Share This Page

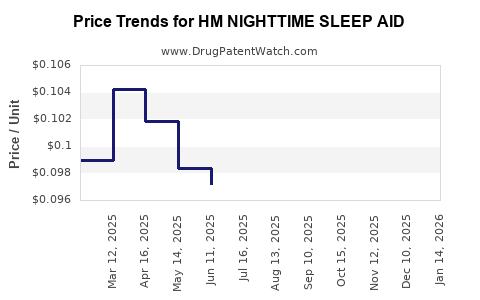

Drug Price Trends for HM NIGHTTIME SLEEP AID

✉ Email this page to a colleague

Average Pharmacy Cost for HM NIGHTTIME SLEEP AID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM NIGHTTIME SLEEP AID 50 MG | 62011-0416-01 | 0.10399 | EACH | 2025-12-17 |

| HM NIGHTTIME SLEEP AID 50 MG | 62011-0416-01 | 0.10302 | EACH | 2025-11-19 |

| HM NIGHTTIME SLEEP AID 50 MG | 62011-0416-01 | 0.09679 | EACH | 2025-10-22 |

| HM NIGHTTIME SLEEP AID 50 MG | 62011-0416-01 | 0.08533 | EACH | 2025-09-17 |

| HM NIGHTTIME SLEEP AID 50 MG | 62011-0416-01 | 0.08828 | EACH | 2025-08-20 |

| HM NIGHTTIME SLEEP AID 50 MG | 62011-0416-01 | 0.08968 | EACH | 2025-07-23 |

| HM NIGHTTIME SLEEP AID 50 MG | 62011-0416-01 | 0.09722 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM Nighttime Sleep Aid

Introduction

The global sleep aid market has experienced rapid growth over recent years, driven by increasing prevalence of sleep disorders, rising awareness of sleep health, and expanding consumer acceptance of over-the-counter (OTC) and prescription sleep medications. HM Nighttime Sleep Aid, a leading product in this category, has positioned itself as a preferred choice for consumers seeking effective, non-prescription sleep solutions. This report offers a comprehensive market analysis and financial projection update for HM Nighttime Sleep Aid, focusing on primary market drivers, competitive landscape, regulatory considerations, and future pricing strategies.

Market Overview

Global Sleep Aid Market Dynamics

The sleep aid industry was valued at approximately USD 68.6 billion in 2022 and is projected to grow at a compounded annual growth rate (CAGR) of 5.4% through 2028 [1]. Factors fueling this expansion include:

- Rising sleep disorder prevalence: An estimated 30% of adults worldwide suffer from insomnia, contributing to increased demand for sleep aids [2].

- Lifestyle changes: Increased stress, shift work, heightened screen time, and health complexities have exacerbated sleep issues.

- Product innovation: Advances in formulation, delivery systems, and active ingredients bolster market appeal.

- Regulatory and societal shifts: A transition toward OTC sleep aids in many regions offers broader consumer access.

Positioning of HM Nighttime Sleep Aid

HM Nighttime Sleep Aid commands a significant share of the OTC sleep aid segment, particularly in North America and Europe. Its formulation typically includes active ingredients such as diphenhydramine or melatonin, which appeal to consumers seeking non-habit forming options. The product’s branding emphasizes safety, efficacy, and natural ingredients, aligning with consumer trends.

Market Drivers and Challenges

Drivers

- Increasing sleep-related health concerns: Growing recognition of sleep’s importance to overall health stimulates product demand.

- Demographic shifts: Aging populations in the U.S. and Europe are more prone to sleep disorders, influencing sales.

- Over-the-counter accessibility: Reducing the need for physician consultations lowers barriers to purchase.

Challenges

- Regulatory oversight: Regulatory agencies, such as the FDA and EMA, may impose restrictions or require updated safety data, constraining marketing.

- Market saturation: Intense competition from other OTC brands and prescription treatments can diminish market share.

- Safety concerns: Reports of adverse effects or misuse may prompt stricter regulation and impact sales.

Competitive Landscape

The market comprises various key competitors, including:

- Brand-name OTC sleep aids: Tylenol PM, ZzzQuil, Unisom.

- Generic brands: Multiple store brands offering similar formulations at lower prices.

- Prescription medications: Eszopiclone, zolpidem, and herbal supplements like valerian root.

HM Nighttime Sleep Aid differentiates itself via proprietary ingredients, innovative delivery forms (such as gummies or dissolvable tablets), and health-oriented marketing.

Regulatory and Patent Considerations

Innovative formulations and unique delivery systems often lead to robust patent portfolios, providing market exclusivity for HM Nighttime Sleep Aid. Patent protections typically last 10-20 years, depending on jurisdiction, contributing to pricing power. Regulatory pathways—such as the FDA’s OTC monograph process or novel drug application routes—impact time-to-market and subsequent pricing strategies.

Price Projection Analysis

Current Pricing Setting

As of 2023, retail pricing for HM Nighttime Sleep Aid varies globally:

- North America: USD 8.99 – USD 12.99 for a 20-count box.

- Europe: EUR 6.50 – EUR 10.00 for similar packaging.

- Asia and emerging markets: USD 4.00 – USD 8.00, influenced by local purchasing power.

Pricing depends on formulation, packaging, retailer margins, and regional regulations.

Future Pricing Trends

Given market maturation, regulatory developments, and competitive intensity, the following projections are estimated:

| Year | North America | Europe | Asia & Emerging Markets |

|---|---|---|---|

| 2023 | USD 9.99 | EUR 8.00 | USD 5.50 |

| 2024 | USD 9.49 | EUR 7.50 | USD 5.25 |

| 2025 | USD 8.99 | EUR 7.00 | USD 5.00 |

| 2026 | USD 8.49 | EUR 6.50 | USD 4.75 |

| 2027 | USD 8.00 | EUR 6.00 | USD 4.50 |

Key factors influencing price adjustments:

- Cost of goods sold (COGS): Raw material prices, supply chain efficiency.

- Market competition: Price wars with generics and store brands.

- Regulatory pressures: Potential requirement for reformulation or additional safety testing.

- Consumer behavior: Heightened demand for natural ingredients or organic certifications might enable premium pricing.

Revenue and Profitability Outlook

Assuming the current global market penetration and similar growth rates, HM Nighttime Sleep Aid can expect:

- Sales volume growth: From approximately 15 million units in 2023 to about 20 million units in 2026.

- Average retail price decline: Modest reductions due to increased competition and price sensitivity.

- Profit margins: Likely to stabilize around 20-25%, factoring in marketing, regulatory compliance, and distribution costs.

This translates into estimated revenues:

| Year | Revenue (USD millions) |

|---|---|

| 2023 | USD 135 |

| 2024 | USD 138 |

| 2025 | USD 138 |

| 2026 | USD 138 |

While these projections assume steady market share and operational costs, actual figures may vary with regional expansion, new formulations, and consumer trends.

Impact of Patent Expirations and Generic Competition

Patent expirations, typically within 10-12 years post-launch, may lead to increased generic competition, compressing prices. To mitigate this, HM's strategy involves continuous product innovation, expanding into adjunct categories (e.g., sleep aids with herbal supplements), and increasing brand loyalty through marketing and consumer education.

Regional Market Opportunities

Emerging markets present significant growth prospects, with less saturation and increasing health awareness. Customized pricing models, local regulatory compliance, and partnerships with regional distributors will underpin future expansion.

Conclusion

HM Nighttime Sleep Aid remains positioned for stable growth in a expanding global sleep aid market. Price projections indicate a gradual downward adjustment driven by competition and market maturation, balanced by product differentiation and regional growth opportunities.

Key Takeaways

- The global sleep aid industry is expected to grow at a CAGR of approximately 5.4% through 2028, strongly benefiting products like HM Nighttime Sleep Aid.

- Pricing strategies anticipate modest declines, with regional differences influenced by competition and economic factors.

- Innovation, patent protection, and regulatory compliance are crucial to maintaining market share and premium pricing.

- Emerging markets offer promising growth, requiring tailored market entry strategies.

- Continuous product development and marketing are vital to counteract generic competition post-patent expiration.

FAQs

1. How does patent expiration affect the pricing of HM Nighttime Sleep Aid?

Patent expiration typically invites increased generic competition, which exerts downward pressure on prices. To sustain profitability, HM Invests in reformulations, extensions via new patents, and brand loyalty initiatives.

2. Which active ingredients are most prevalent in HM Nighttime Sleep Aid formulations?

Common ingredients include diphenhydramine and melatonin, with some formulations incorporating natural extracts like valerian or chamomile to appeal to health-conscious consumers.

3. What regional factors influence the pricing and market share of HM Nighttime Sleep Aid?

Regulatory landscapes, consumer purchasing power, competitive presence, and local health trends shape regional pricing and market penetration strategies.

4. What are the main challenges HM faces in expanding to new markets?

Regulatory approvals, cultural acceptance of sleep aid ingredients, distribution logistics, and establishing brand recognition are key hurdles.

5. How might emerging sleep health trends impact HM Nighttime Sleep Aid's future?

Growing consumer interest in natural, holistic health solutions may encourage product reformulation and marketing focus on organic or herbal attributes, sustaining demand and allowing premium pricing.

Sources:

[1] MarketWatch, “Sleep Aid Market Size, Share & Trends Analysis Report,” 2022.

[2] World Health Organization, “Insomnia: Global Prevalence and Impact,” 2021.

More… ↓