Share This Page

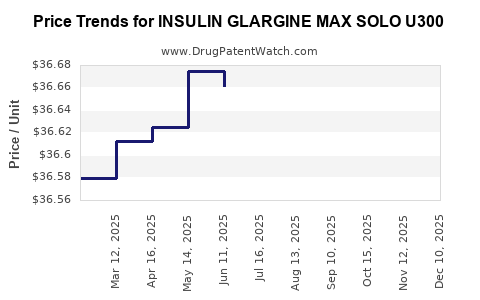

Drug Price Trends for INSULIN GLARGINE MAX SOLO U300

✉ Email this page to a colleague

Average Pharmacy Cost for INSULIN GLARGINE MAX SOLO U300

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INSULIN GLARGINE MAX SOLO U300 | 00955-2900-02 | 36.63224 | ML | 2025-12-17 |

| INSULIN GLARGINE MAX SOLO U300 | 00955-2900-02 | 36.68193 | ML | 2025-11-19 |

| INSULIN GLARGINE MAX SOLO U300 | 00955-2900-02 | 36.67975 | ML | 2025-10-22 |

| INSULIN GLARGINE MAX SOLO U300 | 00955-2900-02 | 36.67009 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Insulin Glargine Max Solo U300

Introduction

Insulin glargine Max Solo U300, marketed under brand names such as Toujeo Max Solo U300 by Sanofi, is a long-acting basal insulin used to manage blood glucose in adult patients with type 1 and type 2 diabetes. Its unique pharmacokinetic profile offers extended duration of action (up to 36 hours), providing consistent basal insulin coverage. As the global diabetes epidemic accelerates, understanding the market dynamics and pricing strategies for innovative insulin formulations like Glargine Max Solo U300 becomes crucial for stakeholders.

This analysis explores the current market landscape, competitive environment, regulatory factors, and pricing projections for Glargine Max Solo U300, enabling pharmaceutical companies, investors, and healthcare providers to assess its commercial trajectory.

Market Landscape Analysis

Global Diabetes Market Overview

The global diabetes therapeutics market was valued at approximately USD 60 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8-9% through 2030. Insulin and insulin analogs constitute a significant segment, driven by rising prevalence, aging populations, and increasing awareness of early intervention.

Key Market Drivers

- Surging Diabetes Prevalence: The International Diabetes Federation estimates over 537 million adults globally suffer from diabetes, with projections exceeding 700 million by 2045 [1].

- Innovation in Insulin Delivery: Longer-acting insulins like Glargine Max Solo U300 address adherence issues caused by multiple daily injections and pharmacokinetic variability.

- Patient-Centric Formulations: Simplified dosing, reduced hypoglycemia risk, and consistent absorption profiles favor higher adoption rates.

- Reimbursement and Payer Policies: Increasing reimbursement coverage in developed markets facilitates market penetration.

Competitive Landscape

Major Players & Products

- Sanofi: Toujeo Max Solo U300, Lantus U100/U300.

- Eli Lilly: Basaglar (biosimilar glargine).

- Novo Nordisk: Tresiba (insulin degludec), Levemir (detemir).

- Biocon / Mylan: Semglee (biosimilar glargine).

Differentiation Factors

- Pharmacokinetic Profile: Glargine U300 has a flatter, more extended profile compared to U100 formulations.

- Dosing Flexibility: Max Solo U300 offers up to 36-hour dosing intervals in certain patients, aiding adherence.

- Pricing & Formulation Access: Biosimilars and generics are exerting price pressure, especially in mature markets.

Regulatory and Reimbursement Trends

- FDA and EMA Approvals: Regulatory bodies have approved Glargine U300 for multiple indications, facilitating broader access.

- Pricing Caps & Negotiations: Payer negotiations are influencing market pricing, particularly in Europe and North America, affecting revenue potential for branded insulins.

Pricing Dynamics and Projections

Current Pricing Landscape

According to recent data, the average wholesale price (AWP) of a 30 mL (100 units/mL) pen of Glargine U100 is approximately USD 250–300. The U300 formulation, due to its higher concentration and clinical differentiation, commands a premium, with prices ranging between USD 400 and USD 550 per 30 mL pen in the US market [2].

In Europe, pricing varies significantly based on national negotiation outcomes, with some countries achieving discounts up to 30-40% off list prices. Biosimilars like Basaglar and Semglee are priced approximately 15-25% lower than the branded Max Solo U300, exerting downward pressure.

Future Price Trajectory

Assumptions for Projections

- Market Penetration: Expected steady increase owing to increased adoption, improved formulary access, and shifting prescribing patterns favoring long-acting analogs.

- Biosimilar Competition: Biosimilar entry anticipated within 3–5 years, progressively influencing prices.

- Healthcare Policy Impact: Favorable reimbursement policies and value-based frameworks expected to moderate inflationary pricing pressures.

Projected Price Trends (2023-2030)

| Year | Estimated Average Price per Pen (USD) | Key Factors |

|---|---|---|

| 2023 | USD Weight in 510–550 range | Initial market saturation, brand dominance |

| 2025 | USD 420–500 | Biosimilar launches, increased competition |

| 2027 | USD 380–460 | Payer negotiations, formulary shifts |

| 2030 | USD 350–400 | Market normalization, biosimilar proliferation |

Note: These projections account for price erosion due to biosimilar entry and reimbursement adjustments. The upward trend in price per unit (due to increased dosing or engineered formulations) is less likely, with downward pressure prevailing.

Factors Influencing Market and Price Projections

Regulatory Changes

Tightening of pricing regulations in major markets like the US and EU is expected to foster price competitiveness. FDA’s push for biosimilars as cost-effective alternatives is likely to accelerate biosimilar market share, impacting NAT (Named-Addition) pricing of branded insulins.

Market Adoption & Prescriber Preferences

Clinicians favor insulins with proven efficacy and minimal adverse effects. The perceived advantages of Glargine Max Solo U300—improved dosing flexibility and lower hypoglycemia risk—can sustain premium pricing, especially in adult and elderly populations.

Biosimilar Competition

Biosimilar insulins, notably Basaglar and Semglee, are priced approximately 20% lower than the U300 formulations. Their increasing availability is expected to compress the pricing margin for branded Max Solo U300, particularly as biosimilar regulations evolve and manufacturing costs decrease.

Patient and Provider Demand

Adherence benefits and simplified dosing regimens are key value propositions. Payers may favor cost-saving biosimilars, but branded formulations like Max Solo U300 will maintain premium pricing due to clinical differentiation.

Strategic Implications for Stakeholders

- Pharmaceutical Manufacturers: Focus on demonstrating clinical benefits, expanding indications, and securing preferential formulary placements to sustain premium pricing.

- Payers: Emphasize biosimilar adoption and value-based formularies to manage rising insulin costs.

- Investors: Monitor biosimilar market entries, regulatory approvals, and reimbursement reforms as indicators of price erosion.

- Healthcare Providers: Balance clinical benefits against cost considerations, advocating for coverage that aligns with patient outcomes.

Key Takeaways

- The global market for long-acting insulins like Glargine Max Solo U300 is poised for growth, driven by rising diabetes prevalence and innovations improving patient adherence.

- Current pricing for Max Solo U300 ranges between USD 400–550 per pen, with downward pressure anticipated due to biosimilar competition and payer negotiations.

- Price projections suggest a gradual decline to USD 350–400 per pen by 2030, reflecting increased biosimilar penetration and regulatory influences.

- Market success hinges on clinical differentiation, regulatory approvals, favorable reimbursement policies, and strategic positioning against biosimilars.

- Stakeholders should focus on value propositions rooted in improved clinical outcomes to sustain premium pricing amid dynamic market forces.

FAQs

1. How does Glargine Max Solo U300 differ from other basal insulins?

Max Solo U300 offers extended pharmacokinetics, with a duration of action up to 36 hours, providing more consistent glucose control and dosing flexibility compared to older formulations like Glargine U100.

2. What are the main factors affecting the pricing of insulin glargine formulations?

Pricing is influenced by manufacturing costs, clinical differentiation, competition from biosimilars, regulatory policies, reimbursement negotiations, and market demand.

3. Are biosimilars expected to significantly impact the market for Glargine Max Solo U300?

Yes, biosimilar insulins like Basaglar and Semglee, priced approximately 20-25% lower, are expected to expand market share and exert downward pressure on branded insulin prices.

4. Which regions are likely to see the highest growth in insulin market value?

North America and Europe lead in market size, adoption, and pricing flexibility, but rising markets in Asia-Pacific, particularly China and India, also present substantial growth opportunities.

5. What strategies can manufacturers employ to maintain the market position of Glargine Max Solo U300?

Focusing on demonstrating clinical benefits, expanding indications, optimizing access through reimbursement strategies, and early biosimilar engagement can help preserve market share.

Sources

[1] International Diabetes Federation. IDF Diabetes Atlas, 10th Edition, 2021.

[2] Medicare.gov. Insulin Pricing Data, 2022.

More… ↓