Share This Page

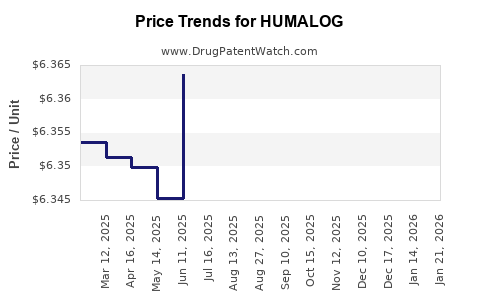

Drug Price Trends for HUMALOG

✉ Email this page to a colleague

Average Pharmacy Cost for HUMALOG

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HUMALOG 100 UNIT/ML VIAL | 00002-7510-01 | 6.36055 | ML | 2025-12-17 |

| HUMALOG 100 UNIT/ML KWIKPEN | 00002-8799-59 | 10.16949 | ML | 2025-12-17 |

| HUMALOG 100 UNIT/ML CARTRIDGE | 00002-7516-59 | 9.76835 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HUMALOG

Introduction

HUMALOG (insulin lispro) is a rapid-acting insulin analog developed by Eli Lilly and Company. It plays a crucial role in managing both type 1 and type 2 diabetes mellitus, offering fast onset and short duration of action, which facilitates mealtime glucose control. As diabetes prevalence surges globally, HUMALOG’s market dynamics and pricing strategies are pivotal for stakeholders ranging from pharmaceutical companies to healthcare providers and payers. This article provides an in-depth analysis of HUMALOG’s current market landscape and forecasts its pricing trajectory over the coming years within the broader context of insulin market trends.

Market Landscape for HUMALOG

Global Diabetes Burden

The rapid rise in diabetes prevalence substantially influences HUMALOG’s market demand. According to the International Diabetes Federation (IDF), approximately 537 million adults worldwide had diabetes in 2021, with projections surpassing 700 million by 2045 [1]. Developed economies like the United States, Europe, and Japan dominate insulin consumption, yet emerging markets exhibit rapid growth driven by urbanization, lifestyle shifts, and improved healthcare infrastructure.

Competitive Positioning

HUMALOG operates in a highly competitive landscape, primarily against other rapid-acting insulins such as Novo Nordisk’s NovoLog (insulin aspart) and Sanofi’s Apidra (insulin glulisine). Biosimilars have emerged as critical price disruptors, with several European and global markets witnessing the entry of generic or biosimilar versions aimed at reducing treatment costs and expanding access.

In addition to traditional branded formulations, newer delivery devices such as pre-filled pens and integrated digital health solutions enhance HUMALOG’s market appeal. Lilly’s continued innovation in delivery options and patient-centric features reinforce HUMALOG's position amidst fierce competition.

Key Market Segments and Usage Trends

- Type 1 Diabetes: Reliant on insulin therapy, often necessitating rapid-acting insulins like HUMALOG for prandial coverage, especially in insulin pump programs.

- Type 2 Diabetes: Increasingly managed with insulin as oral medications become insufficient, especially among elderly and insulin-resistant populations.

- Hospital and Emergency Settings: Utilized for inpatient glycemic control, though often in modified formulations.

Regulatory Environment and Patent Landscape

Eli Lilly’s patent protections for HUMALOG expired in many jurisdictions, facilitating biosimilar entry. The US FDA and European Medicines Agency (EMA) have approved multiple biosimilars, intensifying price competition [2]. While Lilly maintains exclusivity through formulation patents and delivery devices, potential patent litigations and regulatory hurdles influence market dynamics.

Price Trends and Projections

Historical Pricing Overview

Historically, insulin prices in the United States have experienced significant inflation. According to the Health Care Cost Institute, the average list price of insulin nearly doubled between 2012 and 2016, with a sharper increase following limited biosimilar competition [3]. HUMALOG’s retail price has followed this trend, though the clinical demand remains high due to its efficacy and safety profile.

Current Pricing Landscape

-

United States: Retail prices for HUMALOG can range upward of $300 to $400 per vial, with pre-filled pens costing approximately $150 to $200 per pen [4]. Insurance coverage and pharmacy benefit management (PBM) contracts significantly influence out-of-pocket costs for patients.

-

Europe: Prices are generally lower, averaging between €10 to €15 per unit, aided by tighter regulation and government-negotiated reimbursement schemes [5].

-

Emerging Markets: Pricing varies widely, often influenced by local healthcare infrastructure, procurement policies, and market competition.

Future Price Projections (2023-2030)

Factors Impacting Pricing:

- Biosimilar Competition: Entry of biosimilars is expected to exert downward pressure on HUMALOG’s price, potentially reducing costs by 20-50% in established markets.

- Regulatory Developments: Policies favoring price transparency and biosimilar substitution in major markets like the US and EU could accelerate price declines.

- Manufacturing and Supply Chain: Advances in bioprocessing and scalable manufacturing could reduce costs, allowing for more competitive pricing.

- Market Expansion: Increasing demand in emerging economies may initially sustain or slightly elevate prices due to supply constraints but are likely to decline as biosimilars become prevalent.

Projected Price Trends:

- United States: Expect a gradual decrease of 10-20% in list prices by 2025, with potential further reductions of up to 40% by 2030 due to biosimilar competition and policy interventions.

- Europe: Prices may stabilize or decline marginally (~10%) as existing negotiations and biosimilar entries mature.

- Emerging Markets: Prices could decrease substantially, possibly by over 50% over the next decade, driven by biosimilar adoption and market competition.

Pricing Outlook Summary

| Region | 2023 Price Range | 2025 Projection | 2030 Projection |

|---|---|---|---|

| United States | $300–$400/vial | $240–$320 | $180–$240 |

| Europe | €10–€15/unit | €9–€13/unit | €8–€12/unit |

| Emerging Markets | Varies, lower | 20–50% reduction | Significant reduction with biosimilar penetration |

Strategic Implications for Stakeholders

For Eli Lilly

- Innovation Continuity: Sustaining differentiation through innovative delivery devices and digital health integration bolsters competitive advantage amid price pressures.

- Market Expansion: Leveraging biosimilar partnerships and market access strategies in emerging economies can offset declines in high-income regions.

- Pricing Flexibility: Adaptive pricing strategies aligning with biosimilar landscape shifts will be critical to retain market share.

For Payers and Providers

- Cost Management: Embracing biosimilar insulins and negotiating favorable formulary access can significantly reduce expenditure.

- Patient Access: Lower prices and improved delivery options can enhance adherence and glycemic control across populations.

For Policymakers

- Regulatory Harmony: Facilitating biosimilar approval pathways and substitution policies can increase access and reduce costs.

- Pricing Transparency: Promoting transparency in insulin pricing can inform better reimbursement and procurement decisions.

Conclusion

The evolving insulin market landscape predicates a downward trajectory in HUMALOG pricing, primarily driven by biosimilar competition, regulatory changes, and technological advancements. Despite this, HUMALOG will maintain a significant demand base due to its proven efficacy and integral role in diabetes management. Strategic forecasting indicates a steady decline in list prices over the next decade, emphasizing the importance for stakeholders to adapt swiftly to market shifts. Embracing innovation, optimizing supply chain efficiencies, and engaging in strategic partnerships will be essential for maintaining relevance and profitability in an increasingly dynamic insulin market.

Key Takeaways

- The global rise in diabetes prevalence sustains robust demand for rapid-acting insulins like HUMALOG.

- Biosimilar competition is poised to accelerate price reductions, especially in mature markets like the US and Europe.

- Pricing in developed regions is expected to decline gradually (10-20% by 2025, 40-50% by 2030), while emerging markets may see more substantial decreases.

- Innovation in delivery devices and digital health integration remains vital for Eli Lilly to differentiate HUMALOG.

- Stakeholders should prioritize biosimilar adoption and strategic market expansion to navigate pricing pressures effectively.

FAQs

1. How will biosimilar entries impact HUMALOG’s market share and pricing?

Biosimilars are expected to increase competition, leading to reduced prices and potentially eroding HUMALOG’s market share in regions with active biosimilar adoption. Price reductions of 20-50% are projected as biosimilars gain acceptance.

2. What factors could slow down or accelerate HUMALOG’s price declines?

Regulatory barriers, patent litigations, and supply chain costs could slow declines. Conversely, policy initiatives promoting biosimilar substitution, increased manufacturing efficiencies, and market demand could accelerate price reductions.

3. Are there upcoming innovations that could influence HUMALOG’s market value?

Yes, delivery device enhancements, digital health integrations, and next-generation insulin formulations may sustain or boost HUMALOG’s value proposition despite flat or declining list prices.

4. How does regional variation influence HUMALOG pricing strategies?

Pricing varies significantly, influenced by local regulatory frameworks, reimbursement policies, and market competition. High-income regions generally exhibit higher list prices with gradual declines, while emerging markets could see sharper reductions.

5. What strategic moves should Eli Lilly consider to maintain HUMALOG’s competitiveness?

Lilly should prioritize biosimilar partnerships, innovate in delivery technology, expand access through targeted markets, and advocate for policies supporting insulin affordability.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 2022.

[2] U.S. Food and Drug Administration (FDA). Biosimilar approvals.

[3] Health Care Cost Institute. Trends in insulin prices, 2012–2016.

[4] GoodRx. HUMALOG pricing and discount information.

[5] National Health Service (NHS). Insulin pricing and reimbursement policies in Europe.

More… ↓