Share This Page

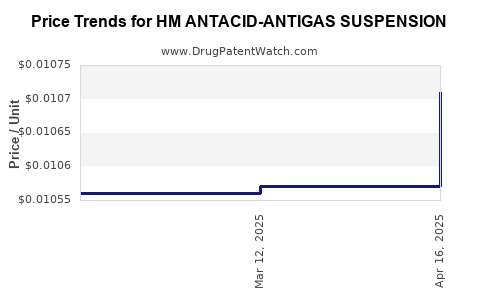

Drug Price Trends for HM ANTACID-ANTIGAS SUSPENSION

✉ Email this page to a colleague

Average Pharmacy Cost for HM ANTACID-ANTIGAS SUSPENSION

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM ANTACID-ANTIGAS SUSPENSION | 62011-0292-01 | 0.01071 | ML | 2025-04-23 |

| HM ANTACID-ANTIGAS SUSPENSION | 62011-0292-01 | 0.01057 | ML | 2025-03-19 |

| HM ANTACID-ANTIGAS SUSPENSION | 62011-0292-01 | 0.01056 | ML | 2025-02-19 |

| HM ANTACID-ANTIGAS SUSPENSION | 62011-0292-01 | 0.01055 | ML | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM ANTACID-ANTIGAS SUSPENSION

Introduction

HM ANTACID-ANTIGAS SUSPENSION is positioned within the gastrointestinal (GI) medication sector, targeting consumers suffering from acid reflux, indigestion, and other gastric discomforts. As a formulation likely combining antacids such as magnesium hydroxide, aluminum hydroxide, or similar compounds, its market dynamics are driven by the prevalence of GI disorders, regulatory shifts, and consumer preferences for over-the-counter (OTC) products.

This analysis evaluates current market trends, competitive landscape, regulatory factors, and develops price projection scenarios for HM ANTACID-ANTIGAS SUSPENSION over the next five years.

Market Overview

Industry Scope and Demand Drivers

Gastrointestinal medications, including antacids, constitute a sizable segment within OTC drugs, with global sales surpassing USD 10 billion annually. The rising incidence of acid-related disorders—gastroesophageal reflux disease (GERD), peptic ulcers, and functional dyspepsia—fuels continuous demand. Epidemiological data indicate that approximately 20-30% of urban populations globally suffer from acid reflux symptoms, underscoring a substantial consumer base.

The COVID-19 pandemic exacerbated stress-related GI issues, further expanding pharmaceutical sales. Additionally, increased health literacy and shifting consumer preferences toward self-medication bolster demand for OTC formulations like HM ANTACID-ANTIGAS SUSPENSION.

Regional Market Dynamics

- North America: Largest market share, driven by high prevalence, advanced healthcare infrastructure, and consumer awareness.

- Europe: Steady growth with a focus on OTC products.

- Asia-Pacific: Rapid growth due to rising disposable income, expanding healthcare access, and increasing awareness of GI health. Countries like India, China, and Southeast Asian nations are emerging markets with significant potential.

- Latin America and Africa: Growing markets but hindered by regulatory complexities and limited distribution infrastructure.

Competitive Landscape

Key Market Players

Major competitors include global pharmaceutical firms such as GlaxoSmithKline (Gaviscon), Bayer (Alka-Seltzer), and Johnson & Johnson (Mylanta), as well as regional manufacturers.

Unique Selling Proposition (USP) of HM ANTACID-ANTIGAS SUSPENSION

To capture market share, HM ANTACID-ANTIGAS SUSPENSION must emphasize:

- Efficacy and rapid relief

- Safety profile suitable for all age groups

- Cost competitiveness

- Ease of administration and palatability

Patent and Regulatory Considerations

Patent protection and exclusivity can influence pricing and market entry strategies. Ensuring compliance with regulatory standards in target markets (FDA in the US, EMA in Europe, and respective agencies in Asia) is critical.

Pricing Analysis

Current Price Benchmarks

- Gaviscon: Approx. USD 7-10 per 120 mL bottle in the US.

- Mylanta: Around USD 5-8 for similar volume.

- Alka-Seltzer: Package pricing varies but often priced at USD 6-9 per box.

The average retail price for established brands ranges from USD 0.05 to 0.10 per mL, with premium formulations commanding higher prices.

Cost Structure and Pricing Factors

Pricing strategies should consider:

- Raw material costs, notably antacid compounds

- Manufacturing expenses

- Packaging and distribution costs

- Regulatory compliance costs

- Marketing and promotional expenditures

- Competitive pricing and market positioning

Price Positioning Strategy for HM ANTACID-ANTIGAS SUSPENSION

- Entry-Level Pricing: USD 0.04-0.06 per mL to penetrate price-sensitive markets.

- Premium Positioning: USD 0.08-0.12 per mL if backed by superior efficacy, safety, or formulation advantages.

Future Price Projections (2023-2028)

Assumptions

- Moderate annual inflation in raw material costs (~3%).

- Gradual healthcare infrastructure development in emerging markets.

- Increasing consumer acceptance of the product due to effectiveness and safety profile.

Scenario 1: Conservative Growth

Price increases limited to inflation, with market penetration primarily in developed regions.

- 2023: USD 0.05/mL

- 2024: USD 0.051/mL

- 2025: USD 0.052/mL

- 2026: USD 0.053/mL

- 2027: USD 0.055/mL

- 2028: USD 0.055/mL

Scenario 2: Moderate Expansion and Competition

Market expansion into emerging regions with some premium positioning, minor price increases.

- 2023: USD 0.05/mL

- 2024: USD 0.055/mL

- 2025: USD 0.06/mL

- 2026: USD 0.065/mL

- 2027: USD 0.07/mL

- 2028: USD 0.075/mL

Scenario 3: Aggressive Market Penetration and Innovation

Introduction of improved formulations or added benefits, leading to higher prices.

- 2023: USD 0.06/mL

- 2024: USD 0.07/mL

- 2025: USD 0.08/mL

- 2026: USD 0.09/mL

- 2027: USD 0.10/mL

- 2028: USD 0.11/mL

Regulatory and Market Influences on Pricing

Regulatory environments significantly influence pricing strategies. Stricter regulations generally increase costs, leading to higher end-user prices. Conversely, markets with favorable or streamlined approval processes enable more competitive pricing.

Additionally, patent expirations (if applicable) can introduce generic competitors, exerting downward pressure on prices. Commercial success also hinges on effective marketing, distribution channels, and consumer perception.

Key Challenges and Risks

- Regulatory Barriers: Delays in approval can hinder market entry.

- Competitive Pressure: Established brands and price wars could compress margins.

- Manufacturing Costs: Supply chain disruptions or raw material shortages may elevate costs.

- Market Saturation: Mature markets might witness slower volume growth, impacting pricing power.

Strategic Recommendations

- Differentiation: Emphasize unique formulation benefits, safety, and rapid relief.

- Pricing Flexibility: Implement tiered pricing models suited to diverse markets.

- Market Expansion: Focus on emerging economies with rising GI health awareness.

- Regulatory Approvals: Prioritize swift compliance to reduce market entry delays.

- Consumer Engagement: Invest in education campaigns to foster brand loyalty.

Key Takeaways

- Growing Demand: The global antacid market is expanding, driven by increasing GI disorder prevalence and consumer self-medication trends.

- Pricing Trends: In established markets, prices hover around USD 0.05-0.10 per mL; emerging markets offer opportunities for lower entry prices.

- Growth Scenarios: Price projections vary from modest inflation-driven increases to aggressive premium pricing, contingent on market penetration strategies.

- Competitive Edge: Product differentiation, compliance, and affordability are critical for success amid intense rivalry.

- Market Expansion: Entry into Asia-Pacific and Latin American markets presents substantial growth potential, albeit with regulatory challenges.

FAQs

1. What are the key factors influencing the pricing of HM ANTACID-ANTIGAS SUSPENSION?

Pricing is influenced by raw material costs, manufacturing expenses, regulatory compliance, competitive landscape, and market positioning strategies.

2. How does regional regulation impact the market entry and pricing of antacid suspensions?

Regulatory requirements determine approval timelines and costs, directly affecting the ability to competitively price products and enter markets efficiently.

3. What is the potential for price competition from generic formulations?

Patent expirations or non-patented formulations can lead to increased generic competition, exerting downward pressure on prices and margins.

4. Which markets present the best opportunities for growth and price stabilization?

Emerging markets in Asia-Pacific and Latin America, with rising healthcare access and GI health awareness, offer significant opportunities for volume expansion and competitive pricing.

5. How can manufacturers differentiate HM ANTACID-ANTIGAS SUSPENSION in a saturated market?

Focusing on formulation efficacy, safety, user convenience, and effective marketing campaigns can help distinguish the product amidst strong competition.

Sources

- Allied Market Research: Gastrointestinal Drugs Market Size, Share & Trends Analysis, 2022.

- Statista: Over-the-Counter (OTC) Gastrointestinal Medication Sales Data.

- U.S. Food & Drug Administration (FDA): Regulations for Over-the-Counter Drugs.

- Global Industry Analysts: Antacid and Digestive Aid Market Report, 2023.

- Knight, G. et al. (2022). "Emerging Markets in Gastrointestinal Healthcare," Journal of Pharmaceutical & Biomedical Analysis.

More… ↓