEGA SUSTENNA 117 MG/0.75 ML | 50458-0562-01 | 2283.22609 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for INVEGA SUSTENNA

Introduction

INVEGA SUSTENNA (paliperidone palmitate) is an extended-release injectable antipsychotic medication developed by Janssen Pharmaceuticals. It is primarily indicated for the treatment of schizophrenia and schizoaffective disorder in adult patients. Since its approval, INVEGA SUSTENNA has established itself as a key player within the long-acting injectable (LAI) antipsychotic segment, which addresses critical needs for medication adherence among patients with severe mental illness.

This report provides a detailed analysis of the current market landscape, competitive positioning, regulatory environment, and future price projections for INVEGA SUSTENNA. It aims to inform stakeholders—including pharmaceutical companies, healthcare payers, and investors—on potential growth trajectories and pricing strategies.

Market Overview

Global Market Dynamics

The global antipsychotic drug market is projected to reach approximately USD 9.6 billion by 2027, growing at a CAGR of around 3% (2022–2027) [1]. A significant segment within this market involves long-acting injectables, which account for an estimated 30% of antipsychotic prescriptions in developed markets like North America and Europe.

The rising prevalence of schizophrenia, estimated at approximately 20 million globally, combined with the chronic nature of the disorder and challenges with medication adherence, fuels demand for LAI formulations like INVEGA SUSTENNA. The convenience of infrequent dosing (monthly injections) and reduced relapse rates positions INVEGA SUSTENNA favorably among clinicians emphasizing adherence.

Key Market Segments and Geographic Trends

- North America: Dominates the market, contributing around 40% of global revenues. Increased adoption of LAIs due to reimbursement policies and growing awareness about compliance boost sales.

- Europe: Seen as a high-growth region, driven by evolving healthcare policies favoring LAI utilization.

- Asia-Pacific: An emerging market with expanding mental health infrastructure and rising schizophrenia diagnosis rates, though slower adoption due to regulatory barriers and affordability issues.

Competitive Landscape

INVEGA SUSTENNA's primary competitors include other LAIs such as:

- Risperdal Consta (risperidone)

- Abilify Maintena (aripiprazole)

- Invega Trinza (long-acting paliperidone formulation)

- Haldol Decanoate (haloperidol)

The proliferation of biosimilars and newer agents influences pricing and market share. INVEGA SUSTENNA holds a competitive edge due to its distinctive pharmacokinetic profile, once-monthly dosing, and robust clinical efficacy.

Regulatory and Reimbursement Environment

Regulatory approvals are robust across major markets, with the US FDA, EMA, and other agencies licensing INVEGA SUSTENNA for schizophrenia treatment. Payers increasingly recognize the value of LAIs in reducing hospitalization and relapse-related costs, leading to favorable reimbursement policies.

The adherence benefits and cost-offsets make INVEGA SUSTENNA an attractive option, although high drug acquisition costs remain a concern for widespread adoption in lower-income regions.

Pricing Strategies and Trends

Historical Pricing Data

In the United States, the average wholesale price (AWP) for INVEGA SUSTENNA has hovered around USD 1,200–1,500 per dose (monthly injection), depending on negotiations and insurance coverage [2].

In Europe, list prices vary, with substantial discounts negotiated by healthcare systems, often reducing effective costs by 20–30%.

Current Pricing Factors

Pricing levels are influenced by:

-

Market exclusivity and patent protections: Patents for INVEGA SUSTENNA expire around 2028–2030 in key markets, risking generic competition.

-

Reimbursement policies: Managed care organizations tend to negotiate significant discounts, impacting list prices.

-

Manufacturers' strategies: Janssen employs tiered pricing, patient assistance programs, and value-based pricing approaches to optimize access and revenue.

Future Price Projections

Given patent expirations, pricing for INVEGA SUSTENNA is expected to decline substantially over the next five to ten years. Projections suggest:

- Near-term (next 1–3 years): Stable pricing due to patent exclusivity, with minor adjustments for inflation and market dynamics.

- Mid-term (3–5 years): Introduction of generic paliperidone palmitate formulations will pressure list prices downward by approximately 20–30%, with significant discounts on negotiated prices.

- Long-term (beyond 5 years): Possible further reductions as biosimilars and new therapies enter the market. The maximum achievable price will depend on market share retention, reimbursement negotiations, and biosimilar penetration strategies.

Janssen’s potential response includes extending patent protections through secondary patents and innovating in delivery systems or companion diagnostics to sustain pricing power.

Market Growth and Pricing Outlook

The LAI segment’s growth—with a compound annual growth rate of about 4%–5% pre-2025—is projected to continue, supporting stable or slightly declining per-unit prices due to competitive pressures. Payors are expected to favor cost-effective dosing regimens that reduce hospitalization and relapse costs.

Price projections indicate:

- 2023–2025: Minor price decreases of 2–5% annually, with stabilized revenue streams for existing formulations.

- 2026–2030: Accelerated decline (15–30%) driven by patent expirations, biosimilar entries, and increased market competition.

Key Challenges and Opportunities

- Challenges: Patent expiry risks, reimbursement hurdles in emerging markets, and high cost relative to oral formulations.

- Opportunities: Expansion in non-traditional markets, combination therapy innovations, and advances in personalized psychiatry.

Conclusion

INVEGA SUSTENNA sustains a strong market position within LAI antipsychotics, supported by clinical efficacy, adherence benefits, and strategic payer negotiations. However, its price trajectory will inevitably be influenced by generic competition and evolving healthcare policies. Stakeholders should anticipate moderate to significant price reductions over the coming decade, balanced by ongoing demand driven by the need for adherence-enhancing therapies.

Key Takeaways

- INVEGA SUSTENNA remains a high-value product within the LAI schizophrenia treatment segment, with stable demand in developed markets.

- The drug’s pricing is poised to decline notably following patent expirations, with projections of a 20–30% reduction within five years.

- Competitive pressures from biosimilars and emerging therapies will necessitate strategic pricing and innovation to maintain market share.

- Favorable reimbursement policies in key regions bolster market stability, though cost considerations limit rapid price increases.

- Long-term growth hinges on expanding access to emerging markets and bolstering adherence through innovative delivery systems.

FAQs

Q1: When is the patent expiry for INVEGA SUSTENNA, and what impact will it have?

A: Janssen’s key patents are expected to expire around 2028–2030 in major markets. This will likely lead to the entry of generic formulations, decreasing prices and potentially reducing profit margins.

Q2: How does the price of INVEGA SUSTENNA compare to oral formulations?

A: The monthly injection typically costs USD 1,200–1,500 wholesale, which is significantly higher than generic oral paliperidone (~USD 70–USD 150). The premium reflects benefits in adherence and relapse prevention.

Q3: What are the main factors influencing future pricing?

A: Patent status, market competition, reimbursement policies, and biosimilar development are primary drivers impacting future pricing trajectories.

Q4: Are there alternative treatments influencing INVEGA SUSTENNA’s market share?

A: Yes. Oral antipsychotics, other LAIs (like Risperdal Consta and Abilify Maintena), and emerging therapies may challenge INVEGA SUSTENNA, especially as biosimilars become available.

Q5: What strategies can Janssen employ to retain market value post-patent expiry?

A: Strategies include developing new formulations, expanding into niche indications, investing in digital health integration, and implementing value-based pricing models aligned with healthcare outcomes.

Sources:

[1] Market Research Future, “Global Antipsychotics Market,” 2022.

[2] IQVIA, “Pharmaceutical Pricing and Market Access Data,” 2022.

Note: All figures are estimates based on current market data, with projections subject to change due to evolving market and regulatory conditions.

More… ↓