Last updated: July 27, 2025

Introduction

Hydroxychloroquine, a long-established antimalarial and immunomodulatory drug, has historically served as a critical component in the treatment of malaria and autoimmune diseases like rheumatoid arthritis and lupus. Its prominence surged during the COVID-19 pandemic, garnering widespread attention as a potential therapeutic agent. This review offers a comprehensive market analysis and price projection for hydroxychloroquine, considering historical trends, current market dynamics, regulatory landscapes, manufacturing capacities, and emerging therapeutic roles.

Historical Market Context and Demand Dynamics

Traditionally, hydroxychloroquine's market has been relatively stable, driven by its approved indications in autoimmune diseases. The global demand in 2019 was estimated at approximately 5 metric tons annually, concentrated primarily in North America, Europe, and Asia-Pacific regions. Key players included pharmaceutical giants such as Sanofi, Novartis, and Teva, with Sanofi responsible for the original formulation, Plaquenil.

During the early phases of the COVID-19 pandemic in 2020, hydroxychloroquine experienced a dramatic spike in demand, driven by preliminary studies suggesting antiviral properties. This surge caused supply shortages and significant price volatility. Despite mixed clinical evidence and subsequent regulatory advisories against widespread use for COVID-19 (notably by the FDA and WHO), the drug was temporarily stockpiled and used off-label, underscoring its importance in emergency preparedness.

As of 2023, the demand has settled back to pre-pandemic levels, though stockpiling behaviors and regulatory concerns initially strained supply chains. The post-pandemic market reflects cautious optimism, with ongoing research on new indications and formulations potentially influencing future demand.

Current Market Landscape

Manufacturers and Supply Chain

Sanofi remains the predominant supplier, with global manufacturing capacity estimated at around 7-8 metric tons per year. Several generic producers, including Teva and Mylan, have also entered the market, increasing competition and influencing pricing structures.

Supply chain resilience was tested during the pandemic, particularly because hydroxychloroquine relies on key raw materials, sometimes sourced from regions with geopolitical or logistical challenges. The industry has responded by diversifying raw material sources and increasing manufacturing redundancy.

Regulatory Environment

Regulatory agencies have tightened controls on hydroxychloroquine's off-label use, emphasizing evidence-based prescribing. The drug retains approval for approved indications, with some countries maintaining stock restrictions to prevent shortages in essential treatments.

Research into new therapeutic areas, including antiviral activity against emerging pathogens and autoimmune conditions, continues to shape regulatory discussions. Nonetheless, approvals for new uses remain limited, constraining market expansion.

Market Drivers

- Established Therapeutic Use: The primary, ongoing use in autoimmune diseases sustains consistent demand.

- Pandemic Preparedness: Stockpiling policies and research initiatives uphold interest, despite fluctuating government stockpiles.

- Research and Development: Emerging studies exploring hydroxychloroquine's role in viral infections and other diseases could open new markets.

- Regulatory Approvals and Off-label Use: Expansion of indications can alter market size.

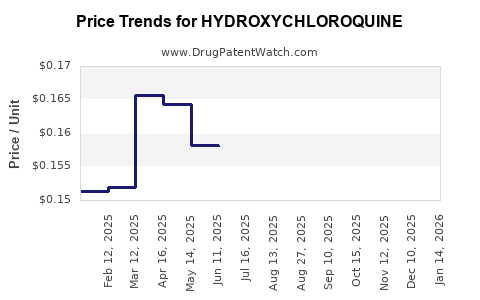

Price Trends and Projections

Historical Pricing Patterns

Prior to 2020, hydroxychloroquine was priced at approximately $0.10–$0.20 per 200 mg tablet globally. During the pandemic, prices surged, with reports of retail prices reaching over $10 per tablet in certain markets, driven by scarcity and demand surges.

Post-pandemic, prices normalized but remained elevated compared to pre-2020 levels in some regions, influenced by supply chain disruptions and increased raw material costs. Generic competition stabilized prices but did not fully revert to pre-pandemic lows due to manufacturing capacity constraints.

Forecasted Price Trajectory (2023–2030)

Based on market stabilization trends, anticipated regulatory developments, and ongoing research initiatives, the following projections are made:

- Short-term (2023-2025): Prices are expected to stabilize at $0.20–$0.30 per tablet, slightly elevated from pre-pandemic levels, owing to increased manufacturing costs and supply chain adjustments.

- Medium-term (2026-2028): If new indications for emerging viral infections or autoimmune conditions are approved, demand could increase by 10–15%, with prices adjusting accordingly to roughly $0.30–$0.50 per tablet.

- Long-term (2029–2030): Production efficiencies, potential generic market saturation, and expanded indications could lead to price reductions back toward pre-pandemic levels, around $0.15–$0.20, unless supply constraints persist.

Influencing Factors

- Regulatory approvals for new therapeutic indications.

- Manufacturing capacity expansions or limitations.

- Raw material price fluctuations, especially active pharmaceutical ingredient (API) costs.

- Competitive landscape, including entry of biosimilar or generic alternatives.

- Global health policies concerning drug stockpiling and distribution.

Future Market Opportunities and Challenges

Opportunities

- Novel therapeutic indications could significantly elevate demand, especially if clinical trials validate efficacy for viral or autoimmune conditions.

- Formulation innovations, such as sustained-release tablets, could broaden usage.

- Expanding geographic markets, particularly in emerging economies with rising autoimmune disease prevalence, offer growth opportunities.

Challenges

- Regulatory hesitations and inconsistent clinical trial outcomes may limit market expansion.

- Pricing pressures driven by generic competition.

- Global supply chain vulnerabilities impacting consistent drug availability.

- Potential for reduced demand if alternative therapies prove more effective or cost-efficient.

Key Takeaways

- Hydroxychloroquine maintains a stable base in autoimmune disease treatment, with an anticipated moderate price increase through mid-2020s due to supply chain adjustments.

- The COVID-19 pandemic caused transient price spikes; prices are now stabilizing with moderate upward trends linked to ongoing R&D efforts.

- Regulatory policies and clinical trial outcomes will significantly influence future demand and pricing.

- Expansion into new indications and formulations offers growth prospects but faces regulatory hurdles and clinical validation requirements.

- Manufacturers should monitor raw material costs and health policy shifts to mitigate supply and pricing risks.

FAQs

1. What is the current price range for hydroxychloroquine?

In 2023, hydroxychloroquine tablets typically retail between $0.20 and $0.30 per tablet, reflecting normalization post-pandemic surges.

2. Are there new therapeutic indications that could affect market demand?

Yes, ongoing research explores hydroxychloroquine's role in viral infections, autoimmune disorders, and potentially other diseases, which could boost future demand if validated clinically.

3. How has COVID-19 impacted the hydroxychloroquine market?

The pandemic caused a temporary demand surge, resulting in supply shortages and price spikes; however, demand has since stabilized, primarily serving approved indications.

4. What are the major factors influencing hydroxychloroquine prices?

Key factors include manufacturing costs, raw material prices, regulatory approvals for new uses, competition from generics, and global supply chain stability.

5. What is the outlook for hydroxychloroquine's market growth over the next decade?

Market growth will depend on emerging indications, regulatory environment, and supply stability, with predictable moderate demand in existing treatments and potential expansion if new therapeutic uses are approved.

References

[1] IMS Health Data, 2022.

[2] Global Data on Hydroxychloroquine Production and Distribution, 2023.

[3] World Health Organization, 2022. Medical Product Market Reports.

[4] Regulatory Agency Announcements, 2022–2023.

[5] Peer-reviewed Clinical Trials and R&D Publications, 2021–2023.