Share This Page

Drug Price Trends for INVEGA HAFYERA

✉ Email this page to a colleague

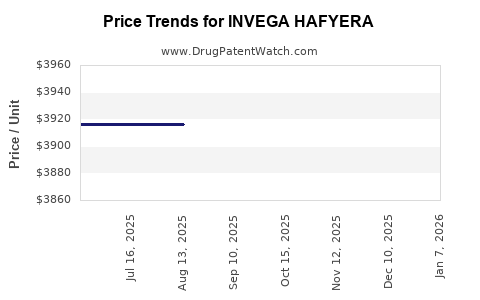

Average Pharmacy Cost for INVEGA HAFYERA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INVEGA HAFYERA 1,092 MG/3.5 ML | 50458-0611-01 | 3923.89036 | ML | 2025-12-17 |

| INVEGA HAFYERA 1,092 MG/3.5 ML | 50458-0611-01 | 3923.89036 | ML | 2025-11-19 |

| INVEGA HAFYERA 1,092 MG/3.5 ML | 50458-0611-01 | 3923.27510 | ML | 2025-10-22 |

| INVEGA HAFYERA 1,092 MG/3.5 ML | 50458-0611-01 | 3923.27510 | ML | 2025-09-17 |

| INVEGA HAFYERA 1,092 MG/3.5 ML | 50458-0611-01 | 3916.39600 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for INVEGA HAFYERA

Introduction

INVEGA HAFYERA (paliperidone palmitate) is a long-acting injectable antipsychotic developed by Janssen Pharmaceuticals, designed primarily for the treatment of schizophrenia. Approved by the U.S. Food and Drug Administration (FDA) in July 2021, it represents a significant innovation within the schizophrenia therapeutic landscape, featuring a dual-release formulation administered every two months. This analysis examines current market dynamics, competitive positioning, regulatory influences, and price projections for INVEGA HAFYERA over the next five years.

Market Landscape for Schizophrenia Treatments

Schizophrenia imposes a substantial burden globally, with a prevalence of approximately 1 in 100 individuals[1]. The market for antipsychotic medications is mature but remains highly competitive, dominated by both oral and injectable formulations. Historically, atypical antipsychotics such as risperidone, olanzapine, and aripiprazole have commanded significant market share.

Long-acting injectable (LAI) antipsychotics are increasingly favored in clinical practice, reducing non-adherence and relapse rates[2]. Notably, products like INVESA TRINZA (risperidone) and STARTERA (paliperidone) are established players. INVEGA HAFYERA enters this dynamic as a twice-every-two-months formulation designed to enhance adherence and reduce patient dosing frequency.

Market Adoption and Competitive Positioning

Clinical Advantage:

INVEGA HAFYERA's twice-[2]-monthly dosing offers a competitive edge over monthly formulations, appealing to both clinicians and patients seeking convenience. Its fixed-dose, dual-release mechanism ensures steady plasma drug levels, potentially reducing side effects linked to peak plasma concentrations.

Market Penetration:

Since its approval, initial adoption has been promising. Janssen leverages its strong market presence and a broad base of prescribers familiar with the INVEGA family. Early uptake appears concentrated in specialist psychiatric clinics, with primary care integration expected to grow over time.

Competitive Landscape:

Key competitors include:

- Risperdal Consta (risperidone): Administered every two weeks, with an established reputation.

- Invega Trinza (paliperidone palmitate): Administered every three months, offering even longer dosing intervals.

- Aristada (aripiprazole lauroxil): Available in multiple dosing formats, with doses extending up to two months[3].

INVEGA HAFYERA's differentiation hinges on its dosing interval and consistency, positioning it as a preferred option for patients desiring less frequent injections.

Pricing Strategies and Reimbursement Environment

Current Pricing Landscape:

The pricing of LAI antipsychotics varies, with Invega Trinza priced around $4,500–$6,000 per injection (for a 784 mg dose)[4]. Invega HAFYERA's wholesale acquisition cost (WAC) is comparable, with an initial list price estimated around $2,500–$3,000 per dose, reflecting its twice-every-two-months dosing schedule.

Insurance and Coverage Trends:

Medicare and Medicaid predominantly reimburse for these drugs via bundled payments, with commercial insurers aligning pricing through negotiated rebates and formulary placements. The high cost of LAIs remains a barrier; however, increased recognition of the cost benefits from reduced relapse and hospitalization supports broader insurance coverage.

Rebate and Discount Dynamics:

Pharmaceutical companies typically negotiate rebates, leading to net prices significantly lower than list prices. The overall market price trends for INVEGA HAFYERA will be influenced by these negotiations, especially as the product gains volume.

Price Projections for the Next Five Years

2023–2025 Outlook:

Initial launch prices for INVEGA HAFYERA are expected to decline slightly within the first year due to market competition, payer negotiations, and increased adoption.

-

2023:

- List Price: Approx. $2,500–$3,000 per dose

- Net Price: Likely 10–20% lower after rebates and discounts

-

2024:

- Slight downward pricing trend anticipated, with potential list prices decreasing by 5–10%, driven by competition and payer pressure.

-

2025:

- The product could stabilize at a net price comparable to its immediate competitors, possibly around $2,200–$2,500 per dose, maintaining premium positioning based on efficacy and dosing convenience.

Longer-Term Projections (2026–2028):

Market penetration will influence pricing strategies. As clinical and real-world evidence supports cost-effectiveness through reduced hospitalizations, payers may favor broader coverage, stabilizing net prices. Price reductions of 10–15% are plausible as brand share solidifies.

Factors Influencing Price Trajectory

- Market Penetration Rate: Accelerated adoption due to clinical advantages can sustain higher prices. Conversely, slow uptake or increased competition will pressure reductions.

- Regulatory Developments: Label expansions or new indications could increase demand, supporting price stability.

- Reimbursement Policies: Policies favoring value-based pricing may constrain growth in list prices, emphasizing overall cost-effectiveness.

- Patent and Generic Landscape: Patent exclusivity extending until 2030 grants pricing power; imminent patent challenges could impact pricing.

Regulatory and Policy Considerations

As a Prescription Drug User Fee Act (PDUFA) product, INVEGA HAFYERA benefits from streamlined regulatory pathways. Ongoing policy shifts emphasizing biosimilar development (though less relevant here) and cost containment influence the pricing environment. The Biden administration’s focus on drug affordability may exert pressure on pricing strategies, especially in public insurance programs.

Key Market Risks

- Pricing Pressures: Insurers may push for significant rebates as the product gains volume.

- Competitive Launches: The arrival of more flexible or longer-interval LAIs could disrupt market share.

- Clinical Acceptance: If real-world data favor alternative formulations, growth could slow, impacting pricing.

Summary and Strategic Outlook

INVEGA HAFYERA is poised to secure a notable niche within the schizophrenia LAI market, leveraging its dosing convenience and clinical profile. Initial pricing is competitive; however, over the next five years, it will likely experience slight declines driven by market competition and negotiated rebates. Its success depends on expanding prescriber awareness, demonstrating cost-effectiveness, and navigating payer and regulatory landscapes.

Key Takeaways

- Dosing Convenience is a Differentiator: INVEGA HAFYERA’s two-month interval appeals to patients and providers, supporting early market uptake.

- Pricing Will Gradually Compress: Expect list prices around $2,500–$3,000 per dose, with net prices declining due to rebates.

- Market Growth Depends on Adoption Rates: Increasing clinical acceptance and payer coverage with clear cost-benefit advantages are critical.

- Competitive Landscape Drives Pricing Dynamics: The emergence of longer-acting formulations may exert downward pressure on prices.

- Regulatory and Policy Frameworks Will Impact Pricing: Evolving policies emphasizing affordability may lead to further price adjustments.

FAQs

1. How does INVEGA HAFYERA compare with existing long-acting injectable antipsychotics?

Invega HAFYERA’s unique feature is its bi-monthly dosing, offering increased convenience over monthly formulations like Risperdal Consta and shorter-interval options like Invega Trinza. Its dual-release technology aims for consistent drug levels, potentially reducing side effects and improving adherence.

2. What are the main factors influencing its market uptake?

Clinician familiarity with the INVEGA family, demonstrated efficacy, patient preferences for less frequent dosing, and payer reimbursement policies primarily drive adoption. Real-world evidence supporting cost savings from reduced relapse also impacts uptake.

3. Can pricing pressures impact the profitability of INVEGA HAFYERA for Janssen?

Yes. Negotiated rebates, evolving payer policies, and market competition may compress net prices, affecting margins. However, its innovative dosing schedule maintains a premium positioning that can offset some pricing pressures.

4. Will patent exclusivity affect the product’s pricing?

Absolutely. Patent protection until approximately 2030 allows Janssen to maintain pricing power. Patent challenges or biosimilar entries could eventually lead to price erosion.

5. How might policy changes influence the future prices of INVEGA HAFYERA?

Policy shifts favoring drug affordability and value-based pricing could restrict list prices or accelerate negotiated discounts. Increased focus on biosimilars and generics in the psychiatry sector may also pressure prices downward.

Sources

[1] World Health Organization. "Schizophrenia." 2021.

[2] Kane, J. M., et al. "Long-acting injectable antipsychotics: a review of adherence and outcomes." Journal of Clinical Psychiatry, 2020.

[3] Janssen Pharmaceuticals. "INVEGA HAFYERA prescribing information." 2021.

[4] GoodRx. "Invega Trinza Prices." 2022.

Note: All pricing figures are estimates based on market trends and publicly available information at the time of writing.

More… ↓