Last updated: July 30, 2025

Introduction

IMITREX, the brand name for sumatriptan, is a leading pharmaceutical treatment for acute migraine attacks. Since its FDA approval in 1992, it has maintained a dominant position in the migraine therapeutics market, driven by its efficacy, safety profile, and rapid onset of action. As the global burden of migraine increases—estimated to affect over 1 billion people worldwide—the demand for effective treatments like IMITREX remains high. This report provides a comprehensive market analysis and forecasts future pricing dynamics for IMITREX, considering patent landscape, competitive landscape, regulatory factors, and emerging market trends.

Market Landscape and Competitive Dynamics

Market Size and Growth Trajectory

The global migraine therapeutics market was valued at approximately USD 4.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4.2% through 2030. This growth is propelled by increased awareness, better diagnosis, and expanding unmet needs, particularly in emerging markets.

Regionally, North America commands the largest share—approximately 45-50%—due to high migraine prevalence, advanced healthcare infrastructure, and strong brand presence of IMITREX. Europe follows, with similar driving factors, while Asia-Pacific exhibits significant growth potential due to rising healthcare access and population demographics.

Competitive Landscape

IMITREX's key competitors include other triptans such as eletriptan (Relpax), rizatriptan (Maxalt), and sumatriptan generics. Recently, newer agents like lasmiditan (Reyvow) and gepants (ubrogepant, rimegepant) have entered the market, targeting both acute and preventive migraine treatment, shifting the competitive environment.

Generic formulations of sumatriptan, now widely available, have exerted downward pressure on the brand-name drug's pricing. Still, IMITREX benefits from brand loyalty, physician prescribing habits, and patient preference due to proven efficacy and safety.

Patent and Regulatory Status

The original patent for IMITREX expired in 2015. Since then, generic versions have flooded the market, intensifying price competition. However, the branded IMITREX retains market share through marketing, physician relationships, and formulary placements. Ongoing patent filings related to formulations or delivery systems could temporarily shield certain formulations from generic competition, influencing price stability in specific markets.

Pricing Analysis

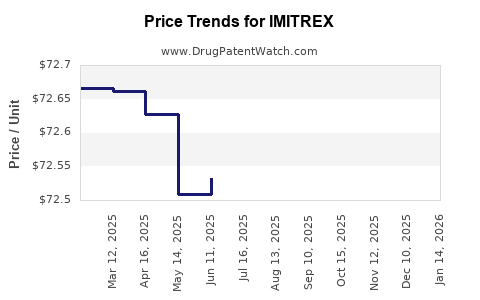

Historical Pricing Trends

Since patent expiry, the retail price of IMITREX has declined considerably. In the US, a typical 30-tablet pack of branded IMITREX (100 mg) initially retailed at approximately USD 250-300, but current prices hover around USD 100-150 due to generic competition and pharmacy benefit management (PBM) negotiations [2].

Factors Influencing Future Pricing

-

Generic Competition: Substantial since 2015, with generics priced at 30-50% of the brand-name. Price erosion continues, though some formulations or delivery methods command premium pricing.

-

Market Penetration in Emerging Economies: Higher prices are observed where generic entry is limited, or regulatory barriers exist.

-

Formulation Innovations: New delivery systems (e.g., intranasal, autoinjectors) may command higher prices, but market penetration would depend on reimbursement policies.

-

Reimbursement and Insurance Coverage: In the US, high co-pays discourage branded drug utilization; however, branded drugs may retain high margins in certain European or Asian markets with different reimbursement policies.

Projected Price Trends (2023-2030)

-

Short-term (2023-2025): Prices are expected to stabilize or slightly decline as more generics enter markets, driven by high-volume sales and cost containment pressures. The average retail price for branded IMITREX in mature markets may range from USD 100-120, with some variation.

-

Mid to Long-term (2026-2030): Prices could decline further by approximately 10-15% annually, assuming sustained generic competition and market saturation. Niche formulations (e.g., tailored delivery systems) could maintain premium pricing segments, but overall, a trend toward commoditization is anticipated.

Emerging Market Considerations

Emerging markets, such as China, India, and parts of Latin America, present unique pricing dynamics:

-

Regulatory Barriers often lead to delayed generic entry, allowing branded drugs to command higher prices temporarily.

-

Pricing Policies in these countries favor generics, often resulting in significantly lower prices—sometimes less than 20% of US prices.

-

Market Access Initiatives and local manufacturing are likely to influence prices both upward and downward, depending on policy shifts and local competition.

Forecasting Key Market Drivers

-

Increasing Prevalence of Migraines: Expected to sustain demand growth, especially among aging populations and lifestyle-related stress factors.

-

Advances in Formulation Technologies: Development of fast-acting, non-invasive formulations may sustain premium pricing segments.

-

Patent Expirations and Generic Dilution: Continuous entry of generics, especially in developed markets, will exert downward pricing pressure but may also expand overall market volume.

-

Regulatory Dynamics: Potential new approvals or combination therapies could reshape market share and price points.

Conclusion: Market Outlook and Price Projections

Given the current landscape, IMITREX's market will likely evolve from a predominantly branded, high-priced product to a highly commoditized one dominated by generics, especially in mature markets. The average retail price in the US and Europe is projected to decline gradually over the next decade, reaching approximately USD 70-90 by 2030. However, niche formulations and innovative delivery systems could sustain higher prices for specific segments.

Pharmaceutical companies aiming to capitalize on this market should focus on differentiating formulations, expanding into emerging markets through strategic pricing, and investing in user-friendly delivery systems that command premium pricing. Stakeholders must monitor patent statuses, regulatory changes, and competitive entries closely to adapt pricing strategies and market forecasts accordingly.

Key Takeaways

-

The global migraine market on a growth trajectory, with increasing demand for effective acute treatments like IMITREX.

-

Patent expirations have significantly reduced IMITREX prices; generics dominate the landscape, exerting downward pressure.

-

In mature markets, average prices for IMITREX are forecasted to decline 10-15% annually over the next decade.

-

Emerging markets may offer higher pricing opportunities temporarily, driven by regulatory and market access conditions.

-

Innovation in formulations and delivery systems could sustain premium pricing niches amidst overall price erosion.

FAQs

1. What factors primarily influence IMITREX price fluctuations?

Patent status, generic competition, formulation innovations, regional regulatory policies, and reimbursement frameworks significantly impact IMITREX pricing.

2. How does generic entry post-patent expiry affect IMITREX's market share?

Generics capture substantial market share due to lower prices, reducing revenue for the brand-name drug but expanding overall market volume by increasing accessibility.

3. What emerging formulations could influence future IMITREX prices?

Intranasal sprays, autoinjectors, and fast-dissolving tablets could command higher prices due to convenience and rapid action.

4. How do regional differences impact IMITREX pricing strategies?

Higher regulatory barriers and market controls in emerging regions may temporarily sustain higher prices, but overall, prices tend to trend lower with increased generic availability.

5. What is the outlook for IMITREX in the context of new migraine therapy classes?

New agents like gepants and ditans expand treatment options, potentially reducing IMITREX’s market share and influencing its pricing strategies, especially in markets where these drugs are preferred.

References

[1] Market Research Future, "Global Migraine Therapeutics Market Analysis," 2022.

[2] GoodRx, "Current US Pharmaceutical Prices," 2023.