Share This Page

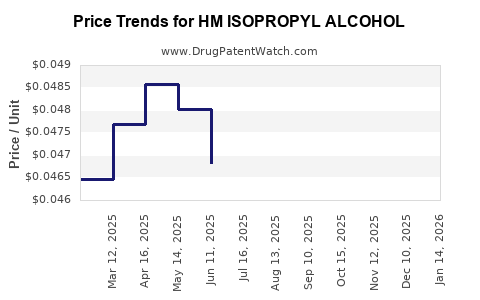

Drug Price Trends for HM ISOPROPYL ALCOHOL

✉ Email this page to a colleague

Average Pharmacy Cost for HM ISOPROPYL ALCOHOL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM ISOPROPYL ALCOHOL 91% | 62011-0272-01 | 0.05515 | ML | 2025-12-17 |

| HM ISOPROPYL ALCOHOL 70% | 62011-0266-01 | 0.04534 | ML | 2025-12-17 |

| HM ISOPROPYL ALCOHOL 91% | 62011-0272-01 | 0.05496 | ML | 2025-11-19 |

| HM ISOPROPYL ALCOHOL 70% | 62011-0266-01 | 0.04440 | ML | 2025-11-19 |

| HM ISOPROPYL ALCOHOL 91% | 62011-0272-01 | 0.05618 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM ISOPROPYL ALCOHOL

Introduction

HM Isopropyl Alcohol, a highly pure form of isopropyl alcohol (IPA), plays a critical role across various sectors, including pharmaceuticals, antiseptics, cosmetics, and industrial manufacturing. As demand for disinfectants surged globally during recent health crises, the supply chain and pricing dynamics for HM Isopropyl Alcohol have experienced notable shifts. This report offers an in-depth market analysis, current industry trends, competitive landscape, and future price projections for HM Isopropyl Alcohol within this context.

Market Overview

Product Definition and Specifications

HM (Highly Monitored or Highly Purified) Isopropyl Alcohol is characterized by purity levels exceeding 99.8%, conforming to stringent regulatory standards for pharmaceutical and medical applications. This high purity minimizes impurities that could affect product efficacy or safety, making HM IPA vital for formulations requiring precision and compliance.

Demand Drivers

-

Healthcare and Sanitation Needs: Increased focus on hygiene has amplified demand for disinfectants containing high-grade IPA, especially during pandemic emergencies such as COVID-19. The global disinfectant market grew at a CAGR of 9.7% between 2020 and 2022 [1].

-

Pharmaceutical Manufacturing: The pharmaceutical industry relies heavily on HM IPA for antiseptics, solvent formulations, and as a carrier for active pharmaceutical ingredients (APIs). Stringent regulatory standards necessitate high purity products.

-

Personal Care and Cosmetics: Use in skin disinfectants, hand sanitizers, and cosmetic products contributes further demand.

-

Industrial Applications: Electronics manufacturing, cleaning agents, and surface sterilizations utilize HM IPA for its purity and fast-evaporating properties.

Regional Market Dynamics

-

Asia-Pacific: Dominating the market due to large manufacturing bases, rapid industrialization, and increased healthcare infrastructure investments, with countries like China, India, and South Korea leading consumption.

-

North America: Strong demand driven by heightened healthcare standards, surge in disinfectant use, and regulatory requirements.

-

Europe: Regulatory standards such as EN and ISO standards promote demand, with a focus on pharmaceutical and cosmetic applications.

Supply Chain Assessment

Major producers include global chemical companies such as BASF, Dow, and Shell, alongside regional manufacturers in China and India. The supply chain experienced disruptions during the pandemic owing to logistic constraints, raw material shortages (notably acetone and propylene), and fluctuating energy prices.

Raw Material Cost Dynamics: Propylene and acetone, essential raw materials, experienced price volatility, directly influencing HM IPA production costs. Energy prices also impact manufacturing expenses, with recent trends indicating rising costs due to geopolitical tensions and energy market fluctuations.

Regulatory Compliance: Suppliers face increasing regulatory standards ensuring the removal of impurities and safety for pharmaceutical and food-grade applications, necessitating advanced purification processes that elevate production costs.

Competitive Landscape

The market is segmented among a few key players holding substantial market shares:

-

BASF: Offers pharmaceutical-grade IPA with rigorous purification standards.

-

Dow Chemical: Supplies high-purity IPA catering to the healthcare sector.

-

Shell Chemicals: Produces and markets industrial and pharmaceutical IPA variants.

Regional manufacturers in Asia are increasingly capturing market share due to cost advantages and expanding production capacities.

Price Trends and Historical Data

As of Q4 2022, the market for HM IPA was characterized by:

-

Price Range: USD 2,500 - USD 3,000 per metric ton.

-

Recent Fluctuations: Prices increased nearly 15% from mid-2021, attributable to raw material shortages, heightened demand, and logistical constraints.

-

Influencing Factors:

- Supply chain disruptions following COVID-19 related restrictions.

- Rising energy prices impacting manufacturing costs.

- Increased regulatory compliance costs for high purity standards.

Future Price Projections

Market Drivers Influencing Price Trends

-

Sustained Demand in Healthcare: As global health initiatives persist and hygienic standards rise, demand for pharmaceutical-grade HM IPA is projected to maintain upward pressure on prices.

-

Raw Material Cost Trajectory: With anticipated tightness in raw material supplies due to geopolitical tensions and energy market volatility, manufacturing costs are expected to escalate.

-

Regulatory Stringency: Further tightening of purity standards (e.g., EPA, FDA regulations) may necessitate advanced purification processes, increasing production costs.

-

Supply Chain Realignment: Regional shifts and investments in local manufacturing capacities are expected to stabilize supply, but lead times for capacity expansion could temporarily sustain elevated prices.

Forecast (2023-2027)

Based on current trends, industry data, and macroeconomic factors, HM Isopropyl Alcohol prices are projected as follows:

| Year | Predicted Price Range (USD per metric ton) | Change from prior year |

|---|---|---|

| 2023 | USD 3,200 - USD 3,600 | +8% - +20% |

| 2024 | USD 3,400 - USD 3,800 | +6% - +11% |

| 2025 | USD 3,500 - USD 4,000 | +3% - +11% |

| 2026 | USD 3,600 - USD 4,200 | +3% - +12% |

| 2027 | USD 3,700 - USD 4,300 | +3% - +10% |

Note: These projections assume a continuation of current demand trends, stable raw material supply, but do consider potential disruptions from geopolitical or environmental events.

Risks to Price Stability

-

Raw Material Price Volatility: Significant fluctuations in propylene and acetone prices could alter production costs unpredictably.

-

Supply Chain Disruptions: Future geopolitical tensions or pandemics may impact transportation and manufacturing capacities.

-

Regulatory Changes: Stricter standards could necessitate additional purification steps, raising prices further.

Conclusion

The HM Isopropyl Alcohol market exhibits a positive growth trajectory driven predominantly by healthcare, pharmaceutical, and industrial demands. While current prices have risen due to supply chain constraints and raw material costs, future projections suggest incremental price increases, stabilized by expanding regional manufacturing and technological advancements in purification. Industry stakeholders should monitor geopolitical developments, raw material markets, and regulatory landscapes to anticipate price fluctuations.

Key Takeaways

-

HM Isopropyl Alcohol remains a critical product across healthcare, pharmaceutical, and industrial sectors, with demand poised to grow steadily.

-

Market prices have experienced significant recent increases, primarily driven by raw material scarcity and logistical challenges.

-

Supply from regional manufacturers and technological upgrades will influence pricing stability in the forthcoming years.

-

Price projections indicate a gradual upward trend, underscoring the importance of strategic procurement and supply chain resilience.

-

Stakeholders should closely monitor raw material markets, regulatory reforms, and logistical developments to optimize sourcing and inventory planning.

FAQs

1. What factors are most influencing HM Isopropyl Alcohol prices today?

Raw material costs, supply chain disruptions, regulatory compliance costs, and ongoing demand from the healthcare sector primarily drive current price fluctuations.

2. How does regional production impact the global HM IPA market?

Regional producers, especially in Asia, provide cost advantages and increased supply capacity, potentially stabilizing prices and reducing dependency on traditional Western suppliers.

3. What regulatory standards affect HM Isopropyl Alcohol manufacturing?

Standards such as USP, EP, ISO, and FDA regulations dictate purity levels, impurity limits, and manufacturing processes, influencing production costs.

4. Will technological advancements reduce the price of HM IPA?

Improvements in purification technology and process efficiencies can lower production costs, potentially leading to stabilized or reduced prices over time.

5. How might geopolitical events impact future prices?

Tensions affecting raw material sourcing, energy prices, or transportation routes can lead to volatility in manufacturing costs and, consequently, market prices.

Sources

[1] Markets and Markets, "Disinfectant Market by Type, Application, and Region," 2022.

More… ↓