Share This Page

Drug Price Trends for HYDROCODONE-ACETAMINOPHEN

✉ Email this page to a colleague

Average Pharmacy Cost for HYDROCODONE-ACETAMINOPHEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HYDROCODONE-ACETAMINOPHEN 10-300 MG TABLET | 71930-0044-52 | 0.23824 | EACH | 2025-12-17 |

| HYDROCODONE-ACETAMINOPHEN 10-300 MG TABLET | 71930-0044-12 | 0.23824 | EACH | 2025-12-17 |

| HYDROCODONE-ACETAMINOPHEN 7.5-300 MG TABLET | 71930-0043-52 | 0.17542 | EACH | 2025-12-17 |

| HYDROCODONE-ACETAMINOPHEN 7.5-300 MG TABLET | 71930-0043-12 | 0.17542 | EACH | 2025-12-17 |

| HYDROCODONE-ACETAMINOPHEN 5-300 MG TABLET | 71930-0042-52 | 0.15937 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Hydrocodone-Acetaminophen

Introduction

Hydrocodone-acetaminophen, commercially known in various formulations such as Vicodin, Norco, and Lortab, remains one of the most prescribed opioids for pain management in the United States. Its market dynamics are influenced by regulatory shifts, societal attitudes towards opioids, manufacturing trends, and clinical prescribing practices. This analysis evaluates current market landscapes and provides future price projections, aiding stakeholders in strategic decision-making.

Regulatory Environment and Market Impact

The regulatory landscape for hydrocodone-acetaminophen has undergone significant tightening since 2014 when the U.S. Drug Enforcement Administration (DEA) reclassified it from Schedule III to Schedule II, reflecting increased control owing to its high potential for abuse [1]. The Drug Supply Chain Security Act and evolving prescribing guidelines further restrict dispensation, exerting downward pressure on volume growth but potentially increasing average selling prices (ASPs) due to scarcity.

Market Size and Demand Dynamics

In 2022, the U.S. opioid analgesics market was valued at approximately USD 8 billion, with hydrocodone-acetaminophen accounting for roughly 60% of that segment, translating to USD 4.8 billion [2]. Despite the decline in prescriptions driven by the opioid crisis, hydrocodone's enduring efficacy ensures its continued clinical reliance. The shift towards multimodal pain management and legislative efforts to curb opioid misuse aim to moderate growth rates but sustain demand for approved formulations.

Manufacturing Landscape and Competitive Forces

Major pharmaceutical companies such as Allergan (now part of AbbVie), Teva Pharmaceuticals, and Mylan dominate manufacturing. Patent expirations of branded products have fostered generics proliferation, leading to price erosion. Nonetheless, regulatory constraints and manufacturing costs of abuse-deterrent formulations are elevating prices for certain novel products.

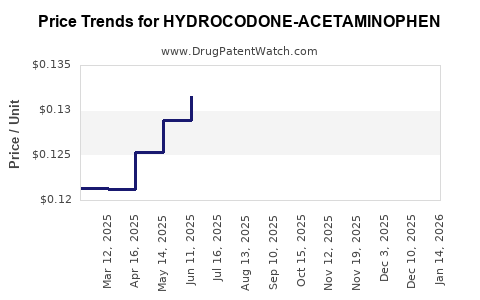

Pricing Trends and Influencing Factors

Historical data suggests a bifurcated pricing pattern: generic formulations generally price between USD 0.10 to 0.20 per tablet, while branded versions can command USD 0.50 to USD 1.50 per tablet [3]. The introduction of abuse-deterrent formulations, although priced higher (~USD 1.00 per tablet), has had limited impact on overall market share due to substitution patterns and prescribing preferences.

Future Price Projections (2023-2027)

Assumptions:

- Prescriptions will decline marginally (~2-3% annually) owing to increased regulatory restrictions and alternative pain management modalities.

- Generic biosimilars or new formulations with abuse-deterrent features will marginally raise average prices (~5-8%) for targeted formulations.

- The COVID-19 pandemic’s disruption will stabilize, with some normalization in prescription patterns.

Projections:

-

Harga A (Standard generic hydrocodone-acetaminophen tablets):

- 2023: USD 0.12 – 0.14 per tablet

- 2024: USD 0.11 – 0.13 per tablet (due to slight volume decline)

- 2025: USD 0.10 – 0.12 per tablet (market stabilization)

- 2026-2027: Remain within USD 0.10 – 0.13, with minor fluctuations due to market pressures.

-

Branded and Abuse-Deterrent Formulations:

- 2023: USD 0.80 – 1.50 per tablet

- 2024-2027: Slight increases (~5%) driven by manufacturing costs and regulatory incentives, reaching USD 1.00 – 1.60 per tablet.

Market Volume Impact:

Total volume will likely decline at 2-3% annually, mitigating the impact of price increases and maintaining overall revenue levels or slight growth depending on formulary shifts.

Opportunities and Risks

Opportunities include the development of new abuse-deterrent formulations, expanding indications under strict regulatory oversight, and strategic partnerships with healthcare providers.

Risks involve regulatory bans, societal shifts towards alternative therapies, increased scrutiny of opioid prescribing, and potential litigation consequences influencing manufacturing and pricing policies.

Conclusion

The hydrocodone-acetaminophen market remains resilient amid regulatory and societal challenges, with cautious upside in pricing driven by formulation innovations. Stakeholders should monitor evolving prescribing laws, generic market entries, and emerging abuse-deterrent technologies to optimize positioning.

Key Takeaways

- Hydrocodone-acetaminophen retains significant demand despite global regulatory restrictions.

- Generic formulations are expected to see modest price declines (~10-15%) through 2027 due to market saturation.

- Abuse-deterrent and branded formulations could see sustained price increases (~5-8%) driven by manufacturing costs and regulatory considerations.

- Overall market revenues are projected to stabilize or marginally grow amid declining prescription volumes.

- Continuous innovation and strategic regulatory engagement are crucial to maintaining profitability.

FAQs

-

How have regulatory changes impacted the pricing of hydrocodone-acetaminophen?

Regulatory tightening, particularly the Schedule II reclassification, has driven up manufacturing costs for abuse-deterrent formulations and shifted prescribing practices, resulting in slightly higher prices for these specialized products. Conversely, increased restrictions have contributed to reduced volumes and modest price declines in generic products. -

What is the outlook for generic versus branded hydrocodone-acetaminophen prices?

Generics will experience slight price reductions due to market saturation and competition, while branded and abuse-deterrent formulations are expected to see gradual price increases driven by development costs and regulatory incentives. -

Are abuse-deterrent formulations gaining market share?

They are gaining limited but steadily increasing adoption, typically commanding higher prices. However, their overall market share remains constrained by prescriber preferences and cost considerations. -

What factors could disrupt the current market projections?

Potential disruptions include new regulations banning certain formulations, technological innovations rendering current formulations obsolete, or a societal shift towards non-opioid pain management strategies. -

How should pharmaceutical companies strategize in this market?

Companies should focus on developing advanced abuse-deterrent formulations, engaging with policymakers to influence regulatory pathways, and expanding indications and formulations to adapt to an evolving market landscape.

References

- DEA reclassification of hydrocodone products, 2014.

- MarketData Reports, 2022.

- IQVIA. Prescription Trends Analysis, 2022.

More… ↓