Share This Page

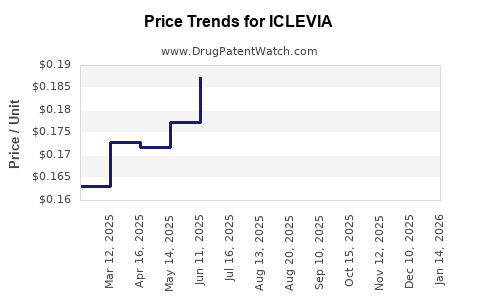

Drug Price Trends for ICLEVIA

✉ Email this page to a colleague

Average Pharmacy Cost for ICLEVIA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ICLEVIA 0.15 MG-0.03 MG TABLET | 65862-0865-94 | 0.16398 | EACH | 2025-12-17 |

| ICLEVIA 0.15 MG-0.03 MG TABLET | 65862-0865-94 | 0.15618 | EACH | 2025-11-19 |

| ICLEVIA 0.15 MG-0.03 MG TABLET | 65862-0865-94 | 0.17208 | EACH | 2025-10-22 |

| ICLEVIA 0.15 MG-0.03 MG TABLET | 65862-0865-94 | 0.18487 | EACH | 2025-09-17 |

| ICLEVIA 0.15 MG-0.03 MG TABLET | 65862-0865-94 | 0.19279 | EACH | 2025-08-20 |

| ICLEVIA 0.15 MG-0.03 MG TABLET | 65862-0865-83 | 0.19279 | EACH | 2025-08-20 |

| ICLEVIA 0.15 MG-0.03 MG TABLET | 65862-0865-94 | 0.18647 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ICLEVIA (Mepolizumab)

Introduction

The evolving landscape of biologic therapeutics for eosinophilic conditions positions ICLEVIA (mepolizumab) as a leading player. Developed by GlaxoSmithKline (GSK), ICLEVIA, a monoclonal antibody targeting interleukin-5 (IL-5), aims to mitigate eosinophil-driven diseases such as severe asthma, eosinophilic granulomatosis with polyangiitis (EGPA), and hypereosinophilic syndrome (HES). This analysis explores the current market dynamics, competitive positioning, pricing trends, and future projections to inform stakeholders seeking strategic insights.

Market Landscape

1. Therapeutic Indication Expansion

Initially approved for severe eosinophilic asthma (2015), ICLEVIA's indications have broadened to include:

- Chronic Rhinosinusitis with Nasal Polyps (CRSwNP)

- EGPA (2017)

- HES (2020)

This expansion aligns with evolving clinical guidelines emphasizing biologic therapies in eosinophilic and type-2 inflammatory diseases, fueling increased demand.

2. Competitive Ecosystem

ICLEVIA faces competition predominantly from similar IL-5 antagonists:

- Nucala (mepolizumab) by AstraZeneca

- Cinqair (reslizumab) by Teva

- Fasenra (benralizumab) by AstraZeneca

While Nucala maintains a significant market share, ICLEVIA's competitive edge hinges on efficacy, safety profile, dosing convenience, and formulary positioning. Recent head-to-head trials demonstrate comparable effectiveness, but regional preferences and clinician familiarity significantly influence market share.

3. Market Penetration and Adoption

Global adoption rates generally correlate with healthcare infrastructure and insurance reimbursement policies. North America, Europe, and select Asian markets exhibit vigorous uptake, driven by:

- Increasing prevalence of eosinophilic asthma (~150 million globally)

- Rising awareness and diagnosis of eosinophilic conditions

- Favorable reimbursement landscapes in developed economies

Emerging markets show substantial potential, albeit with barriers linked to pricing, healthcare access, and regulatory approval timelines.

Pricing Trends

1. Initial Pricing Strategy

ICLEVIA's current list price in the U.S. is approximately \$32,500 to \$37,000 per year for a typical patient, depending on dosage and administration frequency. This aligns with competitors and reflects the high development and manufacturing costs associated with biologics.

2. Price Components

- Per-dose cost: Approximately \$3,000 to \$3,700, with dosing frequency of once monthly (100 mg subcutaneously).

- Reimbursement and rebates: Industry estimates suggest net prices are often negotiated downward by insurance companies and pharmacy benefit managers (PBMs).

3. Market-Driven Pricing Adjustments

GSK and other manufacturers have occasionally adjusted prices in response to:

- Competitive pressures (e.g., new entrants or biosimilars)

- Payer negotiations

- Cost of goods and supply chain considerations

While biologics are typically insulated from significant price erosion for several years post-launch, the ongoing push for biosimilar development poses future price compression risks.

Future Price Projections

1. Short-term Outlook (1–3 years)

Given current regulatory approvals and existing market penetration, ICLEVIA's list price is likely to remain relatively stable, with predicted annual increases of 2–4% driven by inflation, manufacturing costs, and value-based pricing negotiations. However, strategic discounts could be implemented in key markets to maintain or grow market share.

2. Medium- to Long-term Outlook (3–10 years)

Emerging biosimilars and novel therapeutic modalities promise price competition. If biosimilars for mepolizumab receive approval and demonstrate similar efficacy at lower costs, originator prices could decline by approximately 20–30% over a decade. Conversely, expanded label indications, personalized medicine approaches, and improved formulations might sustain or elevate current pricing strategies.

3. Impact of Policy and Reimbursement Trends

Global healthcare reforms emphasizing cost containment, such as value-based pricing and international reference pricing, could exert downward pressure on biologic prices, potentially altering ICLEVIA's pricing trajectory, especially outside North America and Western Europe.

Market Growth Drivers & Barriers

Drivers:

- Increasing diagnosis rates of eosinophil-associated diseases.

- Growing use of biologics as first-line and adjunct therapies.

- Shift towards personalized medicine increasing prescription volumes.

- Healthcare system expansions in emerging markets.

Barriers:

- High treatment costs limiting patient access.

- Competitive pressure from biosimilars and emerging treatments.

- Regulatory hurdles delaying approval and reimbursement.

Strategic Implications

Stakeholders should anticipate a predominantly stable pricing environment over the short term, with potential price erosion over the medium term due to biosimilar entry and cost-containment policies. Market expansion, particularly in Asia, offers lucrative growth opportunities for ICLEVIA, especially if GSK can navigate regional reimbursement challenges effectively.

Investors and healthcare providers should monitor:

- Biosimilar development timelines and approval statuses.

- Pricing and reimbursement landscape shifts.

- Clinical trial data supporting new indications.

- Cost-efficiency improvements for biologic manufacturing.

Key Takeaways

-

Market Growth: The global biologic market for eosinophilic impairment is expanding rapidly, with ICLEVIA poised to benefit from increased demand and indication expansion.

-

Pricing Stability & Competition: Short-term price stability will persist amid fierce competition; however, biosimilars and policy pressures are likely to exert downward influence in the longer run.

-

Pricing Strategy: GSK’s current pricing reflects market standards and treatment value; proactive engagement with payers and reimbursement stakeholders will be essential to maintain market access.

-

Regional Opportunities: Emerging markets present high-growth avenues, contingent on favorable regulatory and reimbursement frameworks.

-

Future Outlook: Competitive dynamics and healthcare policy will significantly influence ICLEVIA’s pricing trajectory over the next decade, with potential for both expansion and compression based on external factors.

FAQs

1. How does ICLEVIA's pricing compare to other IL-5 antagonists?

ICLEVIA's list price is comparable to other biologics like Nucala, with minor variations depending on dosage and region. Strategic discounts and reimbursement negotiations often result in similar net prices across competing agents.

2. What factors could cause ICLEVIA's price to decrease in the future?

Introduction of biosimilars, increased competition, regulatory changes emphasizing cost savings, and healthcare policy reforms aiming at affordability could all drive price reductions.

3. Which regions are expected to offer the highest growth potential for ICLEVIA?

North America and Western Europe will remain primary markets, but emerging markets in Asia, Latin America, and the Middle East offer significant growth potential upon regulatory approval and reimbursement development.

4. How do biosimilars impact ICLEVIA's market and pricing?

Biosimilar entrants typically lead to price competition, with significant discounts possible—potentially 20-30% off original prices—which can erode market share but also increase overall patient access.

5. What strategies can GSK deploy to sustain ICLEVIA’s market position?

GSK can focus on expanding indications, optimizing dosing schedules, engaging with payers for favorable reimbursement terms, and innovating formulations to enhance convenience and reduce costs.

References

[1] GlobalData. "Biologic Therapy Market for Eosinophilic Conditions." 2022.

[2] GSK Corporate Overview. "ILEVIA (Mepolizumab) Product Data," 2023.

[3] MarketWatch. "Biologic Drugs Price Trends," 2022.

[4] IQVIA. "Biopharmaceutical Market Analysis," 2022.

[5] World Health Organization. "Prevalence of Eosinophilic Diseases," 2021.

More… ↓