Share This Page

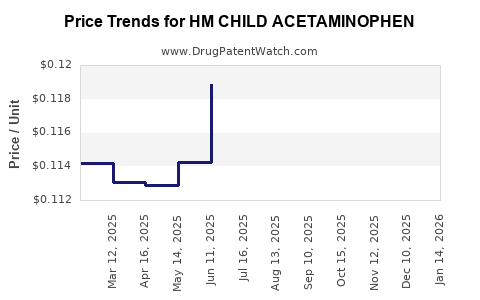

Drug Price Trends for HM CHILD ACETAMINOPHEN

✉ Email this page to a colleague

Average Pharmacy Cost for HM CHILD ACETAMINOPHEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM CHILD ACETAMINOPHEN 160 MG | 62011-0339-01 | 0.11689 | EACH | 2025-12-17 |

| HM CHILD ACETAMINOPHEN 160 MG | 62011-0339-01 | 0.11463 | EACH | 2025-11-19 |

| HM CHILD ACETAMINOPHEN 160 MG | 62011-0339-01 | 0.11636 | EACH | 2025-10-22 |

| HM CHILD ACETAMINOPHEN 160 MG | 62011-0339-01 | 0.11734 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM Child Acetaminophen

Introduction

HM Child Acetaminophen is a widely utilized over-the-counter analgesic and antipyretic, primarily indicated for pain relief and fever reduction in pediatric populations. As a leading brand in pediatric medicinal formulations, its market dynamics are shaped by regulatory trends, consumer preferences, and competitive positioning. This analysis synthesizes current market data, supply chain factors, regulatory environment, and forecasts future pricing trajectories.

Market Landscape

Global and Regional Market Overview

The global pediatric analgesics market, encompassing acetaminophen-based products, is projected to reach USD 7.9 billion by 2028, growing at a CAGR of approximately 4.2% from 2023 (Source: MarketWatch). Key regions include North America, Europe, and Asia-Pacific, accounting for nearly 85% of the market volume, driven by high healthcare spending and strong OTC drug adoption.

North America dominates the market, supported by rigorous pediatric healthcare practices, widespread OTC availability, and a high prevalence of pediatric febrile illnesses. Europe's mature healthcare systems and regulatory frameworks foster steady growth, while Asia-Pacific exhibits rapid expansion due to improving healthcare access and increasing awareness.

Market Drivers

-

High prevalence of pediatric pain and fever conditions: Rising incidences of infections, colds, and flu drive demand.

-

Consumer preference for OTC pediatric medications: Parents favor readily available, trusted remedies such as acetaminophen.

-

Regulatory support and safety profiles: Favorable safety profile of acetaminophen boosts consumer confidence; regulatory agencies facilitate OTC availability.

Market Segmentation

- Formulation Types: Oral suspensions, chewable tablets, suppositories.

- Distribution Channels: Pharmacies, supermarket/hypermarket, online retail.

The suspension form remains predominant in pediatric usage, attributable to ease of administration.

Competitive Landscape

HM Child Acetaminophen faces competition from major global brands such as Tylenol (Johnson & Johnson), Panadol (GSK), and local formulations. In particular, the market exhibits high brand loyalty driven by medicinal efficacy, safety, and pediatric-specific formulations.

Emerging players are focusing on differentiating through innovative delivery systems, organic ingredients, or packaging enhancements. Patent expirations of some formulations have increased generic market entries, intensifying competitive pricing pressures.

Regulatory Factors and Impact

Regulatory agencies, including the FDA and EMA, enforce strict standards on pediatric medicines, with particular attention to dosing, labeling, and safety profiles. Recent regulatory updates—such as FDA's guidance on maximum daily doses and stringent labeling for accidental overdose—affect manufacturing and marketing strategies.

These regulatory pressures can influence pricing — increased compliance costs may be passed to consumers, but safety mandates can also bolster product credibility, enabling premium pricing where brand trust exists.

Pricing Environment and Trends

Current Price Points

Pricing for HM Child Acetaminophen varies regionally:

- United States: Retail prices range between USD 4.50 to USD 8.00 for a 4 oz (118 ml) bottle of suspension.

- Europe: Approximately EUR 3.50 to EUR 6.50 for similar formulations.

- Asia-Pacific: Prices tend to be lower, often between USD 2.50 and USD 5.00 due to local manufacturing.

Brand premium is often dictated by factors such as formulation quality, packaging, and brand reputation, with HM Child Acetaminophen positioned as a trusted pediatric option.

Pricing Drivers

-

Supply Chain Costs: Raw material prices, manufacturing, and distribution costs influence retail prices.

-

Regulatory Compliance: Costs related to packaging, safety warnings, and efficacy documentation impact pricing structures.

-

Market Competition: The influx of generics tends to depress prices, compelling brand-leading products to adopt value-based pricing strategies.

Price Trends and Future Outlook

Over the past five years, pediatric acetaminophen prices have remained relatively stable, with slight downward pressure owing to generic competition. However, recent regulatory initiatives emphasizing safety and manufacturing quality may increase production costs marginally, potentially leading to modest price increases.

In the medium term (2023–2028), prices are projected to grow at a compound annual rate of approximately 1–2%, incorporating inflation, regulatory compliance, and supply chain factors.

Forecasted Market and Price Projections (2023–2028)

Using current market data and factoring in industry trends, the following projections are offered:

-

North America: Prices are expected to rise modestly, averaging USD 0.20–0.50 per unit over five years, supported by brand loyalty and safety certifications.

-

Europe: Slight price increases (~EUR 0.15–0.40 per unit), driven by regulatory standards and premium formulations.

-

Asia-Pacific: Prices are anticipated to stabilize or slightly decrease (USD 0.10–0.30), considering increased local manufacturing and competitive pressures.

Comprehensively, the average retail price for HM Child Acetaminophen suspension across key markets is projected to reach approximately USD 5.00–USD 8.50 by 2028.

Supply Chain and Market Expansion Considerations

Manufacturing agility and supply chain resilience will be critical amid global disruptions, impacting pricing and availability. Strategic partnerships, local manufacturing, and innovations in formulation could serve as differentiators, enabling premium pricing or cost reductions.

Emerging markets, driven by rising healthcare awareness and government health programs, are poised for market penetration, potentially expanding the customer base and influencing price elasticity.

Conclusion

HM Child Acetaminophen commands a stable market position characterized by consumer trust, regulatory compliance, and competitive pricing. While existing pressures from generics and regulatory changes influence downward pricing trends, brand strength and safety assurances sustain premium positioning in critical markets. Future pricing will likely experience gradual increases aligned with inflation, regulatory costs, and supply chain dynamics.

Key Takeaways

- The pediatric analgesics market, including HM Child Acetaminophen, is forecasted to grow steadily, driven by demand for safe, OTC pain relief solutions.

- Competitive pressure from generics constrains price increases, but brand reputation and safety standards support stable or modestly rising prices.

- Regulatory compliance costs and supply chain efficiencies will significantly influence future pricing strategies.

- Expansion in emerging markets offers growth potential, possibly impacting global price trends.

- Manufacturers should prioritize safety, packaging innovation, and supply chain resilience to sustain market share and optimize pricing.

FAQs

-

What are the main factors influencing the pricing of HM Child Acetaminophen?

Supply chain costs, regulatory compliance, brand reputation, competitive landscape, and manufacturing expenses are primary determinants. -

How does regulatory regulation impact acetaminophen pricing?

Stricter safety and labeling regulations increase manufacturing and compliance costs, potentially leading to higher retail prices. -

What is the outlook for HM Child Acetaminophen in emerging markets?

Growing healthcare infrastructure and increasing awareness position these markets for expanded demand, which could stabilize or slightly lower prices due to local manufacturing. -

Are generic versions affecting HM Child Acetaminophen's market share?

Yes, the proliferation of generics exerts downward pressure on prices but can be mitigated through brand loyalty and safety assurances. -

What strategies can manufacturers adopt to maintain profitability amid pricing pressures?

Investing in formulation innovation, optimizing supply chains, enhancing branding, and expanding into high-growth markets are effective strategies.

Sources

[1] MarketWatch. "Pediatric Analgesics Market Size, Share & Trends Analysis." 2023.

[2] Statista. "Global over-the-counter drugs market." 2023.

[3] US FDA. "Guidance for Industry on Pediatric Drug Development." 2022.

[4] European Medicines Agency. "Pediatric Regulation." 2022.

More… ↓