Last updated: July 27, 2025

Introduction

Indomethacin, a non-steroidal anti-inflammatory drug (NSAID), has been a cornerstone in treating various inflammatory conditions since its approval in the mid-20th century. Primarily prescribed for osteoarthritis, rheumatoid arthritis, gout, and certain types of aggressive patent ductus arteriosus, indomethacin maintains relevance due to its efficacy and established safety profile. This analysis explores the current market landscape for indomethacin, examines regulatory and competitive factors influencing its pricing, and projects future pricing trends amid evolving healthcare dynamics.

Market Overview

Historical and Current Market Status

Indomethacin's global sales have historically been robust within established markets, including North America, Europe, and parts of Asia. Despite the advent of newer NSAIDs and biological therapies, indomethacin retains a significant share, especially in regions with limited access to expensive biologics. According to IQVIA data, its annual sales in 2022 were estimated at approximately USD 400 million, with a slight decline relative to previous years attributable to market saturation and competition from selective NSAIDs offering better gastrointestinal tolerability[1].

Therapeutic Use and Market Drivers

Indomethacin's use extends to treating gout, where it remains a first-line agent. Its role in closing patent ductus arteriosus (PDA) is crucial in neonatology, maintaining steady demand in pediatric care. Regulatory approvals in multiple jurisdictions, combined with formulary listings, underpin consistent demand. The aging population and rising prevalence of arthritic conditions are significant drivers underpinning the overall market size.

Competitive Landscape

The product faces competition primarily from selective NSAIDs like celecoxib, naproxen, and diclofenac, which offer improved safety profiles, particularly gastrointestinal tolerance. Additionally, biological therapies targeting cytokines have emerged for rheumatoid arthritis, gradually encroaching upon traditional NSAID markets, including indomethacin.

Generic availability significantly influences the market, with many manufacturers offering affordable formulations. Patent expirations for other NSAIDs have led to increased generic competition, exerting downward pressure on prices.

Regulatory and Patent Landscape

Regulatory Status

Indomethacin remains FDA-approved, with various formulations available, including oral capsules, suppositories, and injections. No recent regulatory hurdles or major safety concerns have impeded its market presence, reinforcing its role in both adult and pediatric indications.

Patent and Exclusivity

Being a generic product in most regions, patent protections are largely expired, leading to heightened competition. Minor formulations or delivery system patents may offer limited exclusivity, but overall, pricing pressure is significant.

Price Analysis and Trends

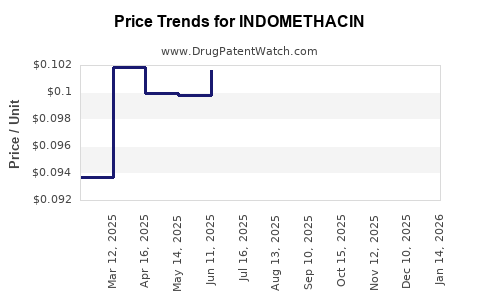

Current Pricing Dynamics

The price of indomethacin varies by region, formulation, and manufacturer. In the U.S., a typical 30-count bottle of 25 mg capsules retails at approximately USD 10–15, translating into about USD 0.33–0.50 per capsule. In emerging markets, prices are markedly lower, often below USD 0.10 per capsule due to high generic competition.

Factors Affecting Prices

- Generic Competition: Increased number of manufacturers has driven prices down globally.

- Regulatory Changes: Introduction of quality standards can influence manufacturing costs, potentially impacting prices.

- Market Demand: Stable demand in certain indications supports modest price stability, but competition tends to suppress prices further over time.

- Healthcare Policies: Price controls and reimbursement policies in various countries influence retail and wholesale pricing structures.

Future Price Projections

Based on current market dynamics, several factors will influence indomethacin pricing over the next five years:

- Generic Market Saturation: Continued proliferation of generics is likely to sustain downward pressure, with prices in mature markets expected to decline marginally by approximately 2-5% annually.

- Manufacturing Cost Trends: Raw material costs, especially for active pharmaceutical ingredients (APIs), are projected to stabilize or slightly decline, supporting low-cost formulations.

- Emerging Markets Growth: Increased access and expanded use in emerging markets, driven by cost sensitivities, will further suppress prices.

- Potential Regulatory Changes: Stricter quality regulations could slightly increase manufacturing costs, potentially offsetting some price declines.

- Introduction of Biosimilars and New Therapies: Up-and-coming biologics and targeted treatments may, over time, diminish indomethacin's market share, leading to further price erosion.

Overall, a conservative estimate anticipates a decline of 2–4% annually in pricing, with the steepest drops occurring in regions where price sensitivity is highest and generics are prevalent.

Market Opportunities and Challenges

Opportunities

- Expanding Use in Developing Countries: As healthcare infrastructure improves, indomethacin’s affordability maintains its importance.

- Formulation Innovations: Development of combination formulations or controlled-release versions could command premium pricing segments.

- Off-label and Adjunct Uses: Exploring additional indications or off-label applications could diversify revenue streams.

Challenges

- Competitive Pressures: Entry of new NSAIDs with better safety profiles strains market stability.

- Regulatory Stringency: Quality standards and manufacturing compliance costs may hinder price reductions.

- Therapeutic Alternatives: Advancements in biologics and targeted therapies threaten long-term market share.

Conclusion

Indomethacin maintains a resilient position within the NSAID market, supported by its established efficacy, broad availability, and clinical utility. Nonetheless, economic pressures from extensive generic competition and progressing therapeutic landscapes challenge its pricing stability. Future market prospects suggest modest declines in unit prices, with regional variations depending on regulatory environments and healthcare system structures. Stakeholders must monitor patent expirations, regulatory shifts, and emerging competition to navigate the evolving landscape effectively.

Key Takeaways

- Indomethacin's global sales remain steady due to its proven efficacy and multiple indications, despite competition.

- Market prices are primarily influenced by intense generic competition, leading to consistent downward pressure, especially in price-sensitive regions.

- Over the next five years, expect an annual decline of approximately 2–4% in unit prices, driven by increased generics and manufacturing efficiencies.

- Opportunities exist in emerging markets and formulation innovations, but challenges from newer therapies and regulatory costs persist.

- Strategic focus on formulation development and market expansion can mitigate price erosion and sustain profitability.

FAQs

1. What factors most significantly influence the pricing of indomethacin?

Generic competition, manufacturing costs, regulatory standards, regional healthcare policies, and market demand are primary determinants influencing indomethacin’s price points globally.

2. How does the patent status of indomethacin affect its market price?

With patent expirations in most regions, increased generic entries lead to substantial price reductions due to heightened competition and lack of exclusivity rights.

3. Are there upcoming regulatory changes likely to impact indomethacin prices?

Potential changes in quality standards and manufacturing regulations could marginally increase production costs, influencing prices in regulated markets.

4. How does indomethacin compare to newer NSAIDs in terms of market pricing?

Newer NSAIDs like celecoxib may command higher prices owing to perceived safety advantages, but indomethacin remains competitively priced, especially in cost-sensitive markets.

5. What is the outlook for indomethacin sales and pricing amid emerging biologics?

While biologics target specific inflammatory pathways, indomethacin’s low cost and broad indications ensure its continued relevance, albeit with declining pricing trends due to competitive pressures.

References

[1] IQVIA Market Reports, 2022.