Last updated: July 27, 2025

Introduction

Indapamide is a widely prescribed antihypertensive and diuretic agent primarily used in the management of hypertension and heart failure. Its robust efficacy, favorable safety profile, and cost-effectiveness have cemented its position as a staple in both generic and branded formulations. This article analyzes the current market landscape of indapamide, evaluates emerging trends, and projects future pricing dynamics, providing valuable insights for stakeholders ranging from pharmaceutical companies to healthcare providers and investors.

Market Overview

Global Market Size and Dynamics

The global antihypertensive drugs market was valued at approximately USD 26 billion in 2022, with diuretics accounting for roughly 12-15% of this segment. Indapamide, classified under thiazide-like diuretics, holds a significant niche within this space due to its efficacy and safety profile. The increasing prevalence of hypertension, affecting over 1.28 billion adults worldwide[1], drives sustained demand for affordable, effective medications like indapamide.

Key factors influencing market dynamics include:

- Prevalence of Hypertension and Cardiac Conditions: Rising incidences driven by aging populations and urbanization sustain an evergreen demand for antihypertensives.

- Generic Promotion: The patent expiry of brand formulations has led to widespread generic manufacturing, intensifying price competition.

- Regulatory Environment: Varying approval processes and patent landscapes across regions influence market access and pricing strategies.

Regional Market Insights

- North America: Dominates with an estimated market share exceeding 40%. The presence of established healthcare infrastructure, high disease awareness, and insurance coverage foster steady demand.

- Europe: The market exhibits steady growth bolstered by aging demographics and comprehensive healthcare systems, with pricing often moderated by regulatory bodies.

- Asia-Pacific: Represents the fastest-growing segment, driven by escalating hypertension prevalence, increasing healthcare expenditure, and expanding pharmaceutical manufacturing capabilities.

Competitive Landscape

The market is saturated with multiple generic manufacturers, including Mylan, Sandoz, and Teva. Brand formulations, such as Indapamide by Sanofi, hold smaller segments mainly due to higher pricing and patent protections that are now mostly expired or nearing expiry.

Price Trends and Analysis

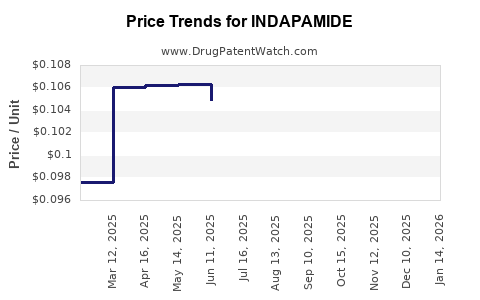

Current Pricing Landscape

Indapamide's pricing varies globally, heavily influenced by regulatory policies, manufacturing costs, and market competition:

- United States: Retail prices for 2.5 mg tablets approximate USD 0.10–0.20 per tablet for generics, with compounded formulations occasionally costing higher depending on pharmacy and distribution channels.

- Europe: Prices tend to be slightly lower, with average costs around EUR 0.05–0.15 per tablet.

- Emerging Markets: Significant variability exists, often influenced by government price controls, local manufacturing, and import tariffs, with prices as low as USD 0.01 per tablet in some regions.

Factors Driving Price Declines

- Patent Expiry: The expiration of key patents has allowed for an influx of generics, precipitating price reductions.

- Market Competition: The proliferation of generic competitors leads to price erosion as manufacturers seek to capture market share.

- Regulatory Price Controls: Many countries enforce price caps to ensure affordability, constraining price growth.

Projected Price Trends (2023-2028)

Based on current indicators and market intelligence, the following projections are presented:

| Region |

2023 Price Range (per tablet) |

Projected 2028 Price Range (per tablet) |

Key Drivers |

| North America |

USD 0.10 – 0.20 |

USD 0.08 – 0.15 |

Increased generics penetration, insurer negotiations, patent expiries. |

| Europe |

EUR 0.05 – 0.15 |

EUR 0.04 – 0.12 |

Regulatory price caps, market competition. |

| Asia-Pacific |

USD 0.01 – 0.08 |

USD 0.008 – 0.07 |

Expansion of local manufacturing, government procurement policies. |

The overall trend indicates a slight decrease in per-unit cost, with stabilization anticipated as the market matures and patent protections diminish.

Market Opportunities and Challenges

Opportunities

- Emerging Markets Expansion: Growing healthcare access and infrastructure investments open avenues for cost-effective generic indapamide formulations.

- Combination Therapies: Developing fixed-dose combinations with other antihypertensive agents can command premium pricing and improve adherence.

- New Formulations: Extended-release or novel delivery systems may fetch higher prices and clinical differentiation.

Challenges

- Price Competition: Aggressive generics proliferation constrains profit margins.

- Regulatory Barriers: Variations in regional approval processes necessitate investment in compliance.

- Market Saturation: In mature markets, growth rates may plateau, necessitating strategic diversification.

Strategic Outlook and Recommendations

Pharmaceutical companies should prioritize lifecycle management strategies, including development of innovative formulations and regional collaborations, to sustain profitability. Simultaneously, engaging in price negotiations and leveraging government tenders can optimize market access.

From a healthcare policy perspective, balancing affordability with innovation entails navigating complex regulatory and reimbursement landscapes, which influence pricing dynamics.

Key Takeaways

- Growing Global Demand: Rising hypertension prevalence sustains strong, consistent demand for indapamide worldwide.

- Price Decline Trend: Patent expiries and increasing generics competition will continue to exert downward pressure on prices, especially in mature markets.

- Regional Variability: Price projections signal significant regional disparities driven by regulatory policies and market maturity.

- Market Diversification Needed: Companies should explore innovative formulations and combination therapies to differentiate offerings and maintain margins.

- Emerging Markets as a Growth Catalyst: Infrastructure developments and demographic shifts position Asia-Pacific and other emerging regions as key growth drivers.

Concluding Remarks

The indapamide market remains robust, driven by global hypertension burdens and cost-effective treatment needs. While price reductions are anticipated, strategic innovation and regional adaptation will be essential for stakeholders seeking sustainable growth. Continuous monitoring of regulatory landscapes, patent statuses, and competitive dynamics will be critical in formulating effective market strategies.

FAQs

-

What factors influence the current pricing of indapamide globally?

Factors include patent status, manufacturing costs, competitive landscape, regional regulations, and healthcare reimbursement policies.

-

How will patent expiries affect indapamide prices?

Patent expiries typically lead to an influx of generic manufacturers, heightening competition and decreasing prices over time.

-

Are there any new formulations or combination therapies involving indapamide?

Yes, efforts are underway to develop fixed-dose combinations with other antihypertensives, which may command higher prices and improve patient compliance.

-

What regions are expected to see the highest growth in indapamide demand?

Emerging markets in Asia-Pacific and Latin America are poised for significant growth due to rising hypertension prevalence and expanding healthcare infrastructure.

-

What strategic moves should pharmaceutical companies consider in this market?

Investing in formulation innovation, regional partnerships, and cost competitiveness will be critical to capture value amid mature and price-sensitive markets.

References

[1] World Health Organization. (2021). Hypertension Fact Sheet.

[2] MarketWatch. (2022). Global Antihypertensive Drugs Market Report.

[3] IQVIA. (2022). Key Trends in the Generic Pharmaceuticals Sector.

[4] European Medicines Agency. (2023). Regulatory Guidelines for Antihypertensive Medications.

[5] National Institutes of Health. (2022). Hypertension Management Guidelines.