Share This Page

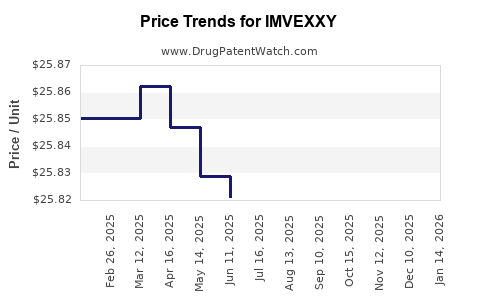

Drug Price Trends for IMVEXXY

✉ Email this page to a colleague

Average Pharmacy Cost for IMVEXXY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| IMVEXXY 4 MCG STARTER PACK | 68308-0747-18 | 25.82871 | EACH | 2025-12-17 |

| IMVEXXY 10 MCG MAINTENANCE PAK | 50261-0110-08 | 25.78001 | EACH | 2025-12-17 |

| IMVEXXY 10 MCG MAINTENANCE PAK | 68308-0748-08 | 25.78001 | EACH | 2025-12-17 |

| IMVEXXY 10 MCG STARTER PACK | 68308-0748-18 | 25.78017 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for IMVEXXY (estradiol vaginal insert)

Introduction

IMVEXXY (estradiol vaginal insert) represents a targeted hormone therapy designed to treat moderate to severe vaginal estrogen deficiency symptoms, including vaginal dryness, irritation, and dyspareunia, related to menopause. Since its approval by the U.S. Food and Drug Administration (FDA) in October 2021, IMVEXXY has entered a competitive landscape dominated by hormone therapy products aimed at menopausal women. This analysis examines current market dynamics, factors influencing demand, pricing strategies, and future price projections.

Market Overview and Therapeutic Landscape

IMVEXXY operates within the broader hormone replacement therapy (HRT) market, focusing specifically on localized estrogen treatments for genitourinary syndrome of menopause (GSM). Its unique delivery system — a suppository inserted vaginally — offers targeted relief with minimal systemic absorption, distinguishing it from oral or transdermal estrogen therapies.

The global menopause management market is projected to reach approximately USD 4.8 billion by 2027, with estrogen and estrogen-progestogen therapies comprising the largest share, driven by increasing awareness and aging populations [[1]]. In the U.S., over 6 million women aged 45-55 are estimated to experience moderate to severe menopausal symptoms, representing a substantial patient base for vaginal estrogen products [[2]].

Market Drivers and Influencing Factors

1. Growing Menopausal Demographic:

The U.S. Census Bureau reports the female population aged 45-54 at over 23 million, with a steady increase due to longevity [[3]]. As women age, the prevalence of GSM symptoms rises, fueling demand for localized estrogen treatments like IMVEXXY.

2. Preference for Targeted Therapies:

Healthcare providers and patients favor localized hormone therapies due to efficacy and fewer systemic side effects. IMVEXXY’s suppository form offers convenience and discreet administration, aligning with current patient preferences.

3. Competitive Landscape:

IMVEXXY faces competition from established vaginal estrogen products such as Estrace Vaginal Cream, Vagifem (estradiol vaginal tablets), and Estring (estradiol vaginal ring). However, its novel delivery system and FDA approval for specific indications could provide a competitive edge.

4. Regulatory and Reimbursement Environment:

The extent of coverage by insurance providers significantly influences pricing and market penetration. As a new entrant, securing formulary inclusion is crucial for market adoption.

5. Clinical Data and Safety Profile:

Positive clinical trial results demonstrating safety and efficacy reinforce confidence among physicians, accelerating prescription rates.

Pricing Strategies and Current Price Points

1. Launch Pricing:

At market entry, IMVEXXY’s pricing was set at approximately USD 250-300 per box of one insert (containing 8 doses), equating to roughly USD 31-38 per dose. This positioning positions IMVEXXY as a premium but competitive localized estrogen treatment.

2. Cost-Effectiveness and Payer Negotiations:

Pricing negotiations with health insurers and Medicaid programs influence both reimbursement levels and patient out-of-pocket costs. Manufacturers often offer discounts or rebates to encourage formulary placement.

3. Comparative Market Pricing:

Existing vaginal estrogen therapies range from USD 25-50 per dose, with formulations like Vagifem priced at approximately USD 35 per tablet [[4]]. IMVEXXY’s premium positioning reflects its unique delivery system and potential benefits.

4. Value-Added Features:

The minimally systemic absorption profile and FDA approval for specific indications support a higher price point, especially if randomized clinical trials demonstrate superior efficacy or safety.

Future Price Projections and Market Dynamics

1. Short-term (1-2 years):

Assuming steady market penetration and limited discounting, IMVEXXY’s price is expected to remain within USD 30-40 per dose. Manufacturer strategies may include discounts to foster formulary acceptance, temporarily reducing out-of-pocket costs.

2. Mid-term (3-5 years):

As clinical data accumulates and competition intensifies, price adjustments will likely occur. If IMVEXXY secures broad insurance coverage, the average price could stabilize around USD 25-35 per dose, aligning with other vaginal estrogen therapies.

3. Long-term (5+ years):

Market maturity may lead to slight price reductions driven by increased competition, patent expirations of existing products, and the emergence of generics. However, if IMVEXXY maintains a unique delivery advantage or receives label expansions, premium pricing may persist.

4. Impact of Patent Exclusivity and Generic Entry:

Patent exclusivity in the U.S. extends until 2034, protecting revenue streams. Patent challenges or generic entrants can pressure prices downward post-expiry, potentially reducing per-dose costs by 30-50%.

Strategic Implications for Stakeholders

- Pharmaceutical companies should focus on securing extensive formulary coverage and demonstrating clinical benefits to justify premium pricing.

- Healthcare providers need clear guidelines on positioning IMVEXXY relative to existing therapies to optimize prescribing practices.

- Payers aim to balance cost containment with access, influencing pricing negotiations through evidence of improved safety and efficacy.

- Patients benefit from access to innovative delivery methods, but affordability remains a concern, emphasizing the importance of insurance coverage.

Key Takeaways

- IMVEXXY enters a market with high unmet needs among menopausal women, backed by increasing demographic demand.

- Its unique delivery system and clinical profile afford it a competitive advantage, supporting a premium price point initially around USD 30-40 per dose.

- Market dynamics, including insurance coverage, clinical efficacy, and competitive pressures, will influence pricing trajectories.

- Over the next 3–5 years, expect price stabilization between USD 20–35 per dose, with potential adjustments based on market expansion and generic competition.

- Strategic positioning emphasizing safety, convenience, and targeted therapy will be critical for sustained profitability and market share.

FAQs

1. How does IMVEXXY differ from other vaginal estrogen treatments?

Unlike creams or tablets, IMVEXXY is a suppository offering targeted delivery with minimal systemic absorption, potentially reducing systemic side effects and improving patient convenience.

2. What factors could influence IMVEXXY’s price reduction in the future?

Patent expiration, increasing generic competition, and broader insurance coverage could lead to notable price reductions.

3. Is IMVEXXY covered by most insurance plans?

As a newer product, insurance coverage is expanding but varies. Negotiations with payers aim to improve formulary inclusion to enhance accessibility.

4. How does clinical efficacy impact IMVEXXY’s pricing?

Positive clinical trial results and demonstrated superiority or safety improvements justify premium pricing, while disappointing data could necessitate price adjustments.

5. What is the potential for IMVEXXY’s global market expansion?

Regulatory approval in other regions depends on local clinical data and market conditions; global expansion could significantly impact revenue and pricing strategies.

Sources

[1] MarketsandMarkets. "Menopause Market by Product," 2021.

[2] North American Menopause Society. "Menopause Symptoms and Management," 2020.

[3] U.S. Census Bureau. "Age and Sex Composition," 2022.

[4] GoodRx. "Vaginal Estrogen Prices," 2022.

More… ↓