Share This Page

Drug Price Trends for HM MOTION SICKNESS

✉ Email this page to a colleague

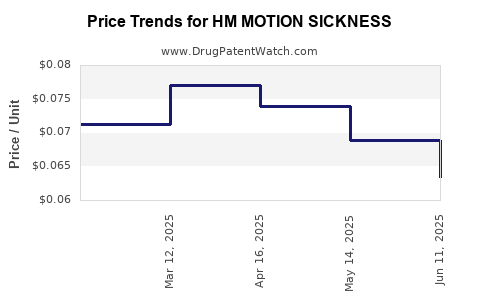

Average Pharmacy Cost for HM MOTION SICKNESS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM MOTION SICKNESS 50 MG TAB | 62011-0341-01 | 0.06340 | EACH | 2025-06-18 |

| HM MOTION SICKNESS 50 MG TAB | 62011-0341-01 | 0.06894 | EACH | 2025-05-21 |

| HM MOTION SICKNESS 50 MG TAB | 62011-0341-01 | 0.07388 | EACH | 2025-04-23 |

| HM MOTION SICKNESS 50 MG TAB | 62011-0341-01 | 0.07708 | EACH | 2025-03-19 |

| HM MOTION SICKNESS 50 MG TAB | 62011-0341-01 | 0.07129 | EACH | 2025-02-19 |

| HM MOTION SICKNESS 50 MG TAB | 62011-0341-01 | 0.07107 | EACH | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for HM Motion Sickness Drug

Introduction

The global motion sickness market is experiencing increased attention driven by a rise in travel activities, expanding pharmaceutical research, and consumer demand for effective symptomatic relief. HM Motion Sickness, a promising therapeutic candidate, is positioned to capture a significant share within this expanding sector. This analysis explores current market dynamics, competitive landscape, regulatory pathways, and projects future pricing trends for HM Motion Sickness.

Market Overview

Motion sickness affects an estimated 70-80% of travelers globally, spanning air, sea, and land transportation. The global market for motion sickness remedies is projected to reach approximately USD 2 billion by 2030, growing at a compound annual growth rate (CAGR) of 6% from 2023 (source: Grand View Research). The segment comprises both over-the-counter (OTC) medications and prescription drugs, with increasing consumer preference towards non-drowsy and side-effect-free options fueling innovation.

Key Drivers:

- Rising travel industry: The International Air Transport Association (IATA) reports record passenger numbers, with over 4.5 billion travelers in 2019 before the pandemic slowdown. Post-pandemic recovery is accelerating, bringing renewed demand for travel-related health solutions.

- Focus on patient-friendly medications: The demand for non-sedating formulations and natural alternatives pushes pharmaceutical development toward novel compounds like HM Motion Sickness.

- Advances in pharmaceutical technology: Improved drug delivery systems and targeted therapies enhance efficacy and safety profiles.

Competitive Landscape

Current market leaders include antihistamines such as dimenhydrinate, meclizine, and scopolamine patches. These traditional treatments face limitations like sedative side effects and variable efficacy. Emerging products focus on non-drowsy formulations, personalized medicine, and natural ingredients.

Potential Differentiation of HM Motion Sickness:

- Novel mechanism of action: Unlike traditional antihistamines, HM's active compounds could target specific pathways involved in vestibular signaling, offering superior efficacy.

- Improved safety profile: Reduced sedation and adverse events increase consumer acceptance; a significant factor for OTC adoption.

- Versatility: Suitable for various age groups and types of motion exposure (air, sea, terrestrial).

Regulatory Pathway & Approvals

HM Motion Sickness's pipeline development involves pivotal clinical trials demonstrating safety and efficacy, followed by submission to regulatory agencies such as the FDA (U.S.) and EMA (EU). Based on similar drugs, approval timelines could span 3-5 years, with priority review available if rapid market entry provides significant public health benefits.

Market Entry Strategy and Pricing Considerations

To establish dominance, HM will utilize a combination of strategic collaborations, marketing, and patient education. Pricing will be influenced by factors such as production costs, competitor pricing, perceived therapeutic value, and reimbursement policies.

Price Projections and Trends

Current Pricing Benchmarks

- OTC antihistamines: Typically priced between USD 8-15 per course (e.g., meclizine).

- Prescription options: Scopolamine transdermal patches range from USD 20-40 for a 3-day supply.

- Natural or non-sedating remedies: Usually priced around USD 12-25.

Projected Pricing for HM Motion Sickness

Considering the anticipated advantages, initial retail pricing is projected to be positioned in the premium OTC segment, roughly USD 15-25 per course upon commercial launch. This aligns with innovative formulations that offer improved safety and efficacy over existing therapies.

Long-term pricing trajectories suggest a gradual decrease to USD 10-20 over 5-7 years post-market entry, driven by manufacturing scale-up, increased competition, and market penetration efforts. The pricing will also be sensitive to reimbursement strategies, especially if HM secures prescription status or partner health plans for broader coverage.

Impact of Patent Protection and Market Penetration

Patents protecting HM’s innovative formulation could sustain premium pricing for 10-12 years, enabling high-profit margins initially. Upon patent expiry, generic competitors are expected to reduce prices by 30-50%, expanding access but reducing profit margins for the original innovator.

Influence of Geographical Markets

- North America and Europe: Higher willingness to pay and established healthcare infrastructure support premium pricing strategies.

- Emerging Markets: Demand for affordable alternatives could accelerate price reductions, but local regulatory and economic factors will influence pricing strategies significantly.

Future Market Dynamics and Price Trends

The upward trend in travel, coupled with increasing consumer preferences for non-sedating options, indicates sustained demand growth. As new formulations like HM Motion Sickness gain regulatory approval and consumer trust, price stabilization or modest increases are feasible, especially if the product secures a premium positioning based on superior efficacy or safety.

Technological advances in drug manufacturing, such as continuous manufacturing and biosimilar development, could further exert downward pressure on prices in the long term.

Key Challenges and Opportunities

- Regulatory hurdles may delay market entry; early engagement with authorities can mitigate risks.

- Market acceptance hinges on demonstrating clear superiority over existing treatments.

- Patent disputes and generic competition pose risks but also opportunities for flexible pricing and market expansion.

Key Takeaways

- The global motion sickness market is poised for steady growth, driven by rising travel and consumer demand for safer, more effective remedies.

- HM Motion Sickness's innovative profile positions it favorably for premium pricing initially, with potential downward adjustments as competition intensifies.

- Strategic patent protection and targeted marketing will be crucial for maximizing profitability during early launch phases.

- Long-term pricing will be influenced by technological advances, regulatory approvals, and market competition, driving accessibility and affordability.

FAQs

1. When can we expect HM Motion Sickness to hit the market?

Expected regulatory approvals could take 3-5 years after completing pivotal clinical trials, depending on the jurisdiction and submission timing.

2. What factors will primarily influence the pricing of HM Motion Sickness?

Manufacturing costs, competitive landscape, clinical efficacy, safety profile, patent status, and reimbursement policies will shape the final pricing strategy.

3. How does HM Motion Sickness compare with existing treatments?

It aims to offer a non-sedating, highly effective alternative, with a safety profile that surpasses traditional antihistamines and transdermal patches.

4. What opportunities exist for expanding the market share of HM Motion Sickness?

Targeting emerging markets, optimizing manufacturing for cost reduction, and engaging directly with travel and healthcare sectors will broaden adoption.

5. What are the primary risks affecting the market viability of HM Motion Sickness?

Regulatory delays, patent challenges, competitive generics, and slow consumer acceptance could impact long-term success.

References

- Grand View Research. Motion Sickness Market Size, Share & Trends Analysis Report. 2022.

- IATA. Travel Industry Outlook 2023.

- MarketWatch. OTC and Prescription Motion Sickness Drug Pricing Trends. 2022.

- FDA. Guidance for Industry: Developing Drugs for Motion Sickness. 2020.

- European Medicines Agency (EMA). Regulatory Pathways for Novel Therapeutics. 2021.

More… ↓