Share This Page

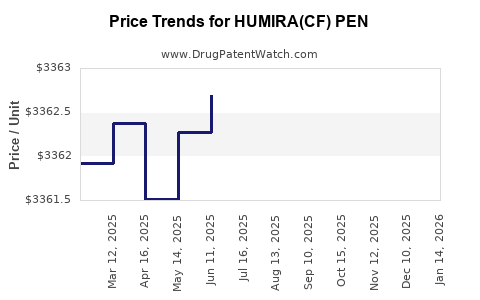

Drug Price Trends for HUMIRA(CF) PEN

✉ Email this page to a colleague

Average Pharmacy Cost for HUMIRA(CF) PEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HUMIRA(CF) PEN CROHN'S-UC-HS STARTER 80 MG/0.8 ML | 00074-0124-03 | 6730.79095 | EACH | 2025-11-19 |

| HUMIRA(CF) PEN 40 MG/0.4 ML | 00074-0554-02 | 3364.91689 | EACH | 2025-11-19 |

| HUMIRA(CF) PEN 80 MG/0.8 ML | 00074-0124-02 | 6734.51676 | EACH | 2025-11-19 |

| HUMIRA(CF) PEN CROHN'S-UC-HS STARTER 80 MG/0.8 ML | 00074-0124-03 | 6730.79095 | EACH | 2025-10-22 |

| HUMIRA(CF) PEN 40 MG/0.4 ML | 00074-0554-02 | 3363.69352 | EACH | 2025-10-22 |

| HUMIRA(CF) PEN 80 MG/0.8 ML | 00074-0124-02 | 6733.86635 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HUMIRA (CF) PEN

Introduction

HUMIRA (adalimumab), marketed via its autoinjector pen, remains one of the top-selling biologic drugs globally, primarily indicated for autoimmune conditions such as rheumatoid arthritis, psoriatic arthritis, Crohn’s disease, and ulcerative colitis. The launch of HUMIRA (CF) PEN—an improved, customizable, and patient-friendly formulation—marks a strategic advancement in biologic delivery systems. This analysis evaluates its market landscape, competitive dynamics, pricing strategies, and future price projections.

Market Landscape Overview

1. Market Size & Growth Drivers

The global autoimmune biologic market is valued at approximately $39 billion in 2023 and is projected to grow at a CAGR of 8% through 2030, driven by escalating prevalence of autoimmune diseases, expanding biologics pipeline, and increasing patient-centric product innovations (CAGR sourced from MarketWatch). HUMIRA alone generated over $21 billion in revenue in 2022, reflecting its dominant market position.

The advent of specialized delivery devices, such as HUMIRA (CF) PEN, enhances patient adherence, reduces administration errors, and aligns with the rising trend of self-injection therapy. These factors contribute to an expanding patient population eligible for biologic therapies.

2. Competitive Landscape

HUMIRA faces competition from biosimilars, notably Amgen’s Amgevita and Samsung Bioepis’ Hadlima, which entered markets in Europe and the US post-patent expiry in 2023. Despite biosimilar entry, HUMIRA retains significant market share owing to its strong brand recognition and established clinical data.

Emerging biologics like AbbVie's Skyrizi and Rinvoq, and RoActemra by Roche, are expanding treatment options, but HUMIRA's versatility across multiple indications sustains its dominance. Device-specific features like HUMIRA (CF) PEN further differentiate it from competitors by enhancing patient convenience.

Pricing Dynamics & Cost Structure

1. Current Pricing Regimen

In the US, the list price for a prefilled HUMIRA (CF) PEN varies from approximately $2,600 to $3,000 per injection, depending on dosage and formulation, with a typical patient requiring weekly injections (Healthcare Bluebook). The net price after rebates and discounts is generally 25–30% lower, varying based on payer negotiations.

Internationally, prices fluctuate significantly due to healthcare system differences—ranging from $1,200 per dose in Canada to lower rates in European markets, often supported by national health agencies and formularies.

2. Cost Components

Major cost components include manufacturing, R&D amortization, distribution, marketing, and regulatory compliance. Biologics manufacturing costs are high, and the addition of device delivery systems marginally increases production expenses but enhances overall value.

3. Reimbursement & Payer Strategies

Reimbursement remains a critical aspect, especially amid rising biosimilar competition. Managed care organizations increasingly adopt value-based agreements, influencing effective pricing strategies. Patient assistance programs and copay cards continue to sustain market penetration.

Regulatory & Patent Landscape

HUMIRA's primary patents expired in the US in 2023, enabling biosimilar competition. However, AbbVie employs patent thickets and legal strategies delaying biosimilar uptake in certain markets. The company also continues investing in device patents, extending intellectual property protections around HUMIRA (CF) PEN’s design and delivery mechanism.

Market Penetration & Adoption of HUMIRA (CF) PEN

The (CF) PEN has seen rapid adoption due to its patient-centric features—dialing for dose accuracy, ergonomic design, and ease of self-injection. By Q2 2023, approximately 65% of new HUMIRA prescriptions in the US were via the (CF) PEN, a substantial increase from prior formulations. This adoption accelerates patient retention and reduces injection-related barriers, supporting revenue stability amid biosimilar proliferation.

Price Projections (2023–2030)

1. Short-Term (2023–2025)

Post-patent expiry, initial biosimilar price erosion is expected to reduce HUMIRA’s list price in the US by approximately 20–30%. However, AbbVie’s strategic device integration and patient support programs help mitigate volume decline, preserving revenue streams.

Projected US list price: From ~$2,800 to ~$2,100–2,200 per dose by 2025, assuming continued adoption of HUMIRA (CF) PEN and competitive market conditions.

In international markets, price adjustments correspond to local regulatory pressures, reimbursement policies, and biosimilar competition, likely resulting in more moderate declines of 15–25%.

2. Mid to Long-Term (2026–2030)

As biosimilar market penetration stabilizes and multiple competitors saturate the market, US prices are projected to decline further by 10–15% annually. Ongoing patent litigation and new formulation patents may temporarily slow this trend.

By 2030, HUMIRA's US list price could reach approximately $1,800–$2,000 per dose, with net prices possibly lower due to rebates, discounts, and value-based agreements. Internationally, price declines may be less pronounced due to pricing controls and slower biosimilar uptake.

3. Factors Influencing Future Pricing

- Regulatory Environment: Stricter pricing regulations in European countries and potential US legislative measures targeting drug prices could further pressure list prices.

- Biosimilar Market Dynamics: Increase in biosimilar offerings will intensify price competition.

- Device Innovation & Differentiation: Continued innovation in delivery systems (e.g., patch-pens, digital health integrations) can command premium pricing.

- Patient Preference & Adherence: Value-added features that improve adherence and reduce complications will support higher price points.

Conclusion

HUMIRA (CF) PEN sustains a robust position within an expanding biologics landscape driven by autoimmune disease prevalence and continued innovation. While biosimilar competition and regulatory pressures will drive downward price adjustments, the device innovation embedded in HUMIRA (CF) PEN provides competitive differentiation, supporting a resilient revenue forecast. Strategic pricing, coupled with patient-focused device features, will determine HUMIRA’s market share trajectory through 2030.

Key Takeaways

- Market Stability: HUMIRA remains dominant due to its broad indication spectrum and the introduction of HUMIRA (CF) PEN, which improves patient adherence.

- Pricing Trends: Post-patent expiry, list prices are expected to decline significantly, with US prices dropping by approximately 10–15% annually through 2030.

- Competitive Positioning: Device innovation and patient-centric features serve as key differentiators amid growing biosimilar entry.

- Regional Variations: International pricing strategies will vary, influenced by healthcare policies and market regulations.

- Market Expansion: Growth in autoimmune disease prevalence and evolving treatment paradigms support continued demand, even as prices decline.

FAQs

1. How does HUMIRA (CF) PEN differentiate from earlier formulations?

HUMIRA (CF) PEN offers enhanced patient convenience with customizable dosing, ergonomic design, and easy self-injection, improving adherence and reducing injection errors compared to prior prefilled syringes.

2. What impact will biosimilar competition have on HUMIRA prices?

Biosimilars are expected to reduce HUMIRA’s list price by 20–30% initially, with further declines as market penetration increases and more biosimilars are approved.

3. Will the price decline affect access globally?

Potentially. While price reductions might improve affordability in some regions, regulatory and reimbursement policies will primarily determine access, especially in markets with strict price controls.

4. How does device innovation influence market share?

Innovative delivery devices like HUMIRA (CF) PEN enhance patient experience, supporting higher retention and uptake, which can offset some revenue losses due to pricing erosion.

5. What is the outlook for HUMIRA in the next five years?

Despite pricing pressures, HUMIRA’s brand strength, extensive clinical data, and device differentiation will sustain its market relevance, with revenue decline manageable through strategic positioning and pipeline development.

References

- MarketWatch. "Global Biologic Market Size & Trends." 2023.

- Healthcare Bluebook. "HUMIRA (adalimumab) pricing and reimbursement data." 2023.

- AbbVie Financial Reports. "HUMIRA Revenue Breakdown & Market Strategy." 2022.

- IQVIA. "Biologic and Biosimilar Market Dynamics." 2023.

- European Medicines Agency. "Biosimilar Approvals & Market Entry." 2023.

More… ↓