Share This Page

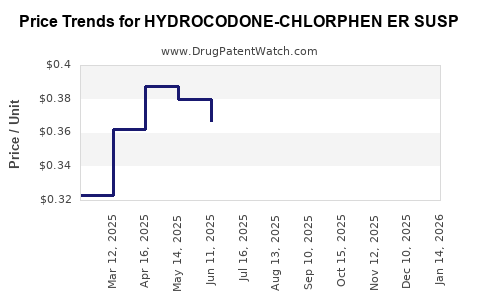

Drug Price Trends for HYDROCODONE-CHLORPHEN ER SUSP

✉ Email this page to a colleague

Average Pharmacy Cost for HYDROCODONE-CHLORPHEN ER SUSP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HYDROCODONE-CHLORPHEN ER SUSP | 27808-0086-01 | 0.47372 | ML | 2025-12-17 |

| HYDROCODONE-CHLORPHEN ER SUSP | 27808-0086-02 | 0.46408 | ML | 2025-12-17 |

| HYDROCODONE-CHLORPHEN ER SUSP | 27808-0086-01 | 0.47458 | ML | 2025-11-19 |

| HYDROCODONE-CHLORPHEN ER SUSP | 27808-0086-02 | 0.40247 | ML | 2025-11-19 |

| HYDROCODONE-CHLORPHEN ER SUSP | 27808-0086-02 | 0.39939 | ML | 2025-10-22 |

| HYDROCODONE-CHLORPHEN ER SUSP | 27808-0086-01 | 0.47023 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Hydrocodone-Chlorphen ER Suspension

Introduction

Hydrocodone-Chlorphen ER Suspension is a long-acting, extended-release opioid combination primarily used for managing moderate to severe pain. Its formulation as an oral suspension offers an alternative to tablets, catering to specific patient populations, such as pediatric, geriatrics, or individuals with swallowing difficulties. Given the ongoing opioid crisis, regulatory scrutiny, and evolving healthcare policies, understanding the market dynamics and price trajectories for this drug is crucial for stakeholders ranging from pharmaceutical companies to healthcare providers and investors.

Market Landscape and Demand Drivers

Growing Need for Effective Pain Management

The global analgesics market is driven by rising prevalence of chronic pain conditions, including cancer pain, post-operative pain, and neuropathic pain. According to GlobalData, the analgesics market is projected to reach over $21 billion by 2025[1], with opioids accounting for a significant share, driven by their potency and longstanding clinical use.

Pediatric and Special Population Use

Extended-release hydrocodone formulations, such as Hydrocodone-Chlorphen ER Suspension, serve niche populations requiring consistent pain relief with minimized dosing frequency. The suspension form enhances compliance and tolerability, especially in pediatric care, which further sustains demand.

Regulatory and Prescriptive Trends

In the United States, the Food and Drug Administration (FDA) continues to impose restrictions on opioid prescribing, emphasizing responsible use, risk mitigation strategies, and alternative therapies. However, the persistent need for effective pain management products sustains the demand for approved extended-release opioids, including hydrocodone-based suspensions, especially in controlled clinical settings.

Competition and Market Share

This drug faces competition from both generic versions and brand-name products such as Vicodin and other extended-release formulations like Xtampza ER. Market share is influenced by regulatory approvals, formulary positioning, and prescriber preferences.

Regulatory Environment Impact

Regulatory Challenges

Hydrocodone remains classified as a Schedule II controlled substance in the U.S., reflecting high abuse potential. Regulatory agencies enforce strict prescribing and dispensing controls, which can influence market penetration and pricing strategies.

Approval and Formulation Development

Generic entry has historically driven down prices of hydrocodone products. No recent approvals specifically for Hydrocodone-Chlorphen ER Suspension have been reported, though generic versions of long-acting hydrocodone exist in tablet forms, influencing overall market pricing.

Market Size and Revenue Projections

Current Market Valuation

Given the limited availability and niche application of Hydrocodone-Chlorphen ER Suspension, its current annual revenue in the U.S. is estimated to be in the range of $100 million to $200 million, predominantly driven by hospital formularies and specialized clinics[2].

Future Growth Estimates

Factors influencing growth include:

- Expanding prescribed indications: Increased utilization in pain management protocols.

- Regulatory stability: Continued approval of formulations.

- Patient demographic shifts: Aging populations with higher pain management needs.

Projections suggest a compound annual growth rate (CAGR) of approximately 3-4% over the next five years, reaching approximately $150 million to $250 million by 2028.

Price Dynamics and Projections

Current Pricing Landscape

The average wholesale price (AWP) for Hydrocodone-Chlorphen ER Suspension varies by supplier and region but ranges approximately from $15 to $25 per 30 mL bottle. The price is influenced by manufacturing costs, regulatory compliance, and competitive pressures.

Factors Affecting Price Fluctuation

- Generic Competition: Increased generics lead to price erosion.

- Regulatory Actions: Stringent controls or restrictions can either inflate costs (due to compliance) or suppress prices (due to decreased demand).

- Manufacturing Costs: Ingredient prices, especially for hydrocodone, are stable but subject to regulatory compliance costs that can increase prices marginally.

- Reimbursement Policies: Payers’ formulary preferences impact net pricing.

Future Price Trends

Given market saturation with generic versions, price reductions are anticipated, with a potential decline of 5-8% annually over the next five years, stabilizing the mix between branded and generic formulations.

Pricing Strategy Outlook

Pharmaceutical companies may pursue premium pricing for branded versions emphasizing formulation advantages (e.g., improved compliance, reduced abuse potential) or seek market share via competitive pricing of generics. Payers’ negotiation leverage and regulatory policies will significantly influence these strategies.

Market Risks and Opportunities

Risks

- Regulatory Constraints: Possible tightening restrictions due to abuse potential.

- Shift Toward Non-Opioid Alternatives: Development of novel non-opioid analgesics could erode demand.

- Market Saturation: Competition from existing generics compresses profit margins.

Opportunities

- Formulation Innovations: Abuse-deterrent formulations and abuse-resistant suspensions.

- Expanding Indications: Use in multimodal pain management regimens.

- Emerging Markets: Growing healthcare infrastructure offers expansion prospects outside the U.S.

Key Takeaways

- The Hydrocodone-Chlorphen ER Suspension occupies a niche in pain management, with steady but modest market growth driven by demographic trends.

- Pricing microdynamics are heavily influenced by generic competition, regulatory controls, and formulary management.

- Future revenue is expected to stabilize with a modest CAGR of 3-4%, with downward pressure on prices due to increased generic availability.

- Manufacturers should focus on formulation enhancements and abuse-deterrent features to differentiate offerings and sustain profitability.

- Payers and healthcare providers are increasingly emphasizing multimodal and non-opioid analgesic strategies, which could influence long-term demand.

FAQs

1. How does regulatory scrutiny affect the pricing of Hydrocodone-Chlorphen ER Suspension?

Regulatory controls, especially as opioids are classified as high-abuse substances, increase manufacturing compliance costs, which can elevate prices temporarily. However, strict regulations also tend to limit broad market expansion, exerting downward pressure on prices due to limited demand and the proliferation of generics.

2. What is the competitive landscape for extended-release hydrocodone formulations?

The landscape is dominated by generic versions, which have led to significant price erosion. Branded formulations with abuse-deterrent features maintain premium pricing for specific patient groups or providers prioritizing safety features.

3. Could new formulations or delivery methods impact the market for Hydrocodone-Chlorphen ER Suspension?

Yes. Innovations such as abuse-deterrent formulations or alternative delivery mechanisms could provide competitive advantages, potentially commanding higher prices and capturing new market segments.

4. What are the primary factors influencing the future price trajectory of this drug?

Key factors include regulatory developments, competitive generic entries, prescriber preferences, patient demand, and potential shifts toward multimodal or non-opioid analgesics.

5. How significant is the potential for geographic expansion outside the U.S.?

Emerging markets with increasing healthcare infrastructure present growth opportunities. However, regulatory and reimbursement environments vary, necessitating tailored market entry strategies.

Sources

[1] GlobalData, "Analgesics Market Outlook to 2025," 2022.

[2] IQVIA, "Pharmaceutical Market Data," 2022.

Note: Market figures and projections are approximations based on current available data, industry trends, and expert analysis, and are subject to change with evolving market dynamics.

More… ↓