Share This Page

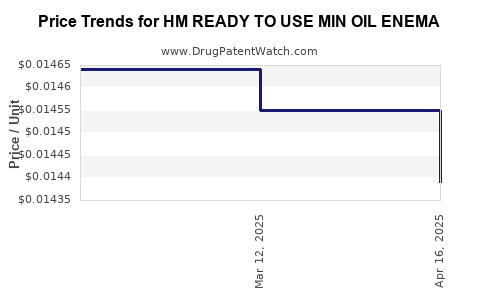

Drug Price Trends for HM READY TO USE MIN OIL ENEMA

✉ Email this page to a colleague

Average Pharmacy Cost for HM READY TO USE MIN OIL ENEMA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM READY TO USE MIN OIL ENEMA | 62011-0270-01 | 0.01439 | ML | 2025-04-23 |

| HM READY TO USE MIN OIL ENEMA | 62011-0270-01 | 0.01455 | ML | 2025-03-19 |

| HM READY TO USE MIN OIL ENEMA | 62011-0270-01 | 0.01464 | ML | 2025-02-19 |

| HM READY TO USE MIN OIL ENEMA | 62011-0270-01 | 0.01468 | ML | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM Ready-to-Use Mineral Oil Enema

Introduction

The global market for over-the-counter (OTC) laxatives, including mineral oil enemas, remains robust driven by increasing prevalence of constipation, aging populations, and rising awareness of bowel health. The product HM Ready to Use Min Oil Enema targets this essential segment, positioned as a convenient, pre-formulated solution designed for ease of use and patient compliance. This analysis explores market dynamics, competitive positioning, regulatory considerations, and price forecasts to assist stakeholders in making informed strategic decisions.

Market Overview

Global Laxative Market Outlook

The global laxative market, valued approximately at USD 4.9 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 4.2% over the next five years [1]. This expansion derives from demographic shifts—particularly aging populations in North America, Europe, and parts of Asia—and increasing lifestyle-related gastrointestinal issues.

Within this domain, mineral oil-based enemas constitute a niche but steady segment, prized for their uncomplicated mechanism and historical trust. The HM Ready to Use Min Oil Enema supports a premium, convenience-oriented position that appeals to both individual consumers and healthcare providers emphasizing patient compliance.

Market Segmentation

-

Therapeutic Segment: Primarily used for relief from constipation, bowel cleansing pre-surgery, or diagnostic procedures.

-

Distribution Channels: Retail pharmacies, hospital pharmacies, online e-commerce platforms, and direct-to-consumer sales.

-

User Demographics: Predominantly adults aged 50+, with increasing use among younger adults facing lifestyle-induced chronic constipation.

Competitive Landscape

Major Players

Key competitors include established OTC brands such as Fleet Enemas (B Braun), Dulcolax, and generic mineral oil enema products distributed by regional pharmaceutical firms [2].

Product Positioning

HM Ready to Use Min Oil Enema emphasizes convenience—pre-filled, single-dose units requiring no preparation or additional administration steps. This differentiator aligns with consumer preferences for minimal effort and rapid relief.

Brand Perception and Trust

A critical success factor is consumer confidence in safety and efficacy. Mineral oil enemas possess a long history of clinical use, reinforcing their market presence despite the advent of alternative laxatives (e.g., osmotic, stimulant, and bulk-forming agents).

Regulatory Landscape

Regulatory Approvals

As an OTC medicinal product, HM Ready to Use Min Oil Enema must comply with regional drug approval regulations (FDA in the U.S., EMA in Europe, etc.), including manufacturing standards (GMP), labeling, and safety data submission.

Market Entry Barriers

High regulatory compliance costs and established competition pose barriers. However, the product's pre-formulated nature simplifies dosing instructions, potentially accelerating regulatory approval and market penetration.

Pricing Dynamics

Factors Influencing Price

-

Manufacturing Costs: Packaging, formulation, compliance costs.

-

Regulatory Fees: Approval, registration, and ongoing compliance costs.

-

Market Positioning: Premium convenience versus basic efficacy.

-

Competitive Pricing: Benchmarking against existing enema products.

Current Market Pricing

In North American markets, mineral oil enemas range from USD 3.50 to USD 7.00 per unit, depending on brand and packaging. The HM Ready to Use Min Oil Enema, given its convenience, may be positioned at a premium—approximately USD 5.00 to USD 8.00 per unit—considering value-added features.

Price Projection and Market Penetration

Short-term (1-2 years)

Initial pricing is likely to align with mid-tier market figures (USD 5.00–USD 6.50), targeting early adopters in pharmacy chains and online platforms. Promotional discounts may reduce effective consumer prices temporarily.

Medium-term (3-5 years)

As production scales and distribution expands, economies of scale could lower manufacturing costs, enabling price reductions or increased margins. Market penetration strategies, including direct-to-consumer marketing, may also influence pricing, potentially maintaining a premium positioning, especially if brand trust solidifies.

Long-term (5+ years)

Given evolving consumer preferences and competition, prices could stabilize within a USD 4.50–USD 6.00 range, with potential for premium pricing in niche segments utilizing functional or organic labeling.

Market Risks and Opportunities

- Regulatory Changes: Stricter safety standards could increase compliance costs.

- Competitive Innovations: New formulations or delivery methods (e.g., suppositories, oral laxatives) might cannibalize market share.

- Growing Demand: Aging demographics and lifestyle factors favor continued demand, supporting stable sales volumes.

- Consumer Preference Shift: Preference for natural or plant-based laxatives may necessitate product repositioning or reformulation.

Conclusion

The HM Ready to Use Min Oil Enema occupies a strategic niche within the expanding OTC laxative market. Its success hinges on optimizing pricing strategies that balance manufacturing costs, consumer willingness to pay for convenience, and competitive positioning. With proper regulatory navigation and targeted marketing, the product can sustain a competitive edge and achieve lucrative market share in the coming years.

Key Takeaways

- The global OTC laxative market is projected to grow at approximately 4.2% CAGR through 2027, supporting sustained demand for mineral oil enemas.

- HM Ready to Use Min Oil Enema’s convenience factor offers a distinct competitive advantage, enabling premium pricing.

- Initial retail pricing estimates position the product around USD 5.00–USD 6.50 per unit, with potential for margin improvements as scale grows.

- Regulatory compliance and consumer trust are critical to market entry and long-term success.

- Opportunities lie in leveraging aging populations, increasing bowel health awareness, and online marketing channels to expand market penetration.

FAQs

Q1: What are the main advantages of the HM Ready to Use Min Oil Enema over traditional mineral oil enemas?

A1: Its pre-filled, ready-to-use design offers convenience, eliminates preparation steps, and enhances patient compliance, differentiating it from traditional, manual application methods.

Q2: What regulatory considerations must be addressed for market entry?

A2: The product must meet regional standards for OTC drug approval, including safety and efficacy data submission, manufacturing compliance (GMP), and proper labeling as per jurisdiction guidelines.

Q3: How does consumer perception influence pricing strategies?

A3: High trust in established ingredients like mineral oil supports premium pricing when combined with convenience features. Negative perceptions around mineral oil safety could impact willingness to pay, necessitating educational marketing.

Q4: What are potential risks affecting the price stability of the product?

A4: Regulatory changes, new competitive products, shifts in consumer preferences towards natural remedies, and supply chain disruptions may influence pricing stability.

Q5: How can producers expand market reach for the product?

A5: Strategies include targeting online sales platforms, collaborating with healthcare providers, implementing awareness campaigns about bowel health, and diversifying packaging options to suit different consumer needs.

Sources

[1] MarketWatch. “Laxatives Market Size, Share & Industry Analysis.” 2022.

[2] IQVIA. “OTC Medicinal Products Market Report,” 2022.

More… ↓