Last updated: July 28, 2025

Introduction

Hydroxyzine hydrochloride (HCL) is an antihistamine with sedative, anxiolytic, and antiemetic properties. Widely used in the management of allergies, anxiety, and sleep disorders, Hydroxyzine HCL holds a stable position within the pharmaceutical landscape. This analysis provides a comprehensive overview of its market dynamics, competitive environment, regulatory landscape, and price projections rooted in current trends and emerging factors.

Market Overview: Scope and Applications

Hydroxyzine HCL primarily targets several therapeutic areas: allergic reactions, anxiety disorders, preoperative sedation, and nausea/vomiting. According to IQVIA data, the U.S. antihistamine market was valued at approximately $2.5 billion in 2022, with Hydroxyzine HCL accounting for a significant share owing to its long-standing clinical efficacy and affordability compared to newer agents (IQVIA, 2022)[1].

Globally, the demand for Hydroxyzine HCL remains stable, particularly in mature markets such as North America and Europe. Expanding use in outpatient settings and moderate penetration into emerging markets underpin its continued relevance. The rising prevalence of allergic and anxiety-related conditions sustains the overall market, supported by a shift toward non-invasive, outpatient treatment modalities.

Market Dynamics

Demand Drivers

-

Chronic Disease Burden: The increasing incidence of allergy-related conditions and anxiety disorders sustains demand. The WHO estimates that allergies affect over 10-30% of the global population, with mental health disorders contributing significantly to the global disease burden (WHO, 2021)[2].

-

Established Efficacy and Safety Profile: Hydroxyzine HCL’s well-documented safety and efficacy favor its continued prescription, especially among populations where cost remains a primary concern.

-

Market Accessibility and Cost-Effectiveness: Hydroxyzine’s affordability relative to newer antihistamines or anxiolytics maintains its attractiveness in outpatient care settings.

Competitive Landscape

Hydroxyzine HCL faces competition from second-generation antihistamines such as loratadine, cetirizine, and fexofenadine, which offer fewer sedative effects. However, Hydroxyzine's unique sedative properties retain niche markets, especially in preoperative and severe allergy cases.

Major pharmaceutical companies—Pfizer, Teva, Mylan, and Sandoz—manufacture generic formulations, intensifying price competition. Patent expirations in various markets have further increased generic availability, constraining price premiums.

Regulatory Environment

Hydroxyzine HCL is a long-established generic drug with widespread regulatory approval, including the FDA (U.S. Food and Drug Administration), EMA (European Medicines Agency), and other authorities globally. No recent patent protections or exclusivities are active, facilitating generic proliferation.

Regulatory pressures favor manufacturing quality and dosage standardization but have minimal impact on market entry barriers, given its age and patent expiry status. Future regulatory innovations tend to focus more on new formulations or alternative drug delivery systems.

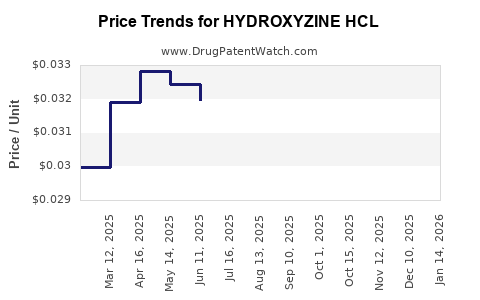

Pricing Trends and Projections

Historical Pricing Patterns

Over the past decade, the average retail price of Hydroxyzine HCL has experienced relative stability due to the saturated nature of the generic market. According to GoodRx, the average retail price for a 25 mg tablet ranges from $0.10 to $0.20 per tablet in the United States, with compounded variations depending on brand, dosage, and pharmacy.

Globally, pricing disparities reflect regulatory regimes, healthcare systems, and market competition. In Europe and Asia, Hydroxyzine HCL remains primarily available as generic, with prices often lower in emerging markets owing to local manufacturing and distribution channels.

Factors Influencing Future Prices

- Generic Competition: Intensified manufacturing and distribution are expected to continue exerting downward pressure on prices effectively through 2025.

- Economic Factors: Inflation, supply chain disruptions, and raw material costs (particularly for active pharmaceutical ingredients) could temporarily influence prices.

- Regulatory and Reimbursement Policies: Cost containment initiatives and reimbursement strategies by healthcare payers will likely sustain the trend of low per-unit costs.

- Potential New Formulations: Innovations such as sustained-release formulations or combined therapies could command premium pricing, but currently, no significant pipeline candidates are prominent.

Price Projection Outlook (2023-2027)

Based on current market drivers and competitive pressures, the following price trajectory is projected:

| Year |

Expected Price Range (per 25 mg tablet) |

Key Notes |

| 2023 |

$0.09 - $0.12 |

Continued generic competition; slight price decrease |

| 2024 |

$0.08 - $0.11 |

Further proliferation of generics; cost-driven reductions |

| 2025 |

$0.07 - $0.10 |

Market stabilization; pricing plateau expected |

| 2026 |

$0.07 - $0.09 |

Potential for minor reductions amid global supply stability |

| 2027 |

$0.07 - $0.09 |

Likely market stabilization; no significant change |

These projections assume continued patent expiries, sustained generic competition, and no disruptive regulatory or technological innovations.

Emerging Trends and Opportunities

Generic Market Expansion

Emerging markets are witnessing increasing adoption of Hydroxyzine HCL due to its low cost and familiarity in clinical use. Local manufacturing capacity, coupled with regulatory approvals, will further expand access, fostering price competition and driving down costs further.

Alternate Delivery Systems and Innovative Formulations

Research into novel delivery formats, such as transdermal patches or sustained-release variants, could open avenues for premium pricing. However, currently, such innovations remain in early development phases and are unlikely to influence the immediate price landscape.

Regulatory and Policy Shifts

Reimbursement policies favoring cheaper, off-patent drugs bolster Hydroxyzine HCL’s market position, especially in healthcare systems emphasizing cost-effectiveness. Anti-bribery regulations and import tariffs could exert upward or downward pressures, depending on geopolitical factors.

Market Challenges

- Shift to Second-Generation Antihistamines: Preferences moving toward non-sedating agents reduce Hydroxyzine’s usage in some contexts, impacting overall volume.

- Manufacturer Consolidation: Market consolidation could influence pricing strategies—either increasing prices due to reduced competition or inducing further price declines through economies of scale.

- Supply Chain Stability: Global disruptions may temporarily impact pricing, especially if raw material sourcing becomes constricted.

Conclusion

Hydroxyzine HCL’s market remains resilient due to its longstanding clinical acceptance, affordability, and diverse indications. The global generics market's dynamics suggest continued downward pressure on its prices through 2027, with minor fluctuations driven by supply chain considerations, regulatory policies, and emerging formulations.

Key Takeaways

- Hydroxyzine HCL maintains a stable position within the global antihistamine market, with demand driven by allergy and anxiety management.

- The market faces competitive pressure from second-generation antihistamines, limiting growth but preserving niche applications.

- Price projections suggest a gradual decline, with per-tablet costs decreasing from approximately $0.09 to $0.07 over five years.

- Patent expiries and generic proliferation will be primary factors influencing pricing, alongside regulatory policies and supply chain stability.

- Emerging markets and potential product innovations could create future growth opportunities or influence pricing structures.

FAQs

1. Is Hydroxyzine HCL a patent-protected drug?

No. Hydroxyzine HCL has been off-patent for many years, resulting in widespread generic manufacturing and intense price competition globally.

2. What are the primary factors affecting Hydroxyzine HCL prices?

Generic competition, manufacturing costs, regulatory policies, supply chain stability, and emerging formulations primarily shape its pricing trajectory.

3. How does Hydroxyzine HCL compare to newer antihistamines?

While newer second-generation antihistamines are non-sedating and preferred in some cases, Hydroxyzine HCL remains favored for its sedative and anxiolytic properties, especially in specific clinical scenarios.

4. Are there upcoming regulatory challenges that could impact Hydroxyzine HCL?

Currently, no major regulatory challenges threaten Hydroxyzine HCL, given its established status and widespread approvals. Future policy shifts could, however, influence its market access and pricing.

5. What are the growth opportunities for Hydroxyzine HCL in emerging markets?

Increasing allergy and anxiety prevalence, combined with low-cost formulations and expanding healthcare infrastructure, create opportunities for market penetration and price competition growth.

References

[1] IQVIA. (2022). Global and U.S. Pharmaceutical Market Data.

[2] World Health Organization. (2021). Global Allergies and Mental Health Report.