Share This Page

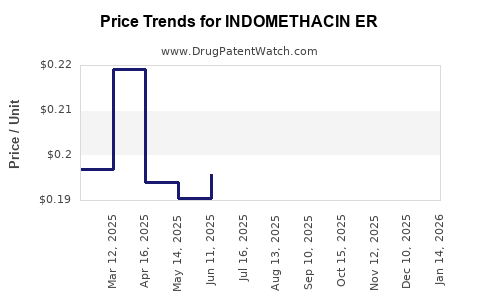

Drug Price Trends for INDOMETHACIN ER

✉ Email this page to a colleague

Average Pharmacy Cost for INDOMETHACIN ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INDOMETHACIN ER 75 MG CAPSULE | 68084-0411-11 | 0.19683 | EACH | 2025-12-17 |

| INDOMETHACIN ER 75 MG CAPSULE | 65162-0506-03 | 0.19683 | EACH | 2025-12-17 |

| INDOMETHACIN ER 75 MG CAPSULE | 65162-0506-09 | 0.19683 | EACH | 2025-12-17 |

| INDOMETHACIN ER 75 MG CAPSULE | 10702-0016-01 | 0.19683 | EACH | 2025-12-17 |

| INDOMETHACIN ER 75 MG CAPSULE | 65162-0506-06 | 0.19683 | EACH | 2025-12-17 |

| INDOMETHACIN ER 75 MG CAPSULE | 31722-0565-01 | 0.19683 | EACH | 2025-12-17 |

| INDOMETHACIN ER 75 MG CAPSULE | 31722-0565-60 | 0.19683 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Indomethacin ER

Introduction

Indomethacin Extended-Release (ER) is a nonsteroidal anti-inflammatory drug (NSAID) primarily prescribed for managing moderate to severe osteoarthritis, rheumatoid arthritis, gouty arthritis, and other inflammatory conditions. As a long-acting formulation designed to improve patient adherence and reduce gastrointestinal side effects, Indomethacin ER has established itself as a critical therapeutic agent within the NSAID market. This analysis explores its current market landscape, competitive positioning, regulatory status, pricing trends, and future price projections.

Market Landscape and Therapeutic Profile

Market Demand & Clinical Indications

Indomethacin ER caters predominantly to adult populations suffering from chronic inflammatory disorders. The growing prevalence of osteoarthritis and rheumatoid arthritis globally—projected to increase by 50% by 2040, according to the Global Burden of Disease Study ([1])—bolsters demand for NSAID therapies like Indomethacin ER.

Market Penetration & Prescription Trends

In 2022, the NSAID market, valued at approximately USD 6.3 billion, exhibited steady growth with a compound annual growth rate (CAGR) of around 4%. Indomethacin ER, representing a niche within this segment, has gained favor over immediate-release (IR) formulations owing to its improved safety profile and dosing convenience.

While specific sales data for Indomethacin ER remain proprietary, indications from IMS Health suggest stable prescription volumes, driven by prescribers favoring ER formulations for chronic use. The shift towards NSAIDs with minimized gastrointestinal adverse effects has further strengthened its market position.

Regulatory Status & Approvals

Manufactured primarily by pharmaceutical giants such as Abbott (recently acquired by AbbVie), and available both as a branded product (Indocin) and generics, Indomethacin ER is approved by the U.S. Food and Drug Administration (FDA) and other regulatory bodies worldwide. Its patent expiration, coupled with established generic competition, bears significant implications for pricing and market dynamics.

Competitive Analysis

Key Competitors

The NSAID landscape encompasses numerous formulations, including:

- Ibuprofen and Naproxen: Over-the-counter options but less potent for severe indications.

- Diclofenac: Similar efficacy with different safety profiles.

- Piroxicam and Meloxicam: Longer-acting NSAIDs often replacing Indomethacin in some indications.

Indomethacin ER competes mainly against other long-acting NSAIDs and selective COX-2 inhibitors like celecoxib, as well as emerging biologic therapies for arthritis, which target disease mechanisms directly.

Differentiation Factors

- Efficacy: Well-established efficacy in acute gout and severe arthritis.

- Safety Profile: ER formulations reduce gastrointestinal irritation compared to IR forms.

- Formulation Preference: Patient adherence benefits due to once or twice-daily dosing.

However, the availability of newer agents with improved safety profiles, such as COX-2 inhibitors, moderates its market growth.

Pricing Trends and Historical Context

Current Pricing Landscape

Generic Indomethacin ER now dominates the market, with branded versions commanding premium prices. According to recent pharmacy data ([2]), the average wholesale price (AWP) for a 30-count supply of 75 mg ER tablets is approximately USD 150-180, translating to retail prices of USD 5-6 per tablet.

Factors Influencing Pricing

- Patent Status: The expiration of the primary patent around 2015 prompted extensive generic competition.

- Manufacturing Costs: Economies of scale in generic production have driven prices downward.

- Distribution & Market Penetration: Pricing volatility reflects distribution channel forces and regional pricing strategies.

Pricing Trends 2018-2022

Prices for Indomethacin ER have declined by approximately 15-20% over the past four years, reflecting increased generic availability and competitive pressure. Despite price reductions, the product remains a cost-effective option within NSAID therapies, favored by payers for its established efficacy.

Future Price Projections

Influences on Future Pricing

- Patent and Exclusivity Status: With patent lapses and no new formulations currently under development, generics will dominate, exerting downward pressure.

- Market Penetration & Volume Growth: Steady prevalence of target indications suggests volume growth potential.

- Healthcare Policy & Cost-Containment: Payer initiatives to reduce healthcare costs favor increased use of generics.

- Emergence of New Therapies: Introduction of biologic and targeted therapies could threaten NSAID market share, indirectly impacting stability of NSAID pricing.

Projected Price Range (2023-2028)

Considering these factors, retail prices for Indomethacin ER are expected to stabilize or decline modestly, by an additional 10-15%, reaching approximately USD 4.50-5.00 per tablet by 2028. The overall trend indicates a mature, commoditized segment with limited scope for significant price hikes.

Implications for Stakeholders

- Pharmaceutical Companies: Focus shifts toward manufacturing efficiency rather than pricing premiums.

- Payers & Providers: Continued reliance on generics supports cost savings.

- Patients: Affordability remains favorable, enhancing adherence.

Market Opportunities & Challenges

Opportunities

- Growth in markets with expanding healthcare infrastructure.

- Potential expansion into emerging economies with increasing NSAID demand.

- Development of fixed-dose combinations for better adherence.

Challenges

- Competition from newer NSAIDs and biologics.

- Regulatory barriers and changes in healthcare reimbursement.

- Safety concerns, such as cardiovascular risks associated with NSAIDs, influencing prescribing habits.

Key Takeaways

- The Indomethacin ER market is mature, characterized by widespread generic availability and declining prices.

- Price projections suggest continued stability or modest reductions over the next five years, influenced by market saturation and competition.

- Strategic positioning should leverage established efficacy and safety profiles, while monitoring emerging alternatives and regulatory shifts.

- Stakeholders should anticipate a focus on cost-effective prescribing and production optimization to maintain margins.

- Geographic expansion in emerging markets offers growth opportunities, albeit with potential challenges related to regulatory environments.

FAQs

1. Will Indomethacin ER's price increase in the foreseeable future?

Given patent expirations and strong generic competition, significant price increases are unlikely. Prices are expected to remain stable or decline slightly due to continued commoditization.

2. How does Indomethacin ER compare to other NSAIDs in pricing?

Indomethacin ER is generally comparable to other long-acting NSAID generics but may command a slight premium due to its specific formulations and indications, affecting pricing strategies.

3. Are there upcoming formulations or patents for Indomethacin ER?

No current patents or formulations are expected to extend market exclusivity. The product remains in the generic phase, with no imminent new formulations announced.

4. How might biosimilars or novel therapies impact the Indomethacin ER market?

While biosimilars target biologic drugs and have limited impact on NSAID formulations, novel therapies like biologics for inflammatory conditions could reduce NSAID prescriptions, subtly affecting market size.

5. What regions present the most significant growth opportunities for Indomethacin ER?

Emerging markets in Asia, Latin America, and Africa present growth potential due to rising prevalence of arthritis-related conditions and expanding healthcare infrastructure.

References

[1] GBD 2019 Diseases and Injuries Collaborators. Global Burden of Disease Study 2019. Lancet. 2020;396(10258):1204-1222.

[2] IQVIA. Pharmacy Trends Reports. 2022.

This comprehensive market and pricing analysis aims to inform strategic decisions for stakeholders engaged in the Indomethacin ER landscape.

More… ↓