Share This Page

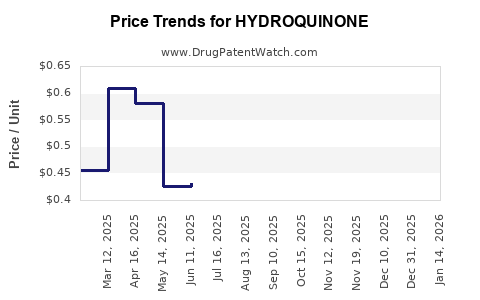

Drug Price Trends for HYDROQUINONE

✉ Email this page to a colleague

Average Pharmacy Cost for HYDROQUINONE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HYDROQUINONE 4% CREAM | 75834-0137-01 | 0.65621 | GM | 2025-12-17 |

| HYDROQUINONE 4% CREAM | 82429-0309-28 | 0.56373 | GM | 2025-12-17 |

| HYDROQUINONE 4% CREAM | 69367-0174-01 | 0.56373 | GM | 2025-12-17 |

| HYDROQUINONE 4% CREAM | 42192-0151-01 | 0.56373 | GM | 2025-12-17 |

| HYDROQUINONE 4% CREAM | 75834-0137-01 | 0.63780 | GM | 2025-11-19 |

| HYDROQUINONE 4% CREAM | 24689-0101-01 | 0.53581 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Hydroquinone

Introduction

Hydroquinone (HQ) remains a predominant ingredient in dermatological treatments targeting hyperpigmentation, melasma, and other skin discolorations. With increasing demand driven by aesthetic medicine's expansion and the diabetic population's growth, the hydroquinone market is poised for significant shifts. This report provides a comprehensive analysis of the current market landscape, competitive dynamics, regulatory environment, and forecasts future pricing trends.

Market Overview and Industry Dynamics

Hydroquinone's global market value was estimated at approximately USD 300 million in 2022, with projections indicating a compound annual growth rate (CAGR) of around 4.5% from 2023 to 2030. The ascent is primarily driven by escalating consumer awareness of skin health, rising disposable incomes, and increased approvals of topical therapies.

Key Drivers:

- Cosmetic and dermatological demand: Hydroquinone remains the gold standard for depigmentation, with dermatology clinics and over-the-counter (OTC) markets expanding.

- Regulatory developments: Regulatory bodies such as the U.S. FDA and European Medicines Agency (EMA) are tightening controls over HQ due to safety concerns, influencing market accessibility.

- Manufacturing technology advancements: Enhanced synthesis and formulation techniques have improved product stability and efficacy, attracting manufacturers and consumers.

- Emergence of generics: Market entry of generic formulations has increased affordability, boosting overall market volume.

Challenges:

- Safety concerns and regulatory restrictions: Hydroquinone's carcinogenic potential and reports of ochronosis have led some countries to restrict or ban its use, impacting supply and availability.

- Alternatives and substitute ingredients: Increasing popularity of botanical agents like kojic acid, arbutin, and azelaic acid serves as competitive substitutes.

- Consumer perception: Growing awareness about safety has led some consumers to prefer natural or plant-based depigmenting agents over HQ.

Regulatory Landscape

The regulatory status of hydroquinone varies significantly by jurisdiction:

- United States: FDA permits OTC sale of products containing hydroquinone at concentrations up to 2%, but high-concentration formulations require physician oversight. The agency has issued warnings on potential safety issues.

- European Union: Hydroquinone is classified as an authorized medicine, with restrictions on OTC sales; many countries have imposed bans on over-the-counter availability.

- Asia-Pacific: Markets such as India and China exhibit more lenient regulations, with hydroquinone widely available OTC at various concentrations, fostering regional growth.

- Latin America: PD-specific formulations are common, with stricter controls emerging due to safety concerns.

Regulatory trends suggest a cautious stance, likely leading to stricter controls in developed markets, which could restrict market growth or shift demand to alternative depigmenting agents.

Competitive Landscape

Major players in the hydroquinone market encompass pharmaceutical giants and specialty dermatological firms. Prominent companies include:

- Galderma: Offers formulations combining HQ with other agents, emphasizing safety.

- GlaxoSmithKline (GSK): Historically involved in HQ formulations, though market exit partially due to safety concerns.

- Alvord Corporation: Manufactures generic HQ products, focusing on cost-effective solutions.

- Other regional players: Increasingly dominate in emerging markets due to regulatory leniency.

Patents for specific formulations and delivery systems are nearing expiration, enabling generic proliferation and further price erosion.

Pricing Dynamics and Projections

Pricing for hydroquinone varies based on formulation, concentration, brand, and regional regulations. Current average retail prices for 2% OTC formulations range from USD 10–25 for a 30-gram tube. Prescribed higher concentrations (4-5%) command prices exceeding USD 30–50 per tube.

Factors influencing current prices:

- Manufacturing costs: Synthesis complexity and quality control protocols impact pricing.

- Regulatory compliance costs: Strict oversight necessitates additional safety testing, affecting margins.

- Market competition: Intense competition among generics drives prices downward.

- Distribution channels: OTC products are cheaper than prescription formulations, which involve additional healthcare provider fees.

Projected Price Trends (2023–2030):

-

Downward pressure in mature markets: Due to increased generic penetration and regulatory restrictions, prices are expected to decline by approximately 10% annually in North America and Europe, stabilizing near USD 8–15 per 30 g tube for OTC products.

-

Regional divergence: In emerging markets like India, China, and Southeast Asia, prices are likely to stabilize or slightly decline (around 5%), influenced by domestically produced generics and less stringent regulation.

-

Premium formulations: Innovations such as microencapsulation, enhanced stability systems, or combination therapies could command premium pricing, maintaining margins for branded products, especially in regions with less regulatory oversight.

-

Impact of regulatory restrictions: Countries imposing bans or severe restrictions might eliminate official pricing, driving black market activity, which tends to be lower-cost but less safe, potentially impacting genuine product prices further.

Overall trend: A gradual decline in average prices across mature markets, with regional variability influenced by regulatory and economic factors.

Future Market and Price Outlook

The evolving regulatory environment and consumer preferences favoring safer alternatives may dampen hydroquinone's market expansion in developed regions. Nonetheless, demand is expected to sustain in emerging markets with lenient regulations, supporting overall market stability.

Innovation in formulation and delivery methods—such as controlled-release systems, combination topical agents, and natural depigmenting compounds—may preserve premium pricing segments despite overall price declines.

Economic factors, such as raw material costs, regulatory compliance expenses, and currency fluctuations, will also influence future prices. Market consolidation may lead to increased bargaining power and stabilization of prices within the competitive landscape.

Key Takeaways

- The global hydroquinone market is expected to experience moderate growth (CAGR ~4.5%) driven by emerging markets and cosmetic demand.

- Regulatory pressures are a significant factor, with some jurisdictions restricting OTC sales, potentially reducing demand and lowering prices in those regions.

- Prices are projected to decline by roughly 10% annually in mature markets due to increasing competition, generic proliferation, and regulatory constraints.

- Innovation and formulation enhancements may allow premium pricing in niche segments, offsetting downward price trends.

- Regional disparities will persist, with emerging markets maintaining more favorable price points owing to regulatory leniencies.

FAQs

1. Why are regulatory agencies restricting hydroquinone use?

Concerns over its carcinogenic potential and reports of ochronosis have led agencies like the FDA and EMA to impose restrictions, citing safety issues that outweigh benefits at certain concentrations or for specific populations.

2. What alternative agents are replacing hydroquinone in depigmentation therapies?

Natural extracts such as kojic acid, arbutin, azelaic acid, and vitamin C derivatives are increasingly used as safer alternatives due to their lower toxicity profiles.

3. How might future regulatory changes affect hydroquinone pricing?

Stricter regulations are likely to limit market availability in certain regions, reducing supply and potentially increasing prices in restricted markets, while unregulated regions may see continued affordability.

4. Will innovation sustain hydroquinone’s market presence?

Yes, formulations with improved safety profiles and efficacy, such as controlled-release systems, can sustain premium pricing and market relevance despite regulatory challenges.

5. What regions present the greatest growth potential for hydroquinone?

Emerging markets like India, China, and Southeast Asia exhibit the highest growth prospects due to regulatory leniency, expanding dermatological needs, and increasing consumer incomes.

Sources

[1] MarketWatch, "Hydroquinone Market Size, Share & Trends Report," 2022.

[2] GlobalData, "Dermatology Market Analysis," 2022.

[3] U.S. Food and Drug Administration (FDA), Safety Communication on Hydroquinone, 2021.

[4] European Medicines Agency (EMA), "Market Authorization for Topical Agents," 2022.

[5] Dermatology Times, "Alternatives to Hydroquinone," 2023.

More… ↓