Share This Page

Drug Price Trends for INSULIN ASPART PENFILL

✉ Email this page to a colleague

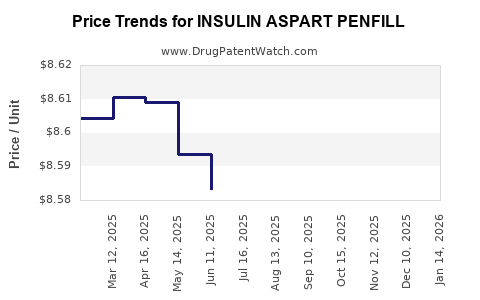

Average Pharmacy Cost for INSULIN ASPART PENFILL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INSULIN ASPART PENFILL 100 UNIT/ML CARTRIDGE | 73070-0102-15 | 8.60867 | ML | 2025-12-17 |

| INSULIN ASPART PENFILL 100 UNIT/ML CARTRIDGE | 73070-0102-15 | 8.60041 | ML | 2025-11-19 |

| INSULIN ASPART PENFILL 100 UNIT/ML CARTRIDGE | 73070-0102-15 | 8.59603 | ML | 2025-10-22 |

| INSULIN ASPART PENFILL 100 UNIT/ML CARTRIDGE | 73070-0102-15 | 8.59168 | ML | 2025-09-17 |

| INSULIN ASPART PENFILL 100 UNIT/ML CARTRIDGE | 73070-0102-15 | 8.58898 | ML | 2025-08-20 |

| INSULIN ASPART PENFILL 100 UNIT/ML CARTRIDGE | 73070-0102-15 | 8.58236 | ML | 2025-07-23 |

| INSULIN ASPART PENFILL 100 UNIT/ML CARTRIDGE | 73070-0102-15 | 8.58315 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Insulin Aspart PenFill

Introduction

Insulin Aspart PenFill, commercially known as Novo Nordisk’s Fiasp, is a rapid-acting insulin used by individuals with diabetes mellitus. Its advanced formulation allows for quicker absorption and onset of action, improving glycemic control, particularly around meal times. As the global incidence of diabetes surges, driven by lifestyle factors and sedentary habits, the demand for innovative insulin formulations like Insulin Aspart PenFill skyrockets. This article provides a comprehensive market analysis and price projection outlook for Insulin Aspart PenFill, emphasizing industry dynamics, competitive positioning, pricing strategies, and future market potential.

Market Overview

Global Diabetes Epidemic and Insulin Market Growth

The International Diabetes Federation (IDF) estimates over 537 million adults living with diabetes worldwide as of 2021, with projections reaching 643 million by 2030. Type 1 and insulin-dependent Type 2 diabetes patients represent a significant segment requiring continuous insulin therapy. This burgeoning patient base fuels a rapidly expanding insulin market, expected to reach approximately $62 billion globally by 2027, with a Compound Annual Growth Rate (CAGR) of about 8-9% (Grand View Research, 2022).

Insulin Delivery Devices and Innovations

Traditionally, insulin administration involved vial and syringe methods; however, modern delivery systems—prefilled pens, cartridges, and continuous subcutaneous insulin infusion (CSII)—have driven patient adherence and glycemic control. Among these, pen injectors dominate owing to ease of use, portability, and dosing accuracy, especially in outpatient settings.

Position of Insulin Aspart PenFill in the Market

Insulin Aspart PenFill, marketed mainly by Novo Nordisk under the Fiasp brand, is positioned in the rapid-acting insulin segment. It competes with other fast-acting insulins such as Eli Lilly’s Lyumjev (insulin lispro) and Sanofi’s Apidra (insulin glulisine). The PenFill formulation, designed for use with prefilled pens, offers notable advantages in convenience, dosing precision, and rapid onset, making it preferred in both hospital and outpatient settings.

Competitive Landscape

Key Players and Products

| Company | Product Name | Delivery Format | Market Share | Differentiators |

|---|---|---|---|---|

| Novo Nordisk | Fiasp (Insulin Aspart PenFill) | Prefilled pen | Dominant | Faster onset, stability in PenFill format |

| Eli Lilly | Lyumjev | Prefilled pen | Growing | Improved absorption profile |

| Sanofi | Apidra | Vial and pen | Moderate | Cost-effective, established brand |

Market Penetration and Adoption Dynamics

The adoption of Insulin Aspart PenFill hinges on factors like clinical efficacy, patient preference, reimbursement policies, and manufacturer distribution capabilities. Novo Nordisk’s extensive global presence and early entry into the rapid-acting insulin segment position Fiasp favorably to capture incremental market share, especially among insulin-dependent diabetics seeking rapid onset insulin options.

Regulatory and Reimbursement Environments

Regulatory approvals in major markets (FDA in the US, EMA in Europe) facilitate access. Reimbursement landscape significantly influences market penetration; countries with broad insurance coverage support widespread adoption, whereas cost considerations in lower-income regions restrict utilization.

Price Analysis and Projection

Current Pricing Landscape

The pricing of Insulin Aspart PenFill varies globally due to differences in healthcare systems, regulatory environments, and market competition. In the US, retail prices for Fiasp dissuade many patients due to high out-of-pocket costs, often exceeding $300 for a 10 mL pen containing 300 units (average retail price). Insurance coverage and pharmacy benefits reduce patient costs, but persistent affordability issues remain.

In Europe and other developed markets with nationalized healthcare, negotiated prices average between €20-€35 per pen, reflecting regional drug price regulations and discounts.

Pricing Factors Influencing Future Trends

- Market Competition: Introduction of biosimilars could suppress prices, although biosimilar development for insulin formulations faces scientific and regulatory hurdles.

- Manufacturing Costs: Advances in production and supply chain efficiencies may enable cost reductions, promoting price stabilization.

- Regulatory Approvals: Faster approval pathways in emerging markets could lead to price decreases due to increased competition.

- Reimbursement Policies: Shift toward value-based pricing could limit price increases and focus on clinical outcomes.

Price Projection (2023-2030)

-

Short Term (2023-2025):

- Stable or slight decline in prices due to ongoing competitive pressures.

- Expect average retail price for a PenFill pen to hover around $250-$300 in the US.

- In Europe, prices are likely to remain steady at €20-€35, moderated by regional negotiations.

-

Mid to Long Term (2026-2030):

- Likelihood of moderate price decreases driven by biosimilar entry, especially if patent expirations occur around 2027-2028.

- Technological innovations could justify price stabilization for premium formulations like Fiasp.

- Overall, prices are projected to decrease by 10-20% in value-adjusted terms with market maturation and increased competition.

Market Growth and Revenue Projections

Drivers of Growth

- Increasing global prevalence of diabetes.

- Rising adoption of prefilled pen devices.

- Consumer preference for rapid-acting insulins with flexible dosing.

- Expansion into emerging markets, driven by improved healthcare infrastructure and lower-cost formulations.

Revenue Projections

Based on current growth trends, global sales of Insulin Aspart PenFill could grow at a CAGR of approximately 6-8% through 2030, reaching $3-$4 billion annually. The market’s expansion is attributable to both increased patient numbers and higher per-unit consumption driven by newer formulations.

Regulatory and Patent Outlook

Patent protections for Fiasp extend until approximately 2027-2028, after which biosimilar entrants could influence pricing and market share. Regulatory delays, patent litigations, and market exclusivity determine the timing and extent of biosimilar penetration.

Key Market Opportunities and Challenges

Opportunities

- Expansion into emerging markets via tiered pricing strategies.

- Development of combination therapies integrating Insulin Aspart PenFill.

- Digital health integration for dosing, adherence, and monitoring.

Challenges

- Patent cliffs reducing exclusivity.

- Competition from biosimilars and novel insulin delivery devices.

- Cost constraints limiting affordability in lower-income regions.

- Regulatory hurdles delaying approvals in certain territories.

Key Takeaways

- The Insulin Aspart PenFill market is poised for steady growth fueled by the global diabetes epidemic and increasing demand for rapid-acting insulin formulations.

- Current pricing remains high in regions like the US, with moderate prices in Europe influenced by regional negotiations.

- Price projections suggest slight declines over the next 5-8 years due to biosimilar entries, technological innovation, and market maturation.

- Competitive pressure and patent expirations after 2027 will significantly influence market dynamics and pricing strategies.

- Manufacturers should strategize around emerging markets and technological innovations to sustain growth and optimize pricing.

FAQs

1. How does Insulin Aspart PenFill differ from traditional insulin formulations?

Insulin Aspart PenFill offers a faster onset of action compared to standard rapid-acting insulins, enabling better post-meal glucose management. Its formulation allows for flexible dosing and convenient delivery via prefilled pens.

2. What factors influence the pricing of Insulin Aspart PenFill in different markets?

Pricing variations depend on regional healthcare policies, reimbursement frameworks, competitive dynamics, manufacturing costs, and negotiations between pharmaceutical companies and payers.

3. Are biosimilars likely to impact the Insulin Aspart PenFill market?

Yes. Biosimilar insulin products are expected to emerge around 2027-2028, which could lead to price reductions and increased market competition, particularly in regions with active biosimilar policies.

4. What growth opportunities exist for Insulin Aspart PenFill manufacturers?

Expansion into emerging markets, enhancing patient adherence through digital innovations, and developing combination therapies provide significant growth potential.

5. How can payers and healthcare providers influence future pricing trends?

Through formulary decisions, negotiated discounts, and value-based care models, payers and providers can drive prices downward, improve accessibility, and encourage the adoption of cost-effective insulin therapies.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th Edition, 2021.

[2] Grand View Research. Insulin Market Size, Share & Trends Analysis Report, 2022.

[3] National Public and Insurance Data on insulin prices and reimbursement.

[4] Company Financial Disclosures and Pricing Strategies, Novo Nordisk, 2023.

[5] Regulatory Agency Publications and Patent Status Updates.

This article is intended to inform business and healthcare professionals about market conditions and projections related to Insulin Aspart PenFill, enabling strategic planning and investment decisions.

More… ↓