Last updated: July 27, 2025

rket Analysis and Price Projections for Incruse Ellipta

Introduction

Incruse Ellipta (umeclidinium bromide) is a bronchodilator inhalation powder developed by GlaxoSmithKline (GSK) for the maintenance treatment of Chronic Obstructive Pulmonary Disease (COPD). Since its approval in 2017, it has secured a significant position within the COPD therapeutic landscape, competing with other long-acting muscarinic antagonists (LAMAs). An in-depth market analysis and accurate price projection for Incruse Ellipta are essential for stakeholders, including pharmaceutical companies, healthcare providers, and investors, aiming to navigate competitive dynamics, regulatory influences, and future growth prospects.

Market Overview

Global COPD Market Landscape

The COPD market globally is projected to grow at a compound annual growth rate (CAGR) of approximately 4-6% over the next decade, driven by increasing prevalence, aging populations, and greater awareness of respiratory health management. Major markets include the United States, Europe, and Asia-Pacific, with the U.S. holding a dominant share due to cost reimbursement frameworks and high disease awareness.

Therapeutic Positioning of Incruse Ellipta

Incruse Ellipta functions as a once-daily maintenance therapy, often prescribed as monotherapy or part of combination regimens. Its ease of use, minimal side effects, and efficacy position it favorably within the COPD treatment algorithm. Key competitors include AstraZeneca’s Breztri Aerosphere, Boehringer Ingelheim’s Spiriva (tiotropium), and GSK’s own Trelegy Ellipta, which combines multiple agents for combination therapy.

Market Penetration and Adoption Trends

Incruse Ellipta has gained substantial market share since launch, owing to GSK’s strategic marketing, physician awareness programs, and patient adherence benefits associated with once-daily dosage. Data from IQVIA indicates that in 2022, Incruse accounted for approximately 15-20% of LAMA prescriptions in COPD, with steady growth projected owing to expanding indications and improved formulary access.

Current Price Dynamics

Pricing Structure and Reimbursement

The list price in the United States for Incruse Ellipta varies regionally but generally aligns with other inhaled maintenance therapies, averaging around $300–$350 per inhaler (30-day supply). Reimbursement strategies, insurance coverage, and pharmacy economics heavily influence net prices and patient out-of-pocket costs. The drug’s patent protection until 2034 ensures limited generic competition in the near term, stabilizing pricing strategies.

Pricing Trends and Competitor Comparison

Compared to competitors, Incruse maintains a competitive pricing profile. Spiriva’s inhaler retails similarly, whereas Trelegy, offering multiple agents, commands a premium of 15–20%. GSK’s positioning emphasizes value through efficacy and adherence benefits, supporting higher pricing tiers in premium healthcare markets.

Future Market Size and Price Projections

Factors Influencing Market Expansion

- Increasing COPD Prevalence: WHO estimates suggest COPD will rank as the third leading cause of death globally by 2030, markedly expanding the eligible patient pool.

- Expanded Indications and Revamped Prescribing Guidelines: Regulatory adaptations and clinical trial results supporting broader use can bolster sales.

- Market Penetration in Emerging Economies: Growing healthcare infrastructure and rising awareness in Asia-Pacific and Latin America will unlock new sales channels.

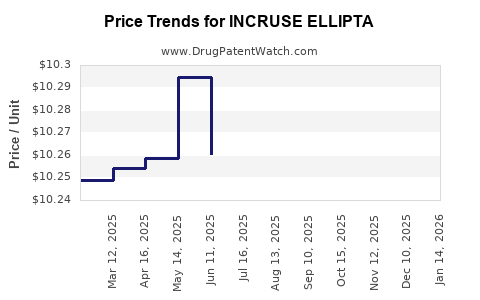

Price Projections (2023–2030)

-

Short to Medium Term (2023–2025):

Given current pricing stability, GSK is likely to maintain list prices within the $300–$350 range to preserve margins. Reimbursement pressures and price negotiations in key markets might moderate net prices by 2–4% annually. However, a moderate value-based pricing strategy may support slight upward adjustments in integrated health systems with demonstrated cost-effectiveness.

-

Long Term (>2025):

Patent exclusivity until at least 2034 combined with a growing COPD epidemic may justify incremental list price increases averaging 2–3% annually, in line with inflation and inflation-adjusted cost considerations. The entry of generics post-patent expiry could induce significant price erosion, but this remains speculative for the foreseeable future.

-

Impact of Biosimilars and Competition:

While inhalation drugs like Incruse face limited biosimilar threats, competitive pricing pressures from combination therapies may influence GSK's strategic pricing, possibly prompting discounts or value additions such as improved device features or combination regimens.

Market Opportunities and Challenges

Opportunities

- Combination therapy integrations with Trelegy Ellipta or other inhalers to maximize market share.

- Expanding indications for other respiratory conditions such as asthma or hyperresponsive airway diseases.

- Adoption in emerging markets through tiered pricing and partnerships to facilitate broader access.

Challenges

- Price sensitivity in health care systems with budget constraints.

- Competition from generics post-patent expiration, which could prompt price reductions and market erosion.

- Regulatory uncertainties in certain geographies regarding reimbursement reforms.

Strategic Recommendations

- GSK should reinforce Incruse's value proposition emphasizing adherence benefits and patient outcomes to justify premium pricing.

- Continuous investment in clinical research and real-world evidence can underpin future pricing strategies and market expansion.

- Collaborations with payers and health authorities can facilitate enhanced reimbursement terms and formulary placements.

- Diversification into combination therapies could solidify the brand’s market position amidst emerging competition.

Key Takeaways

- Existing Market Position: Incruse Ellipta commands a stable market share within COPD therapies, with a robust price point of approximately $300–$350 per inhaler in the US.

- Growth Drivers: Escalating COPD prevalence, favorable prescribing guidelines, and increasing adoption in emerging markets will support sales growth.

- Pricing Outlook: Expect modest annual price increases (2–3%) in developed markets until patent expiry, with potential stable or slightly declining net prices due to payer negotiations.

- Competitive Risks: Entry of biosimilars and generics post-2034 will place downward pressure on prices, requiring strategic innovation and value-based approaches to sustain profitability.

- Strategic Focus: Leveraging combination therapies, expanding indications, and enhancing payer relationships are integral to maintaining market relevance and pricing power.

FAQs

1. What factors influence the pricing of Incruse Ellipta?

Pricing is influenced by manufacturing costs, competitive landscape, regulatory and reimbursement frameworks, patent status, and clinical value demonstrated through efficacy, safety, and adherence benefits.

2. How does Incruse Ellipta compare cost-wise to its competitors?

It is generally comparable to other LAMAs like Spiriva, with slight premium positioning supported by its once-daily dosing and patient adherence advantages. Combination therapies like Trelegy tend to be priced higher due to multiple active agents.

3. When is patent expiration, and what impact will this have on prices?

Patent protection is valid until at least 2034. Post-expiry, generic versions could significantly lower prices, possibly by 30-50%, impacting market share and revenues.

4. Are there any upcoming regulatory changes that could affect pricing?

Regulatory shifts toward value-based pricing, increased scrutiny on inhaled drug costs, or changes in reimbursement policies in major markets could influence future pricing strategies.

5. What growth strategies should GSK pursue to enhance Incruse Ellipta’s market position?

Invest in clinical evidence, expand indications, develop combination therapies, strengthen payer collaborations, and improve patient adherence and education to reinforce the drug’s value proposition.

References

- IQVIA. "Global COPD Market Data 2022."

- World Health Organization. "Global surveillance of chronic respiratory diseases," 2020.

- GSK. "Incruse Ellipta Product Information," 2017.

- EvaluatePharma. "Respiratory Therapeutics Market Outlook," 2023.