Share This Page

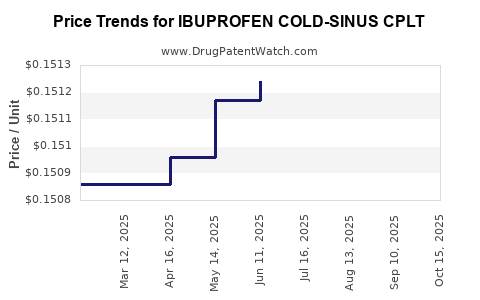

Drug Price Trends for IBUPROFEN COLD-SINUS CPLT

✉ Email this page to a colleague

Average Pharmacy Cost for IBUPROFEN COLD-SINUS CPLT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| IBUPROFEN COLD-SINUS CPLT | 24385-0465-60 | 0.15171 | EACH | 2025-10-22 |

| IBUPROFEN COLD-SINUS CPLT | 24385-0465-60 | 0.15148 | EACH | 2025-09-17 |

| IBUPROFEN COLD-SINUS CPLT | 24385-0465-60 | 0.15140 | EACH | 2025-08-20 |

| IBUPROFEN COLD-SINUS CPLT | 24385-0465-60 | 0.15124 | EACH | 2025-07-23 |

| IBUPROFEN COLD-SINUS CPLT | 24385-0465-60 | 0.15124 | EACH | 2025-06-18 |

| IBUPROFEN COLD-SINUS CPLT | 24385-0465-60 | 0.15117 | EACH | 2025-05-21 |

| IBUPROFEN COLD-SINUS CPLT | 24385-0465-60 | 0.15096 | EACH | 2025-04-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Ibuprofen Cold-Sinus CPLT

Introduction

The combination drug Ibuprofen Cold-Sinus CPLT is a pharmaceutical product designed to alleviate symptoms associated with cold and sinus congestion. Its formulation typically includes Ibuprofen, a non-steroidal anti-inflammatory drug (NSAID), combined with decongestants such as pseudoephedrine or phenylephrine, and possibly antihistamines or other supportive ingredients. This analysis evaluates the current market landscape, competitor dynamics, regulatory considerations, and provides price projections based on recent trends and demand forecasts.

Market Landscape

Global Demand and Therapeutic Segment

The demand for OTC cold and sinus medications remains robust, driven by seasonal fluctuations, aging populations, and increasing consumer health awareness. The global cold and flu remedy market was valued at approximately $11.4 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2030 [1].

Ibuprofen-based cold sinus formulations occupy a significant share within this segment due to their efficacy in reducing pain and inflammation. The product caters to both adult and pediatric populations, expanding its market reach worldwide.

Market Drivers

- Rise in respiratory infections: Increased incidence of cold and sinus-related ailments, compounded by seasonal and environmental factors.

- Consumer preference for OTC options: Consumers favor over-the-counter (OTC) medications for quick symptom relief, reducing reliance on prescription drugs.

- Healthcare cost pressures: Patients and healthcare systems prefer cost-effective OTC remedies over prescription alternatives.

- Pandemic influence: COVID-19 heightened awareness of respiratory symptoms, boosting demand for symptomatic relief agents.

Key Regional Markets

- North America: Dominates with approximately 45% of the market, driven by high OTC consumption, advanced healthcare infrastructure, and consumer awareness.

- Europe: Accounts for roughly 27%, with strong OTC channels and aging demographics.

- Asia-Pacific: Fastest-growing region with CAGR of 6-8%, fueled by expanding middle-class populations and increased healthcare access.

- Latin America and Middle East & Africa: Emerging markets with increasing OTC sales, albeit at a slower growth rate.

Competitive Landscape

Major players manufacturing Ibuprofen Cold-Sinus CPLT include:

- Johnson & Johnson (e.g., Tylenol Cold & Sinus)

- Reckitt Benckiser (e.g., Dristan and similar formulations)

- GSK and Sanofi offer various OTC cold remedies with similar active ingredients.

- Numerous regional and generics manufacturers contribute significantly, intensifying competition.

Market consolidation has occurred through acquisitions and strategic alliances, emphasizing efforts to expand product portfolios and distribution networks.

Regulatory Environment

Regulatory approval for OTC cold and sinus products varies by jurisdiction but generally requires demonstrating safety, efficacy, and proper labeling. The US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose stringent standards. Recent regulatory shifts focus on ingredient safety, marketing claims, and proper packaging to minimize misuse.

Pricing policies in different markets influence product positioning, with price controls in developed nations and freer pricing in emerging markets.

Pricing Analysis

Current Price Points

Market surveys indicate:

- North America: Retail prices for Ibuprofen Cold-Sinus CPLT range from $6.99 to $9.99 per pack (typically 12-20 capsules/tablets).

- Europe: Prices vary between €5.50 to €8.50 depending on branding and retailer policies.

- Asia-Pacific: More price-sensitive, with costs historically between $3.50 to $6.00, often influenced by local manufacturing and distribution channels.

- Generic alternatives are priced approximately 15-25% lower than branded counterparts.

Price Trends and Future Projections

Given the demand stability and competitive landscape, prices are expected to follow these trajectories:

- North America & Europe: Prices will likely stabilize or increase marginally (~2-3% annually) owing to inflation, packaging enhancements, and regulatory compliance costs.

- Emerging Markets: Prices will remain relatively stable or decrease slightly due to increased competition and local manufacturing efficiencies.

Factors Influencing Future Pricing

- Regulatory changes: Stricter labeling or formulation standards could raise production costs, leading to higher retail prices.

- Market penetration: Entry of cheaper generics can pressure branded product prices downward.

- Supply chain dynamics: Disruption in raw ingredient supply or manufacturing logistics could cause temporary price fluctuations.

- Consumer sentiment: Growing preference for natural or herbal alternatives may impact traditional OTC formulations, influencing pricing strategies.

Projected Price Range for 2025-2030

- North America & Europe: Expect retail prices to range from $7.50 to $10.50 per pack, with a moderate CAGR of 2-3%.

- Asia-Pacific and Latin America: Predicted prices will range from $4.00 to $6.00, with a CAGR of 3-4%, barring major market disruptions.

- Pricing for generics is expected to continue exerting downward pressure, aiming for a 10-15% reduction in average retail prices over the forecast period in mature markets.

Strategic Market Opportunities

- Product differentiation: Incorporating natural ingredients or extended-release formulations can command premium pricing.

- Regional expansion: Tapping into emerging markets presents growth potential, especially with affordable, effective OTC products.

- Partnerships: Collaborating with retail chains and online platforms ensures wider distribution and consumer access.

- Regulatory navigation: Proactive compliance can facilitate quicker market entry and safeguard pricing strategies.

Key Takeaways

- The Ibuprofen Cold-Sinus CPLT market remains firmly positioned within the OTC cold remedy segment, with steady demand driven by seasonal and global respiratory health concerns.

- Pricing stability is anticipated, with slight upward trends in developed regions due to inflation and regulatory costs, while competition in emerging markets could pressure prices downward.

- Market expansion hinges on strategic product innovation, regional customization, and navigating complex regulatory environments.

- Competitive positioning relies on balancing affordability with perceived value, especially as generic versions gain prominence.

- Supply chain resilience and proactive regulatory compliance are critical to maintaining price consistency and market share.

FAQs

1. What are the main active ingredients in Ibuprofen Cold-Sinus CPLT?

Typically, the formulation includes Ibuprofen for pain and inflammation relief, combined with a decongestant such as pseudoephedrine or phenylephrine to alleviate sinus congestion. Additional components may include antihistamines or acetaminophen for fever reduction.

2. How does the market outlook for OTC cold remedies impact pricing?

Stable or increasing demand supports moderate price growth. Market competition, especially from generics, exerts downward pricing pressure, while regulatory changes may impact manufacturing costs and retail prices.

3. Which regions are most promising for expanding the sales of Ibuprofen Cold-Sinus CPLT?

Emerging markets in Asia-Pacific and Latin America represent significant growth opportunities due to rising healthcare spending, increasing prevalence of respiratory illnesses, and expanding OTC distribution channels.

4. What are the main regulatory considerations affecting pricing and marketing?

Authorities demand rigorous safety and efficacy data, proper labeling, and restrictions on claims. Compliance increases costs but also ensures market stability. Regulatory barriers can delay entry, affecting pricing strategies.

5. Will the trend toward natural or herbal remedies impact the future demand for Ibuprofen Cold-Sinus CPLT?

An increasing consumer shift toward natural products may pose competition, but mainstream OTC formulations retain their relevance due to proven efficacy, convenience, and brand loyalty. Companies may adapt by integrating natural ingredients or positioning their products distinctly.

References

[1] GlobalData. "Cold and Flu Remedy Market Size & Forecast," 2022.

More… ↓