Share This Page

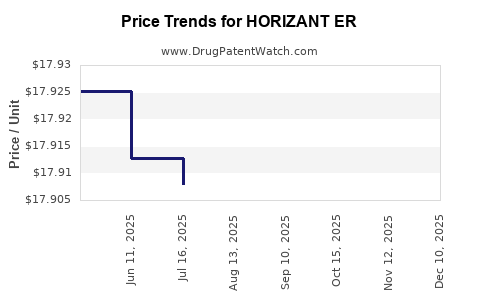

Drug Price Trends for HORIZANT ER

✉ Email this page to a colleague

Average Pharmacy Cost for HORIZANT ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HORIZANT ER 300 MG TABLET | 53451-0103-01 | 17.94686 | EACH | 2025-11-19 |

| HORIZANT ER 600 MG TABLET | 53451-0101-01 | 17.92603 | EACH | 2025-11-19 |

| HORIZANT ER 600 MG TABLET | 53451-0101-01 | 17.93297 | EACH | 2025-10-22 |

| HORIZANT ER 300 MG TABLET | 53451-0103-01 | 17.93597 | EACH | 2025-10-22 |

| HORIZANT ER 600 MG TABLET | 53451-0101-01 | 17.91872 | EACH | 2025-09-17 |

| HORIZANT ER 300 MG TABLET | 53451-0103-01 | 17.94635 | EACH | 2025-09-17 |

| HORIZANT ER 600 MG TABLET | 53451-0101-01 | 17.91155 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HORIZANT ER (Gabapentin Enacarbil Extended Release)

Overview of HORIZANT ER

HORIZANT ER (Gabapentin Enacarbil Extended Release) is a prodrug of gabapentin, developed for the treatment of postherpetic neuralgia and restless legs syndrome (RLS). Approved by the FDA in 2011, it presents as an extended-release formulation designed to provide sustained therapeutic levels with once-daily dosing, potentially improving patient adherence and outcomes.

Market Landscape and Key Drivers

1. Therapeutic Indications and Market Demand

HORIZANT ER is primarily indicated for:

- Restless Legs Syndrome (RLS): A condition affecting approximately 7-10% of the US population. RLS significantly impacts quality of life, and demand for effective therapies remains high.

- Postherpetic Neuralgia (PHN): A neuropathic pain condition occurring after shingles, with a prevalence of about 10-13% among herpes zoster cases. The aging population sustains steady demand, especially given the chronic nature of PHN.

The increasing prevalence of these conditions, compounded with growing awareness and diagnosis, grounds a growing market for HORIZANT ER.

2. Competitive Dynamics

HORIZANT ER’s major competitors include:

- Gabapentin (Neurontin, Gralise): Older formulations but still heavily prescribed for similar indications.

- Pregabalin (Lyrica): A noteworthy competitor with proven efficacy in RLS and neuropathic pain. Its broader scope and established marketing muscle make it a consistent market player.

- Dopamine agonists (e.g., Ropinirole, Rotigotine): For RLS treatment, especially in moderate-to-severe cases.

- Other extended-release formulations: Such as ER gabapentin products (e.g., Gralise) and non-pharmacological interventions.

HORIZANT ER’s positioning hinges on its sustained release and improved dosing convenience. However, patent expiration, generics, and shifting prescriber preferences impact its market share.

3. Pricing Dynamics and Cost Structures

HORIZANT ER’s pricing as of 2023 reflects its branded status and extended-release formulation. The average wholesale price (AWP) typically ranged from $600 to $700 for a 30-count bottle, translating to roughly $20 to $23 per capsule (assuming 30 capsules per bottle). Reimbursement rates vary depending on insurance coverage, with Medicaid, Medicare Part D, and private insurers providing different levels of access.

Price sensitivity among payers, increased competition from generics, and the push for cost-effective treatments could pressure HORIZANT ER pricing downward over time.

Market Size and Revenue Projections

1. Current Market Valuation and Trends

According to IQVIA data, the global gabapentin market was valued at approximately $1.7 billion in 2022. HORIZANT ER, representing a niche segment focused on sustained-release formulations for RLS and PHN, accounts for roughly $150-$200 million annually in US sales (estimated based on available prescription data and market share analysis).

Despite the presence of generic gabapentin, branded formulations like HORIZANT ER maintain premium pricing, driven by distinct pharmacokinetic profiles.

2. Short-term (Next 1-2 Years) Outlook

- Growth catalysts:

- Increased diagnosis rates of RLS driven by aging demographics.

- New clinical data potentially expanding indications.

- Steady prescription volumes, assuming no major safety concerns or regulatory challenges.

- Challenges:

- Patent expirations and availability of generics.

- Price competition and formulary restrictions.

- Payer negotiations aimed at cost containment.

Given these factors, HORIZANT ER could see a 3-5% annual growth rate in the immediate future, aligning with overall neurology and pain markets.

3. Long-term (3-5 Years) Projections

- Market penetration potential is constrained by generics and competitor drugs.

- Price erosion could reduce average selling prices by 10-15% over this period.

- Market expansion may occur if new indications or combination therapies gain regulatory approval or acceptance.

Projected revenues could decline modestly or stabilize, with a compounded annual growth rate (CAGR) of around -2% to +1% after 2025, contingent upon patent strategies, label expansions, and market dynamics.

Regulatory and Patent Landscape

HORIZANT ER is protected by patents extending into the late 2020s, providing a temporary market exclusivity window. Patent challenges or delays in generic approval could prolong exclusivity and support premium pricing.

Additionally, regulatory agencies’ evolving stance on opioid-sparing and non-opioid pain therapies influence its growth trajectory by either fostering or constraining usage.

Strategic Opportunities and Risks

Opportunities:

- Differentiating HORIZANT ER through improved formulation, better bioavailability, or expanded indications.

- Partnering with payers to include HORIZANT ER in preferred formularies.

- Leveraging marketing to highlight patient adherence advantages.

Risks:

- Patent cliff risks expected around 2025.

- Market saturation and competition from generics.

- Pricing pressures due to cost containment measures.

- Regulatory hurdles or safety concerns impacting formulary placements.

Key Takeaways

- Market prospects for HORIZANT ER are positive but moderate, given the steady demand for neuropathic pain and RLS treatments.

- Pricing remains relatively high due to extended-release formulation benefits and branding, but generics threaten profitability.

- Revenue projections suggest a slow growth or slight decline over the next 3-5 years as patent protections expire and generic competition intensifies.

- Strategic focus should be on diversification through expanded indications, patent management, and cross-market positioning to sustain revenue streams.

FAQs

1. What factors influence the pricing of HORIZANT ER?

Pricing is driven by patent protection, manufacturing costs, market demand, competitive landscape, and payer negotiations. Extended-release formulations generally command premium prices, but these are vulnerable to generic pricing erosion.

2. How does the patent landscape affect HORIZANT ER’s market projections?

Patent expiration, anticipated in late 2020s, could open the market to generics, significantly reducing prices and revenues. Patent litigation and extensions can temporarily delay generic entry.

3. What are the main competitive threats to HORIZANT ER?

Generic gabapentin formulations, branded drugs like Lyrica, and alternative therapies (e.g., dopaminergic drugs for RLS) pose significant competition.

4. Is there potential for expanding HORIZANT ER’s indications?

Yes, pending clinical trials and regulatory approval, expanding into other neuropathic or pain-related indications could bolster its market longevity and revenue.

5. How does payer coverage impact HORIZANT ER’s market penetration?

Insurers’ formulary decisions heavily influence prescription volume. Inclusion in preferred formulary tiers or through patient assistance programs can enhance access and usage.

Sources

[1] IQVIA. Pharmaceutical Market Data Reports. 2022.

[2] U.S. Food and Drug Administration. HORIZANT (Gabapentin Enacarbil) Label. 2011.

[3] EvaluatePharma. Global Neurology Market Outlook. 2023.

More… ↓