Last updated: August 4, 2025

Introduction

Inderal LA (propranolol extended-release) is a beta-adrenergic blocker primarily indicated for the treatment of hypertension, angina pectoris, arrhythmias, and certain neurological conditions such as migraine prophylaxis. Its unique pharmacokinetic profile offers a once-daily dosage option, enhancing patient adherence. Given its long-standing presence market and expanding therapeutic indications, an in-depth market analysis and price projection for Inderal LA are vital for stakeholders, including pharmaceutical companies, healthcare providers, and investors.

Market Overview

Global Market Size and Growth Trends

The global beta-blocker market was valued at approximately USD 4.5 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of about 3.8% through 2030 [1]. Propranolol, the active ingredient in Inderal LA, remains a significant segment within this market owing to its extensive clinical use and its patent expiration status. The extended-release formulation, in particular, caters to patients requiring sustained blood pressure and anti-arrhythmic effects, thus commanding a substantial share in the cardiovascular therapeutics niche.

Key Therapeutic Indications

- Hypertension: Inderal LA offers a stable plasma level, reducing blood pressure effectively.

- Migraine prophylaxis: Its efficacy in migraine prevention sustains consistent demand.

- Arrhythmias and tachyarrhythmias: It reduces abnormal cardiac rhythms.

- Other uses: Off-label applications include performance anxiety and certain tremors.

Market Drivers

- Aging Population: An increasing prevalence of hypertension and cardiovascular diseases among aging demographics.

- Chronic Disease Management: Growing emphasis on long-term management of chronic cardiovascular conditions.

- Advancements in Drug Delivery: The convenience of extended-release formulations promotes compliance.

- Generic Competition: As patent exclusivity has expired, generic versions have proliferated, impacting branded prices.

Market Challenges

- Generic Market Penetration: Intense price competition compresses profit margins.

- Price Sensitivity: Healthcare systems and insurers prioritize cost-effective therapies.

- Regulatory Pressures: Stringent approval pathways and compliance standards influence market dynamics.

Competitive Landscape

Leading Players

Post-patent expiry, multiple generic manufacturers produce propranolol extended-release formulations, including Teva, Sandoz, Mylan, and others. The presence of generics significantly affects pricing strategies and market shares.

Branded vs. Generic

While the branded Inderal LA benefits from established clinician loyalty and perceived quality, generics account for approx. 85% of prescriptions due to their affordability [2]. Despite this, branded products maintain niche markets through differentiation and marketing.

Price Analysis

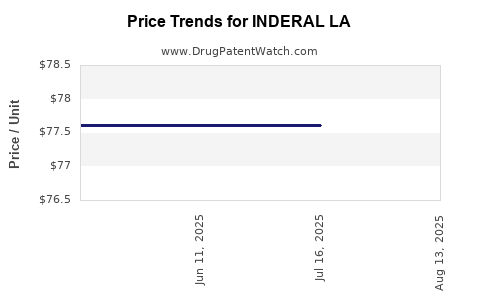

Historical Pricing Trends

- Brand-Name Inderal LA: Historically, the brand's wholesale acquisition cost (WAC) ranged from USD 170– USD 250 per month supply, varying by pharmacy and region.

- Generic Equivalents: Generic propranolol extended-release formulations are priced approximately 30–50% lower than the brand, with some markets offering generic versions at USD 80– USD 150 per month supply.

Market Pricing Factors

- Manufacturing Costs: Generic manufacturers leverage large-scale production to minimize costs.

- Reimbursement Policies: Insurance coverage and formularies influence patient copays and market prices.

- Distribution Channels: Pharmacies, hospitals, and online platforms influence the final retail price.

- Geographical Variations: Developed markets like the US, EU, and Japan tend to have higher drug prices compared to emerging markets owing to different regulatory and economic factors.

Price Projections (2023–2030)

Factors Influencing Future Prices

- Patent and Exclusivity Status: As patent protections for Inderal LA expired in most regions, generic proliferation will dominate, exerting downward pressure on prices.

- Market Demand: Demand for long-acting beta-blockers will remain robust, particularly for chronic cardiovascular management.

- Cost-Reduction Initiatives: Push toward cost containment by healthcare providers will favor generics.

- Potential Partnerships and Strategic Alliances: Large pharmaceutical firms may introduce new formulations or combination therapies, potentially influencing overall pricing structures.

Projected Trends

- Brand-Name Prices: Expected to decline steadily by 15–20% annually, reaching approximately USD 60–80 per month supply by 2030.

- Generic Prices: Anticipated to stabilize around USD 50–100 per month supply by 2030, assuming market saturation.

Estimations

By 2030, the global market for propranolol extended-release formulations could worth USD 1–1.2 billion, driven mainly by emerging markets. Price reductions and increased volume sales will offset unit price declines, maintaining steady revenue streams.

Regulatory and Innovation Outlook

- Regulatory Landscape: Continuous updates to pharmacovigilance and quality standards may influence manufacturing costs, indirectly affecting prices.

- Innovations: Next-generation formulations, including novel delivery mechanisms or fixed-dose combinations, could introduce premium price tiers, influencing overall market dynamics.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Focus on optimizing manufacturing efficiency, expanding access in emerging markets, and differentiating through new formulations.

- Healthcare Systems: Prioritize procurement of cost-effective generics, negotiate favorable reimbursement terms, and promote therapeutic adherence.

- Investors: Monitor patent expiry milestones and generic market entry timelines, informing investment strategies accordingly.

Key Takeaways

- The Inderal LA market is predominantly driven by generic competition, exerting downward pressure on prices.

- Price projections indicate a consistent decline in the brand-name product, with generics becoming the primary revenue driver.

- Emerging markets will increasingly contribute to global sales due to rising cardiovascular disease prevalence and access improvements.

- Regulatory and technological innovations may influence future pricing strategies and product differentiation.

- Stakeholders must balance cost containment with therapeutic efficacy to retain market share.

FAQs

1. How has patent expiry affected Inderal LA’s market prices?

Patent expiry has led to a surge in generic propranolol extended-release products, significantly reducing prices for consumers and healthcare systems. The branded Inderal LA has experienced a decline in market share, with generics dominating prescriptions.

2. What are the main factors driving future price declines?

The primary factors include intense generic competition, healthcare cost containment efforts, and increased market penetration in emerging regions.

3. Will the demand for Inderal LA increase or decrease in the coming years?

Demand is likely to sustain or modestly increase due to the aging population, rising chronic cardiovascular conditions, and the convenience offered by extended-release formulations.

4. How do regional differences influence Inderal LA pricing?

Pricing varies globally, influenced by regulatory environments, reimbursement policies, distribution channels, and economic factors. Developed countries typically have higher prices, but also stricter regulatory standards.

5. Are there upcoming innovations that could change the market landscape?

Yes, developments in drug delivery technology, combination therapies, and personalized medicine could enable premium pricing and redefine current market dynamics.

References

[1] MarketWatch. "Beta-Blockers Market Size, Share & Trends." 2022.

[2] IQVIA. "Global Prescriptions Data & Market Share." 2022.