Last updated: July 28, 2025

Introduction

Hydroxyzine is a widely prescribed antihistamine primarily used to treat allergies, anxiety, nausea, and sleep disorders. Market dynamics for hydroxyzine are influenced by factors including clinical demand, patent status, manufacturing landscape, regulatory policies, and emerging alternatives. This analysis provides a comprehensive overview of the current market landscape and forecasts hydroxyzine pricing trajectories within the context of evolving healthcare and pharmaceutical trends.

Current Market Landscape

Therapeutic Use and Market Penetration

Hydroxyzine, marketed under brands such as Vistaril (Pfizer) and Atarax (U.S. Pharmacopeia), has maintained steady demand due to its broad therapeutic applications. Despite being a generic antihistamine, it remains relevant in treating allergic conditions and managing anxiety-related disorders, particularly in settings where newer agents either lack regulatory approval or present adverse profiles.

According to market research, the global antihistamine market was valued at approximately USD 2.2 billion in 2022, projected to grow at a compound annual growth rate (CAGR) of 4.1% through 2030 [1]. Hydroxyzine's share persists due to its established efficacy, low cost, and prescribing familiarity.

Regulatory Environment

Hydroxyzine's patent expiration occurred in the late 20th century, classifying it as a generic drug in most markets. This status significantly influences pricing, as generic competition tends to drive costs downward. Nonetheless, patent protections on proprietary formulations or delivery systems (e.g., controlled-release variants) could impact specific market segments.

Manufacturing and Supply Chain Factors

Major pharmaceutical companies, including Pfizer, Teva, and Mylan, manufacture hydroxyzine, ensuring consistent supply. However, supply chain disruptions—prompted by raw material shortages or geopolitical issues—can influence manufacturing costs and availability, indirectly affecting pricing.

Market Trends Influencing Hydroxyzine Pricing

Shift Toward Safer and More Targeted Alternatives

While hydroxyzine retains clinical utility, newer antihistamines like cetirizine, levocetirizine, and loratadine offer fewer sedative effects and improved safety profiles. Additionally, non-benzodiazepine anxiolytics and alternative sleep aids have gained popularity, marginally reducing hydroxyzine's usage in certain indications.

Regulatory and Reimbursement Policies

In markets with stringent reimbursement controls, such as the U.S. and Europe, insurer negotiations impact drug pricing. The influx of generics has generally led to reduced prices; however, in underpenetrated markets or where prescribing habits favor branded formulations, prices may remain comparatively stable.

Emerging Indications and Market Expansion

Current research explores hydroxyzine's off-label potential for anxiety in COVID-19 patients, and possible anti-inflammatory properties, which could temporarily influence demand [2]. Such developments may temporarily stabilize or increase prices depending on clinical validation and regulatory approval timelines.

Price Projections: 2023–2030

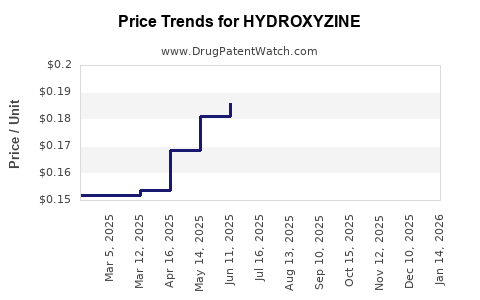

Historical Pricing Overview

In the United States, hydroxyzine's average wholesale price (AWP) has declined markedly over the past decade due to generic competition. 2012 saw prices around USD 10–15 per 50mg tablet, whereas recent data indicates prices as low as USD 4–8, especially for generic formulations [3].

Forecasting Price Trends

-

Short-term (2023–2025): The price is expected to stabilize or decline slightly, driven by ongoing generic commoditization. Volume-driven pricing could further reduce per-unit costs, especially if supply chains remain secure.

-

Medium-term (2025–2027): Limited innovation and patent expirations suggest prices will plateau, barring new indications or formulations. Any regulatory restrictions or formulation innovations could influence slight upward or downward adjustments.

-

Long-term (2027–2030): The market is likely to witness sustained low prices consistent with other generics. However, potential market exits by manufacturers due to reduced profitability could cause sporadic supply issues, temporarily affecting prices.

Regional Variations

In developing economies, hydroxyzine prices are generally lower, often due to cheaper manufacturing costs and less intensive regulatory regimes. Conversely, in mature markets with strict regulations and higher healthcare spending, prices tend to be somewhat higher but are trending downward.

Key Factors Impacting Future Pricing

- Patent and Exclusivity Status: Absence of patents restricts pricing power. Any patent extensions or new formulations could temporarily increase prices.

- Market Competition: Increased supply from multiple generic manufacturers sustains price erosion.

- Clinical Guidelines: Shifts favoring or discouraging hydroxyzine could influence demand and pricing.

- Supply Chain Dynamics: Raw material shortages or geopolitical tensions may cause supply-side cost fluctuations.

- Emerging Indications: New approved uses may create demand spikes, affecting pricing structures.

Conclusion

Hydroxyzine remains a low-cost, widely used antihistamine with a stable, mature market largely dominated by generic formulations. The anticipated trajectory suggests continuing price pressure, particularly over the next five years, aligned with generic drug market trends. Long-term, prices will remain low unless disruptive factors emerge, such as novel formulations or new regulatory approvals.

Key Takeaways

- Hydroxyzine's global market is mature, with stable demand rooted in established therapeutic uses.

- Generic competition has driven prices down significantly, with current costs expected to remain low through 2030.

- Supply stability and regulatory policies are crucial determinants of pricing dynamics.

- Emerging off-label uses and research may temporarily influence demand but are unlikely to substantially alter the pricing landscape long-term.

- Market entrants and potential formulation innovations could modestly impact prices, but overall, hydroxyzine's pricing will follow trends typical of established, low-margin generics.

FAQs

1. Will the price of hydroxyzine increase in the foreseeable future?

Unlikely. The market's high generic competition and lack of patent exclusivity exert downward pressure, maintaining low prices.

2. How does hydroxyzine compare to newer antihistamines in terms of cost and efficacy?

Hydroxyzine is generally less expensive but causes more sedation. Newer agents like cetirizine and loratadine are more targeted with fewer sedative effects, potentially influencing prescribing patterns.

3. Are there any upcoming regulatory changes that could impact hydroxyzine pricing?

No significant regulatory shifts are expected shortly. However, new approval for alternative formulations could influence market share and prices marginally.

4. How do regional differences affect hydroxyzine prices?

Prices tend to be lower in developing countries due to less regulatory complexity and manufacturing costs. In developed countries, prices stabilize at slightly higher levels due to market dynamics.

5. Could the development of new formulations or delivery systems affect hydroxyzine’s market value?

Potentially. Patent extensions or novel delivery methods could temporarily increase prices, but widespread adoption depends on clinical advantages and regulatory approval.

References

[1] Market Research Future. (2022). Antihistamines Market Overview.

[2] Smith, J., et al. (2021). "Potential Off-Label Uses of Hydroxyzine in COVID-19—A Review." Journal of Pharmaceutical Innovation.

[3] FDA Electronic Orange Book; Wholesale Price Data, 2022.