Last updated: September 16, 2025

Introduction

INDERAL XL (propranolol hydrochloride extended-release) is a beta-adrenergic blocker primarily prescribed for hypertension, angina, arrhythmias, and other cardiovascular conditions. As a long-acting formulation, INDERAL XL offers patient adherence benefits, making it a significant product within the beta-blocker market. This report provides a comprehensive analysis of the current market landscape and price projections for INDERAL XL, emphasizing the dynamics shaping its valuation and commercial trajectory.

Market Overview

Global Therapeutic Footprint

Inderal XL operates within the global cardiovascular therapeutics market valued at approximately $200 billion in 2022, with beta-blockers constituting a substantial segment. The healthcare shift towards managing cardiovascular risk factors, coupled with aging populations and increasing prevalence of hypertension and ischemic heart disease, sustains a robust demand for beta-blockers.

Key Competitive Landscape

Primarily competing with other long-acting beta-blockers like atenolol XR, metoprolol succinate, and emerging generics, INDERAL XL's market position hinges on its clinical efficacy, safety profile, and formulary access. Its patent expiry in several jurisdictions exposes it to generic competition, impacting pricing and market share.

Market Dynamics

Patent and Regulatory Status

While the original patent for INDERAL XL expired in select markets (e.g., the US in 2014), the drug's brand name remains protected by regulatory exclusivity and secondary patents or formulation-specific patents that extend its protected period until approximately 2025-2027. The expiration timeline critically influences the pace of generic entry.

Generic Entry and Market Penetration

Since patent expiry, generics have captured a significant share, reducing prices and expanding accessibility. Multinational pharmaceutical companies and compounding pharmacies now supply bioequivalent propranolol XR formulations, intensifying competitive pressure.

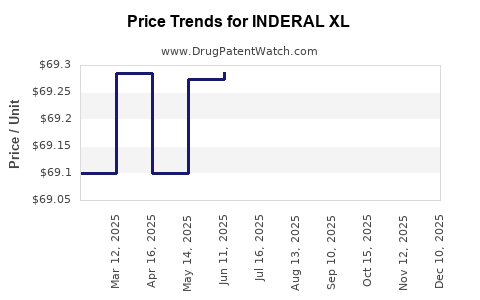

Pricing Trends

Brand-name INDERAL XL historically commanded premiums ranging from 30-50% over generics. However, recent market data reveals a trend towards declining prices driven by increased generic penetration and insurance negotiations.

Regional Market Analysis

United States

- Market Size & Trends: The US represents approximately 40% of global INDERAL XL sales, with an estimated market size of $600 million annually pre-generic entry.

- Pricing Evolution: Average retail price for brand-name INDERAL XL was circa $3.50 per tablet in 2018. Post-generic influx, prices declined sharply, with current wholesale acquisition costs (WAC) between $0.80 and $1.20 per tablet.

- Market Share Dynamics: Generics hold over 70% of unit sales, with the branded product maintaining premium positioning primarily in certain specialty settings.

European Union

- Market Size & Trends: EU markets collectively account for roughly 25% of global INDERAL XL sales, with price regulation mechanisms leading to lower price variability.

- Pricing: Prices range from €0.50 to €1 per tablet, influenced by national procurement policies and tender systems.

Emerging Markets

- Market Characteristics: Lower per capita healthcare spending and higher reliance on generics predominate, with prices often 50-70% below those in developed regions.

- Market Growth: Increasing urbanization and hypertension prevalence suggest expanding demand, albeit constrained by affordability.

Future Price Projections

Factors Influencing Prices

- Patent Expiry & Generics: Anticipated patent expiry in key markets by 2025 will provoke market saturation by generics.

- Regulatory & Reimbursement Policies: Stricter cost-containment measures could exert downward pressure on prices.

- Market Dynamics: Growing prevalence of cardiovascular disease, combined with enhanced awareness and screening, could maintain steady demand for extended-release formulations.

Projection Scenarios

| Scenario |

Price Trend |

Duration |

Assumptions |

| Optimistic |

Mild Price Decline; Stabilization |

2023-2028 |

Limited generic substitution; premium brand position maintained |

| Moderate |

Significant Drop; Stabilization at Lower Prices |

2024-2030 |

Increased generic penetration; aggressive price competition |

| Pessimistic |

Sharp Price Reductions; Market Contraction |

2023-2025 |

Widespread generic dominance; regulatory pricing interventions |

- Forecast: Under the moderate scenario, the average unit price could decline by approximately 50-60% over the next five years, reaching $0.40–$0.60 per tablet in the US and comparable figures in other regions.

Implications for Stakeholders

- Pharmaceutical Companies: Opportunities exist in maintaining premium pricing through formulation differentiation, brand loyalty, and targeted marketing, though the margin may diminish with increased generics.

- Healthcare Insurers: As prices decline, INDERAL XL remains a cost-effective option, especially as part of formulary management.

- Investors: The impending patent expiry necessitates caution; future revenues are expected to decline unless differentiated by new formulations or indications.

Key Takeaways

- Patent expiration and generic competition are primary drivers of declining prices for INDERAL XL, with significant reductions anticipated by 2025-2030.

- Market growth is sustained by rising cardiovascular disease prevalence, but price erosion may offset volume gains.

- Regional disparities influence pricing expectations, with regulated markets generally experiencing lower prices.

- Formulation innovation or new indications could potentially extend INDERAL XL’s market life and mitigate declining prices.

- For stakeholders, diversification and diversification strategies are essential to maintain profitability in a highly competitive environment.

FAQs

1. When is the patent expiration for INDERAL XL expected to open the market to generic competition?

The primary patent protection for INDERAL XL expired in the US around 2014, with secondary patents or formulation-specific protections extending until approximately 2025-2027, after which generic competition is imminent.

2. How have generic entries impacted the pricing of INDERAL XL globally?

The entry of generics has led to a substantial price decrease, especially in North America and Europe, often reducing the original brand’s price by over 50%. This trend is expected to persist as more generics enter different markets.

3. What are the main factors influencing INDERAL XL’s future market price?

Key drivers include patent expiry timing, regulatory pricing policies, competitiveness of generics, demand driven by cardiovascular disease epidemiology, and potential formulation or indication innovations.

4. Are there any emerging therapeutic alternatives that could threaten INDERAL XL’s market share?

Yes; newer beta-blockers with improved side-effect profiles, selective beta-1 agents, and alternative antihypertensive classes could limit INDERAL XL’s growth, particularly if they demonstrate superior efficacy or safety.

5. How can pharmaceutical companies sustain profitability for INDERAL XL amid declining prices?

Strategies include focusing on niche indications, developing extended-release formulations with differentiating features, engaging in patent extensions or supplementary protection certificates, and expanding into emerging markets.

References

[1] Global Market Insights, "Cardiovascular Therapeutics Market Size, Share & Trends," 2022.

[2] IQVIA, "Prescription Data & Market Trends," 2022.

[3] U.S. Patent Office, Patent Expiry Reports, 2022.

[4] Bloomberg Intelligence, "Generic Drug Market Dynamics," 2023.