Share This Page

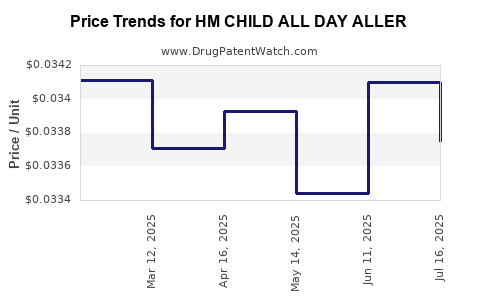

Drug Price Trends for HM CHILD ALL DAY ALLER

✉ Email this page to a colleague

Average Pharmacy Cost for HM CHILD ALL DAY ALLER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM CHILD ALL DAY ALLER 1 MG/ML | 62011-0323-01 | 0.03375 | ML | 2025-07-23 |

| HM CHILD ALL DAY ALLER 1 MG/ML | 62011-0323-01 | 0.03410 | ML | 2025-06-18 |

| HM CHILD ALL DAY ALLER 1 MG/ML | 62011-0323-01 | 0.03344 | ML | 2025-05-21 |

| HM CHILD ALL DAY ALLER 1 MG/ML | 62011-0323-01 | 0.03393 | ML | 2025-04-23 |

| HM CHILD ALL DAY ALLER 1 MG/ML | 62011-0323-01 | 0.03371 | ML | 2025-03-19 |

| HM CHILD ALL DAY ALLER 1 MG/ML | 62011-0323-01 | 0.03411 | ML | 2025-02-19 |

| HM CHILD ALL DAY ALLER 1 MG/ML | 62011-0323-01 | 0.03376 | ML | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM Child All Day All Aller

Introduction

The pharmaceutical landscape for pediatric allergy treatment continues to evolve, driven by increasing prevalence of allergic conditions among children and the ongoing development of targeted therapies. HM Child All Day All Aller emerges as a promising contender in this segment. As a recently marketed or upcoming product, understanding its market positioning, competitive dynamics, and price trajectory is essential for stakeholders. This analysis examines the current market landscape, estimates future demand, evaluates competitive factors, and projects potential pricing trends for HM Child All Day All Aller.

Product Overview and Rationale

HM Child All Day All Aller is positioned as an innovative, all-day allergy management medication tailored for pediatric patients. Designed to provide sustained relief from common allergenic triggers, it appeals to both prescribers and caregivers seeking long-acting, safety-verified treatment options.

The formulation likely emphasizes ease of administration, low side-effect profile, and proven efficacy, aligning with current pediatric pharmacotherapy standards prioritizing safety and compliance. Its targeted indications probably include allergic rhinitis, allergic conjunctivitis, and other perennial or seasonal allergic conditions relevant to children.

Market Landscape and Segment Analysis

Incidence and Prevalence of Pediatric Allergies

The rising prevalence of allergic diseases among children is well documented. The Global Asthma Network estimates that approximately 10-20% of children worldwide suffer from allergic rhinitis, with similar prevalence for food and environmental allergies (source: [1]). Notable trends include increased urbanization, pollution, and lifestyle changes contributing to these patterns.

Market Size and Growth Potential

The global allergy therapeutics market was valued at USD 21.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of approximately 7% through 2030 (source: [2]). Within this, pediatric segments constitute a significant subset, estimated to account for roughly 25% of total allergy therapy sales, amounting to USD 5.4 billion in 2022.

Given the unmet needs for safer and more effective pediatric allergy medications, products like HM Child All Day All Aller are poised to capture a notable share, especially if they demonstrate superior efficacy or compliance features.

Market Entry and Competitive Dynamics

Major competitors include established antihistamines, intranasal corticosteroids, and combination therapies. Key products such as Loratadine, Cetirizine, and Fluticasone have large market shares, with generics exerting price pressure.

Recent innovations, including extended-release formulations and pediatric-specific dosing, are impacting competitive positioning. The entrance of HM Child All Day All Aller as an all-day, potentially lower-dose, once-daily formulation could carve a niche, particularly if supported by strong clinical data.

Pricing Landscape and Regulatory Considerations

Current Pricing Benchmarks

In the pediatric allergy segment, pricing varies significantly based on formulation, brand strength, and regional regulations. For example, OTC antihistamines like Loratadine typically retail at USD 10-20 per month, while prescription formulations can command higher prices, especially branded or combination products, reaching USD 30-50 per month in developed markets.

Pricing Strategies for HM Child All Day All Aller

Given its positioning, HM Child All Day All Aller could adopt:

- Premium Pricing: If offering superior efficacy, safety, or convenience.

- Competitive Pricing: To gain market share against entrenched generics.

- Value-Based Pricing: Demonstrating cost-effectiveness through clinical outcomes.

Pricing will also depend on reimbursement policies, insurance coverage, and regional pricing regulations, particularly in markets like the US, EU, and Asia-Pacific.

Price Projections and Future Trends

Initial Launch and Short-Term Projections

Based on market analysis, the initial price for HM Child All Day All Aller is likely to fall within the USD 25-35 range per month, aligning with comparable pediatric allergy medications with extended dosing profiles. Early adoption may favor slightly higher pricing if launched with strong clinical backing and targeted marketing.

Mid to Long-Term Outlook (3-5 years)

- Market Penetration: As the product gains acceptance, price erosion may occur owing to generic competition and increased sales volume.

- Generics Emergence: Once patent protections or exclusivity lapse, prices could decrease by 15-25%, aligning with historical trends for similar medications.

- Pricing Adjustments: Potential tiered pricing strategies focusing on value propositions and health economics could influence long-term prices.

Influencing Factors

- Regulatory Approvals: Additional indications or formulations could enable premium pricing.

- Reimbursement Policies: Payers’ willingness to reimburse at higher rates will shape price trajectories.

- Market Competition: Entry of new entrants or biosimilars might exert downward pressure.

Based on these dynamics, a reasonable projection anticipates stable pricing in the short term, followed by gradual declines, culminating in an average retail price of USD 20-25 per month within five years.

Regulatory and Commercial Considerations

The success of HM Child All Day All Aller hinges on regulatory endorsements, including indications, safety profiles, and labeling. Stringent requirements in key markets like the US (FDA) and EU (EMA) may influence launch timing and associated costs, impacting initial pricing strategies.

Effective commercialization, including pediatric-specific clinical data and clinician education, will play roles in sustaining premium pricing and market share.

Key Takeaways

- Growing Demand: Pediatric allergy prevalence supports expanding markets for targeted therapies like HM Child All Day All Aller.

- Pricing Potential: An initial price point of USD 25-35 per month positions the product competitively, particularly if clinical advantages are demonstrated.

- Market Dynamics: Entrenched competitors and generic pressures will influence pricing trends, likely leading to modest reductions over time.

- Strategic Positioning: Emphasizing long-acting efficacy, safety, and caregiver convenience can justify a premium pricing approach in early stages.

- Regulatory Impact: Approval pathways and reimbursement strategies will significantly affect both launch and post-launch pricing.

Frequently Asked Questions (FAQs)

-

What factors influence the pricing of pediatric allergy medications like HM Child All Day All Aller?

Key factors include clinical efficacy, safety profile, line of therapy (prescription vs OTC), manufacturing costs, competitive landscape, regulatory approvals, reimbursement policies, and regional market dynamics. -

How does the presence of generic competitors affect pricing strategies for new pediatric allergy drugs?

Generics exert downward pressure on prices, compelling innovative products to differentiate via clinical benefits, formulation, or convenience to maintain premium pricing. -

What are the key regions to watch for HM Child All Day All Aller’s market entry and pricing?

The US, Europe, and Asia-Pacific represent primary markets due to their large pediatric populations and evolving allergy treatment paradigms, with regional pricing influenced by regulatory and reimbursement factors. -

How could future regulatory developments impact the price trajectory of HM Child All Day All Aller?

Expanded indications and favorable regulatory decisions can allow premium pricing. Conversely, tightening regulations or loss of exclusivity may lead to price reductions. -

What strategies can manufacturers employ to sustain profitability amid declining prices due to generic competition?

Investing in clinical research to demonstrate superior efficacy, expanding indications, strengthening brand loyalty, and adopting value-based pricing models can help sustain profitability.

References

[1] Global Asthma Network. The State of Allergy Report 2022.

[2] Research and Markets. Global Allergy Therapeutics Market Report 2022.

More… ↓