Share This Page

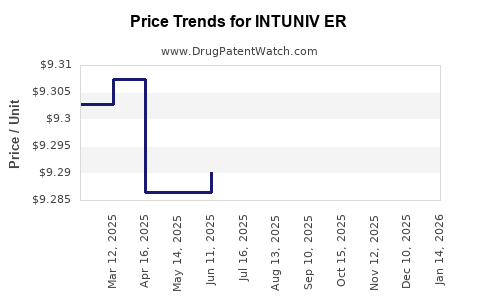

Drug Price Trends for INTUNIV ER

✉ Email this page to a colleague

Average Pharmacy Cost for INTUNIV ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INTUNIV ER 4 MG TABLET | 54092-0519-02 | 9.29900 | EACH | 2025-12-17 |

| INTUNIV ER 1 MG TABLET | 54092-0513-02 | 9.31360 | EACH | 2025-12-17 |

| INTUNIV ER 2 MG TABLET | 54092-0515-02 | 9.30908 | EACH | 2025-12-17 |

| INTUNIV ER 3 MG TABLET | 54092-0517-02 | 9.31542 | EACH | 2025-12-17 |

| INTUNIV ER 2 MG TABLET | 54092-0515-02 | 9.29797 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for INTUNIV ER

Overview of INTUNIV ER

INTUNIV ER (generic name: guanfacine extended-release) is a prominent medication primarily prescribed for Attention Deficit Hyperactivity Disorder (ADHD) in children and adolescents. Developed and marketed by Shire Pharmaceuticals (now part of Takeda Pharmaceutical Company), INTUNIV ER gained FDA approval in 2009 for ADHD management, positioning itself as a non-stimulant treatment alternative. Its mechanism involves selective alpha-2 adrenergic receptor agonism, offering benefits over stimulant medications through improved tolerability and reduced abuse potential.

Market Landscape and Key Drivers

Global ADHD Treatment Market

The global ADHD therapeutics market is projected to reach approximately USD 13 billion by 2027, exhibiting a compound annual growth rate (CAGR) of around 6% from 2020-2027, driven by increasing diagnosis rates, expanding awareness, and therapeutic innovations.[1] The U.S. dominates this landscape, accounting for nearly 60-70% of global revenues due to high diagnosis rates and insurance coverage.

Market Share of INTUNIV ER

Within the non-stimulant segment, INTUNIV ER holds a significant position, owing to its favorable profile in pediatric populations. Competition primarily includes other non-stimulant therapies such as clonidine and new agents like Kapvay (clonidine extended-release) and newer non-stimulants like Qelbree (viloxazine extended-release), approved in 2021.[2] As stimulant medications like Adderall and Vyvanse dominate the overall ADHD market, INTUNIV ER's share remains concentrated among non-stimulant options, estimated at roughly 15-20% within its segment.

Market Penetration Factors

- Efficacy and Tolerability: Improved side effect profile compared to first-generation agents boosts adoption.

- Pediatric Approval: Exclusivity in pediatrics facilitates narrow but stable market penetration.

- Guidelines and Physician Preferences: National ADHD treatment guidelines increasingly include non-stimulants as first-line or adjunct options, positively affecting INTUNIV ER's prescription rates.

- Insurance Coverage: Favorable reimbursement status in key markets supports steady sales.

Regulatory and Competitive Dynamics

The competitive landscape is evolving, with introduction of novel therapies like Qelbree, which offers lower abuse potential and no dependence. Though Qelbree's arrival intensifies competition, INTUNIV ER benefits from established regulatory approval and physician familiarity, providing a resilient market position.

Regulatory considerations, including patent protections and potential biosimilar or generic entrants, influence pricing strategies and future revenue forecasts. The patent landscape for INTUNIV ER was secured until 2028, with generic versions expected thereafter, impacting pricing trajectories.

Pricing Analysis

Current Price Points

In the U.S., the average wholesale price (AWP) for a 30-count bottle of INTUNIV ER (per 1 mg, 2 mg, 3 mg, and 4 mg doses) ranges from USD 385 to USD 620, translating to approximately USD 12.83 to USD 20.67 per tablet.[3] Average outpatient net prices, after rebates, tend to be lower but remain relatively stable, with per-pill costs estimated around USD 10-15.

Pricing Trends

- Pre-Patent Expiry: Premium pricing maintained due to market exclusivity and clinical preference.

- Post-Patent Expiry: Anticipated price reductions of 30-50% with introduction of generics.

- Market Pressures: Payers seeking cost-effective alternatives could accelerate price erosion.

Pricing Factors Influencing Future Marketability

- Generic Entry: Expected around 2028, with significant reductions in pricing.

- Formulation Innovations: Potential for extended formulations or combination therapies to command premium prices.

- Market Access Strategies: Value-based pricing tied to outcomes could sustain higher price points amidst competitive pressures.

Future Price Projections

Based on historical trends, competitive environment, and market dynamics, the following projections are delineated:

| Year | Estimated Average Price per Unit (USD) | Key Assumptions |

|---|---|---|

| 2023 | USD 10-15 | Stable demand, no generic competition yet. |

| 2024 | USD 9-14 | Slight market normalization; increased insurance negotiations. |

| 2025 | USD 8-13 | Rising adoption of alternatives affecting pricing. |

| 2026 | USD 7-12 | Anticipated patent expiry approaching; price compression begins. |

| 2027 | USD 6-10 | Ongoing market stabilization; generic competition likely on horizon. |

| 2028+ | USD 3-5 | Post-patent, significant price erosion with multiple generics. |

Market Opportunities and Challenges

Opportunities:

- Expansion into adult ADHD market as off-label prescriptions rise.

- Diversification into combination formulations, such as with stimulants.

- Adoption in emerging markets driven by increasing ADHD awareness.

Challenges:

- Unsurpassed competition from newer non-stimulants and generics.

- Stringent reimbursement policies impacting profitability.

- Patent expiry leading to price erosion and revenue decline.

Strategic Recommendations

- Invest in Differentiation: Focus on novel delivery mechanisms or combination therapies to justify higher prices.

- Leverage Data: Demonstrate real-world efficacy and tolerability to sustain premium pricing.

- Enhance Market Penetration: Expand into underserved pediatric and adult markets, emphasizing safety profile.

- Prepare for Patent Cliff: Accelerate pipeline development or consider licensing deals to offset post-patent revenue drops.

Key Takeaways

- INTUNIV ER occupies a vital position within the non-stimulant ADHD treatment market, benefiting from its established efficacy and tolerability profile.

- Market growth is driven by increasing ADHD diagnoses globally, with the U.S. dominating revenues.

- Current pricing maintains a premium stance, but upcoming patent expiry around 2028 portends significant price reductions due to generics.

- Future revenues will depend on strategic positioning, differentiation, and market expansion efforts amid emerging competition.

- Price erosion post-patent expiry highlights the importance of pipeline innovation and value-based pricing strategies.

FAQs

1. When can generic versions of INTUNIV ER be expected?

Generic versions are likely to enter the market around 2028, following patent expiration scheduled for that period.

2. How does the pricing of INTUNIV ER compare to other ADHD medications?

INTUNIV ER generally commands a higher price point than some stimulants, owing to its non-stimulant status and favorable side effect profile, though newer non-stimulants like Qelbree offer competitive pricing and alternative benefits.

3. What factors influence INTUNIV ER’s market share?

Factors include physician preference, efficacy and safety profile, insurance coverage, patient compliance, and competitive landscape developments.

4. How might patent expiration affect INTUNIV ER’s profitability?

Patent expiration typically leads to price erosion, with generic competition reducing revenue margins significantly unless offset by formulary wins, pipeline launches, or increased market penetration.

5. Are there emerging markets for INTUNIV ER?

Yes, increasing ADHD awareness and improving healthcare infrastructure in Asia, Latin America, and Africa offer growth opportunities, although pricing and regulatory challenges may impact adoption.

References

[1] Grand View Research. ADHD therapeutics market size, share & trends analysis report, 2020-2027.

[2] US Food and Drug Administration. FDA approves Qelbree for attention deficit hyperactivity disorder in pediatric patients. 2021.

[3] Red Book. Wholesale acquisition prices for INTUNIV ER as of 2023.

More… ↓