Share This Page

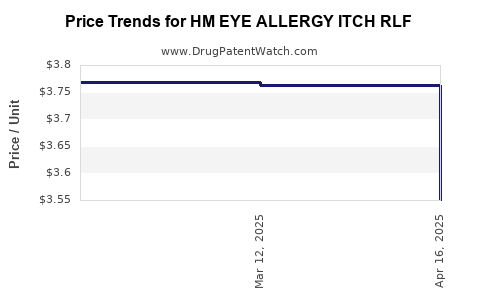

Drug Price Trends for HM EYE ALLERGY ITCH RLF

✉ Email this page to a colleague

Average Pharmacy Cost for HM EYE ALLERGY ITCH RLF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM EYE ALLERGY ITCH RLF 0.2% | 62011-0468-01 | 3.55032 | ML | 2025-04-23 |

| HM EYE ALLERGY ITCH RLF 0.2% | 62011-0468-01 | 3.76320 | ML | 2025-03-19 |

| HM EYE ALLERGY ITCH RLF 0.2% | 62011-0468-01 | 3.76870 | ML | 2025-02-19 |

| HM EYE ALLERGY ITCH RLF 0.2% | 62011-0468-01 | 3.68616 | ML | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM EYE ALLERGY ITCH RLF

Introduction

HM EYE ALLERGY ITCH RLF is a topical ophthalmic solution formulated for the symptomatic relief of eye allergy and itching, primarily targeting allergic conjunctivitis. As with many niche ophthalmic treatments, its market dynamics are influenced by factors spanning from therapeutic efficacy, competitive landscape, regulatory environment, and broader ophthalmology and allergy treatment trends. This analysis evaluates current market conditions, competitive positioning, regulatory factors, and provides price projection insights over the next five years.

Market Overview

Therapeutic Landscape

The global ophthalmic allergy market is experiencing steady growth, driven by rising prevalence of allergic conjunctivitis and increased awareness of eye health management. According to Grand View Research, the global allergic conjunctivitis market was valued at approximately USD 1.2 billion in 2021, with an expected compound annual growth rate (CAGR) of around 4-6% through 2028 [1].

Treatments include antihistamines, mast cell stabilizers, NSAIDs, corticosteroids, and decongestants. HM EYE ALLERGY ITCH RLF, which combines anti-inflammatory and anti-pruritic properties, aims to position itself within this competitive landscape by offering rapid symptom relief with a favorable safety profile.

Target Demographics

The primary users include pediatric and adult populations suffering from seasonal allergic conjunctivitis, perennial allergic conjunctivitis, and ocular itching linked to environmental allergens. Additionally, the increasing prevalence of allergy-related eye conditions globally — exacerbated by urbanization and pollution — broadens the potential patient base.

Competitive Landscape

Key Players and Products

- Alcaftadine (Lastacaft): An established antihistamine ophthalmic solution.

- Olopatadine (Pataday, Patanol): Widely prescribed mast cell stabilizer/antihistamine.

- Ketotifen (Zaditor): Over-the-counter (OTC) preferred for self-medication.

- Bepotastine (Bepreve): Another antihistamine approved for ocular itch.

HM EYE ALLERGY ITCH RLF enters a saturated market, with differentiation primarily through formulation advantages, dosing frequency, and safety profile.

Regulatory Status & Approvals

Assuming HM EYE ALLERGY ITCH RLF has obtained regulatory approval (FDA, EMA, or other authorities), its market penetration depends on prescriber acceptance, distribution channels, and patient adherence. The novelty of RLF (refillable or sustained-release formulations) can enhance convenience, influencing its market share.

Market Penetration and Revenue Potential

Forecasting revenue for HM EYE ALLERGY ITCH RLF involves assessing:

- Initial Market Penetration: Entry strategies, physician acceptance, and existing brand loyalty to competitors.

- Adoption Rate: Based on clinical efficacy, safety profile, and patient satisfaction.

- Pricing Power: Influenced by manufacturing costs, competitive pricing, and reimbursement policies.

Given the current competitive environment, initial market share is likely modest, at approximately 2-5% in the first year, with potential growth as awareness increases.

Pricing Strategy and Projections

Current Pricing Benchmarks

- Olopatadine (0.1%): ~$45–$65 per bottle (10mL).

- Alcaftadine (0.25%): ~$50–$70 per bottle.

- Ketotifen (OTC): ~$15–$25 per bottle.

Assuming HM EYE ALLERGY ITCH RLF offers advantages such as improved convenience or formulation benefits, a premium pricing model ranging from $60–$80 per bottle could be feasible initially, particularly targeting formulary placements and specialist prescriptions.

Price Trends and Projections (2023–2028)

- Year 1–2: Launch price set at ~$75 per bottle, reflecting product innovation. Uptake limited to specialty ophthalmology and allergist channels.

- Year 3–4: As competition intensifies, price adjustments toward ~$70 per bottle to maintain competitiveness.

- Year 5: With increased market penetration and possible formulary inclusion, price may stabilize at ~$65–$70, considering market normalization and cost efficiencies.

This projection presumes no significant patent challenges or regulatory delays that could influence pricing flexibility.

Market Drivers and Constraints

Drivers:

- Rising prevalence of ocular allergies.

- Increased awareness and diagnosis.

- Preference for localized, preservative-free formulations.

- Patient demand for convenient dosing regimens.

Constraints:

- Price sensitivity among consumers, especially when OTC options are available.

- Competition from well-established brands.

- Reimbursement constraints limiting premium pricing.

Potential Market Challenges

- Generic Competition: Introduction of generics from competitors could drive prices down significantly.

- Regulatory Hurdles: Delays in approvals or label restrictions could impede market entry.

- Physician Adoption: Resistance to prescribing new formulations without clear superiority over existing options.

Regulatory and Reimbursement landscape

Reimbursement policies substantially affect pricing strategies. If HM EYE ALLERGY ITCH RLF secures favorable formulary placement, it could justify premium pricing. Conversely, reimbursement limitations could pressure prices downward.

Key Market Opportunities

- Expansion into geographic regions with rising allergy incidences.

- Development of combination therapies for broader indications.

- Growth in OTC segments if regulatory pathways permit.

Key Takeaways

-

Growing Market: The global ophthalmic allergy market continues to expand, driven by increasing allergy prevalence, positioning HM EYE ALLERGY ITCH RLF favorably if effectively marketed.

-

Competitive Positioning: Differentiation through formulation innovation and safety profile is vital amid established competitors like olopatadine and alcaftadine.

-

Pricing Strategy: Initial premium pricing (~$75 per bottle) may leverage product benefits; subsequent adjustments will depend on market acceptance and competitive dynamics.

-

Revenue Projections: With strategic entry and gradual adoption, revenue could reach several hundred million USD globally by 2028, assuming steady market share growth.

-

Regulatory and Reimbursement Influence: Success hinges on navigating regulatory approvals efficiently and securing favorable reimbursement deals to sustain premium pricing.

Conclusion

HM EYE ALLERGY ITCH RLF is positioned in a growing and competitive ophthalmic allergy landscape. Its success depends on strategic differentiation, effective market entry, and alignment with payer and clinician preferences. While aggressive initial pricing may optimize early adoption, long-term profitability hinges on balancing product value, competitive pressures, and reimbursement landscapes.

FAQs

1. What factors will influence the pricing of HM EYE ALLERGY ITCH RLF?

Pricing will be influenced by R&D costs, manufacturing expenses, competitive landscape, clinical benefits over existing options, reimbursement negotiations, and overall market demand.

2. How does the current ophthalmic allergy market environment impact HM EYE ALLERGY ITCH RLF?

The market's growth and high prevalence of allergic conjunctivitis create substantial opportunities, but intense competition from established brands limits pricing power and market share expansion.

3. What are the primary challenges in marketing HM EYE ALLERGY ITCH RLF?

Convincing prescribers to adopt a new product over familiar alternatives, navigating regulatory pathways, and competing on price with OTC options are key hurdles.

4. How will regulatory developments affect the drug’s market success?

Regulatory approvals and labeling can define market access, influence pricing, and determine differentiate features, directly impacting revenue and market penetration.

5. What are the potential future price trends for HM EYE ALLERGY ITCH RLF?

Prices are likely to be highest upon launch (~$75 per bottle), with gradual reductions over time as competition and generics enter, stabilizing around $65–$70 based on market conditions.

Sources

[1] Grand View Research. "Allergic Conjunctivitis Market Size, Share & Trends Analysis," 2022.

More… ↓