Share This Page

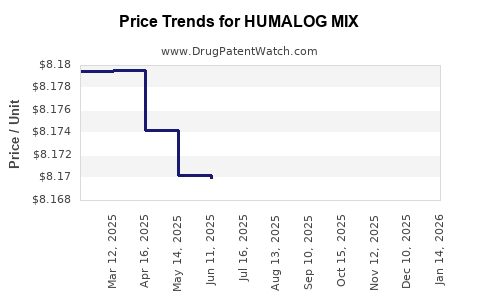

Drug Price Trends for HUMALOG MIX

✉ Email this page to a colleague

Average Pharmacy Cost for HUMALOG MIX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HUMALOG MIX 50-50 KWIKPEN | 00002-8798-59 | 10.15577 | ML | 2025-12-17 |

| HUMALOG MIX 75-25 KWIKPEN | 00002-8797-59 | 10.17295 | ML | 2025-12-17 |

| HUMALOG MIX 75-25 VIAL | 00002-7511-01 | 8.15341 | ML | 2025-12-17 |

| HUMALOG MIX 50-50 KWIKPEN | 00002-8798-59 | 10.15584 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HUMALOG MIX

Introduction

HUMALOG MIX, a pivotal insulin formulation combining rapid-acting and intermediate-acting insulins, has established itself as a critical therapeutic agent for managing diabetes mellitus, particularly type 1 and type 2 diabetes. Its unique pharmacokinetic profile affords comprehensive glycemic control, which makes it a mainstay in diverse healthcare settings worldwide. This analysis evaluates the current market landscape, competitive dynamics, regulatory trajectory, and future pricing forecasts for HUMALOG MIX, providing essential insights for stakeholders including investors, healthcare providers, and pharmaceutical strategists.

Market Landscape Overview

The global diabetes therapeutics market is experiencing exponential growth driven by increasing prevalence rates, advances in insulin formulations, and evolving treatment guidelines favoring personalized, intensive glycemic management. As of 2022, it was valued at approximately USD 65 billion and is projected to expand at a compound annual growth rate (CAGR) exceeding 8% through 2028 [1].

Within this landscape, insulin products such as HUMALOG MIX contribute a significant share, particularly in North America and Europe, due to high diabetes prevalence and comprehensive reimbursement frameworks. The Asia-Pacific region is also witnessing rapid adoption driven by rising urbanization, lifestyle changes, and improving healthcare infrastructure.

Competitive Environment

HUMALOG MIX's primary competitors include Novo Nordisk’s NovoMix, Lilly’s Humulin, and biosimilar versions of basal insulins entering the market. Biosimilars are increasingly challenging originator products by offering lower prices, fostering market competition, and pressuring margins.

Pharmaceutical companies are innovating with newer fixed-dose combinations, ultra-long-acting insulins, and smart insulin delivery systems, which could influence HUMALOG MIX's market share. However, the product retains its relevance owing to its established efficacy, familiar usage pattern, and the breadth of clinical data supporting its safety.

Regulatory and Patent Landscape

Patent exclusivity for HUMALOG MIX (insulin lispro protamine and insulin lispro) is expected to expire around 2030, opening pathways for biosimilar entries. Regulatory agencies worldwide, such as the FDA and EMA, continue to approve high-quality biosimilars, potentially intensifying price competition.

Recent advancements in biosimilar manufacturing and regulatory convergence lower entry barriers, further fueling generic/investor confidence, but also necessitate continuous pricing adaptations post-patent expiry.

Current Pricing Dynamics

Pricing for HUMALOG MIX varies significantly by region due to differences in healthcare systems, reimbursements, and negotiated discounts. In the US, the list price hovers around USD 300–350 per vial, with net prices often lower owing to discounts and rebates [2].

In Europe, retail prices tend to be lower, averaging EUR 150–200 per vial. Emerging markets exhibit more substantial variability, often influenced by local regulation and economic status.

Factors Influencing Future Price Trends

Several pivotal factors are shaping future pricing trajectories:

-

Patent Expiry and Biosimilar Competition: Post-2030, biosimilar insulin lispro mixes will introduce downward price pressure, similar to historical trends observed with other biologics.

-

Market Penetration of Concentrated and New-Generation Insulins: Products such as ultra-long-acting insulins and novel delivery devices may cannibalize HUMALOG MIX sales, leading to strategic pricing adjustments.

-

Healthcare Policy and Reimbursement Reforms: Increased emphasis on cost-effectiveness can incentivize price negotiations and early adoption of generic alternatives.

-

Technological Innovations: Development of digital health integrations, closed-loop insulin pumps, and smart pens could influence demand dynamics and value-based pricing.

-

Global Economic Factors: Inflation, currency fluctuations, and supply chain disruptions can intermittently impact overall drug prices.

Price Projection Analysis (2023–2030)

Based on current trends and macroeconomic factors, the following projections are delineated:

-

Short-term (2023–2025): Prices are likely to remain relatively stable with minor fluctuations due to existing patent protections and ongoing negotiations. Slight reductions (2–5%) may occur due to increased rebates and discounts in mature markets.

-

Mid-term (2026–2028): Pre-expiry preparations, including potential biosimilar launches, could induce price compression averaging 10–15%. Payers may increasingly shift toward preferred biosimilars, exerting competitive pressure.

-

Post-patent expiry (2029–2032): Significant price reductions anticipated, potentially 25–40%, as biosimilars gain uptake, leading to broader affordability and market share redistribution.

Strategic Implications

Manufacturers should anticipate a phased approach to pricing, balancing incremental revenue with long-term market share retention. Early engagement with payers and proactive biosimilar development can optimize market entry and pricing strategies post-patent expiration.

Conclusion

HUMALOG MIX’s market position remains robust due to its longstanding clinical effectiveness. However, impending patent expiry, evolving competitive landscape, and healthcare reforms necessitate strategic pricing and innovation initiatives. Stakeholders must adopt dynamic, data-driven approaches to sustain profitability and market relevance amid impending biosimilar proliferation.

Key Takeaways

- The global diabetes market continues rapid growth, with insulin products like HUMALOG MIX occupying a key segment driven by increasing disease burden and therapeutic complexity.

- Patent expiration around 2030 is poised to catalyze biosimilar entry, exerting substantial downward pressure on prices, especially in developed markets.

- Short-term pricing stability is expected through 2025, with slight reductions driven by rebate strategies; significant declines are projected post-2030.

- Strategic actions now—such as biosimilar pipeline development, technological innovation, and payer engagement—are crucial to maintaining competitive positioning.

- Continuous monitoring of regulatory trends, market dynamics, and healthcare policies will be vital for stakeholders seeking to optimize pricing strategies and maximize commercial viability.

FAQs

1. When will patents for HUMALOG MIX expire, and what does it mean for pricing?

The primary patents for insulin lispro products are expected to expire around 2030. Post-expiry, biosimilar competitors can enter the market, leading to increased price competition and potential reductions of 25% or more.

2. How do biosimilars impact the pricing of HUMALOG MIX?

Biosimilars offer comparable efficacy at lower prices, pressuring originator pricing. Their proliferation typically results in significant discounts, fostering affordability but challenging profit margins for original manufacturers.

3. What regional differences influence HUMALOG MIX's pricing trends?

Pricing varies widely—Mature markets like the US and Europe have standardized reimbursement systems and negotiated discounts, whereas emerging markets face pricing volatility governed by economic factors and regulatory policies.

4. Are there innovations that could sustain HUMALOG MIX’s market share?

Yes. Integrating digital health solutions, developing combination or ultra-long-acting insulins, and improving delivery devices may enhance value proposition and patient adherence, maintaining market relevance.

5. How can manufacturers prepare for the post-patent biosimilar era?

Proactively invest in biosimilar R&D, establish strong payer and provider relationships, pursue innovative delivery systems, and focus on differentiation through clinical data and patient-centric solutions.

References

[1] Research and Markets. Global Diabetes Therapeutics Market Report 2022.

[2] Medicare Payment Advisory Commission. "Insulin Pricing and Reimbursement." 2022.

More… ↓