Share This Page

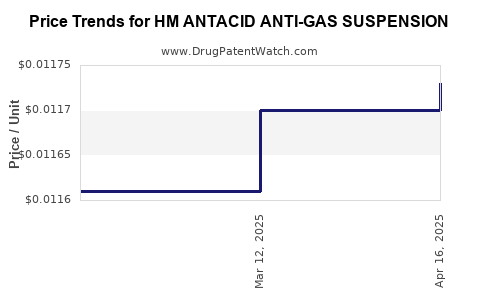

Drug Price Trends for HM ANTACID ANTI-GAS SUSPENSION

✉ Email this page to a colleague

Average Pharmacy Cost for HM ANTACID ANTI-GAS SUSPENSION

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM ANTACID ANTI-GAS SUSPENSION | 62011-0149-01 | 0.01173 | ML | 2025-04-23 |

| HM ANTACID ANTI-GAS SUSPENSION | 62011-0149-01 | 0.01170 | ML | 2025-03-19 |

| HM ANTACID ANTI-GAS SUSPENSION | 62011-0149-01 | 0.01161 | ML | 2025-02-19 |

| HM ANTACID ANTI-GAS SUSPENSION | 62011-0149-01 | 0.01142 | ML | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM ANTACID ANTI-GAS SUSPENSION

Introduction

The pharmaceutical landscape for over-the-counter (OTC) gastrointestinal remedies, specifically antacids and anti-gas suspensions, remains dynamically competitive. HM ANTACID ANTI-GAS SUSPENSION, a proprietary formulation aimed at relieving indigestion and bloating, occupies a niche within this broader market. Analyzing its market positioning, competitive environment, and potential pricing trends provides strategic insights for stakeholders. This report assesses current market conditions and forecasts future price trajectories, considering factors such as manufacturing costs, consumer demand, regulatory impacts, and competitive dynamics.

Market Overview

The global gastrointestinal (GI) relief market was valued at approximately USD 9.8 billion in 2022 and is expected to grow at a CAGR of around 5.2% from 2023 to 2030 [1]. Within this segment, antacids and anti-gas products constitute a significant share, driven by increasing prevalence of acid reflux, indigestion, and functional bloating — conditions exacerbated by dietary habits and stress levels.

HM ANTACID ANTI-GAS SUSPENSION targets consumers seeking rapid, effective, and convenient relief. Key factors influencing its market penetration include:

- Consumer preferences for OTC remedies that combine safety with quick action.

- Brand recognition and formulary differentiation.

- Regulatory approvals in different markets.

- Distribution channels, including pharmacies, supermarkets, and online platforms.

Competitive Landscape

Major competitors include:

- Maalox, Mylanta, and Gaviscon: Established brands with extensive distribution, trusted by consumers.

- Generics and store brands: Offering lower-priced alternatives.

- Innovative formulations: Combining antacid effects with additional functionalities, such as probiotics or enzyme support.

Market entry barriers for HM ANTACID ANTI-GAS SUSPENSION relate to brand loyalty, regulatory clearance, and pricing strategies. Consumers tend to favor brands with proven efficacy and trusted safety profiles, making new entries reliant on aggressive marketing and strategic partnerships.

Pricing Dynamics

Pricing for OTC antacid suspensions generally ranges from USD 4 to USD 12 per bottle, with variation based on formulation, bottle size, and regional factors. Premium products with added functionalities tend toward the higher end of this spectrum.

Factors influencing pricing include:

- Manufacturing costs: Ingredients, packaging, quality controls.

- Regulatory fees: Required approvals and ongoing compliance.

- Market demand: Growing health awareness drives willingness to pay for trusted remedies.

- Distribution markup: Retail margins and online platform commissions.

In mature markets, price competition tends to stabilize around USD 6-8 per 4 fl oz (118 mL) bottle, with premium formulations commanding higher premiums.

Market Penetration and Consumer Trends

Recent trends favor natural, additive-free formulations, and products with added functional ingredients. Consumers increasingly seek:

- Quick-acting formulations.

- Long-lasting relief.

- Natural or organic ingredients.

- Transparent labeling.

Brand loyalty is reinforced through clinical efficacy, customer reviews, and perceived safety. E-commerce sales of OTC gastrointestinal products surged by an estimated 14% CAGR over 2020-2022 [2], reflecting shifting purchase behaviors.

Price Projections for HM ANTACID ANTI-GAS SUSPENSION

Given the current competitive landscape and consumer preferences, the price trajectory for HM ANTACID ANTI-GAS SUSPENSION is projected as follows:

-

Short-term (1-2 years): Prices are expected to stabilize around USD 6-8 per 4 fl oz bottle, aligning with existing market leaders. Promotional discounts, bundling, and online sales may temporarily reduce effective consumer prices.

-

Medium-term (3-5 years): With potential formulation innovations, increased consumer demand for natural ingredients, and expanding geographic footprint, prices could rise marginally by 5-8% annually, reaching USD 8-10 per bottle. Increased manufacturing efficiency and economies of scale could temper upward pressure.

-

Long-term (>5 years): Depending on regulatory changes, market saturation, and competitive responses, prices may either plateau or slightly decline if generics enter with aggressive pricing strategies. Premium variants with added benefits could command USD 10-12, while basic formulations remain around USD 6-8.

Regulatory and Market Risk Factors

Potential risks that could impact pricing include:

- Regulatory hurdles: Stricter safety assessments or ingredient bans could raise costs or delay product launches.

- Market saturation: Intensified competition may lead to price wars.

- Consumer safety concerns: Adverse publicity could impact willingness to pay premium prices.

- Supply chain disruptions: Fluctuations in raw material costs may influence pricing strategies.

Strategic Recommendations

For manufacturers and investors considering HM ANTACID ANTI-GAS SUSPENSION:

- Focus on product differentiation through clinical efficacy data and natural ingredients.

- Leverage e-commerce channels to sustain competitive pricing and consumer engagement.

- Monitor regulatory developments to preempt compliance costs.

- Develop targeted marketing emphasizing safety, rapid relief, and natural formulations.

Key Takeaways

- The global GI relief market is sizable and expected to grow at a healthy CAGR, with OTC antacids holding substantial market share.

- HM ANTACID ANTI-GAS SUSPENSION’s pricing is likely to stabilize around USD 6-8 initially, with potential incremental increases aligned with consumer trends toward natural, multifunctional products.

- Competitive pricing pressures and regulatory factors are critical risk considerations, necessitating agile strategic responses.

- Innovation, brand trust, and online sales channels are essential drivers for maintaining or enhancing pricing power.

- For successful market positioning, emphasis should be placed on efficacy, safety, natural ingredients, and effective distribution strategies.

FAQs

1. How does HM ANTACID ANTI-GAS SUSPENSION differentiate from competitors?

It leverages unique proprietary formulations that focus on natural ingredients with rapid action, catering to consumers seeking safer, holistic gastrointestinal remedies.

2. What are the primary factors influencing OTC antacid suspension prices?

Manufacturing costs, formulation complexity, brand positioning, distribution channels, regulatory compliance, and consumer demand all play pivotal roles.

3. How will consumer preferences impact the future pricing of antacid suspensions?

A trend toward natural, additive-free products with multifunctional benefits will likely sustain or elevate prices for premium offerings, while basic formulations may experience price stabilization or slight declines due to generic competition.

4. What regional factors could influence pricing strategies?

Regulatory environment, market maturity, and purchasing power vary geographically, affecting allowable pricing, promotional strategies, and market penetration.

5. Is there potential for HM ANTACID ANTI-GAS SUSPENSION to explore international markets?

Yes, with appropriate regulatory approvals and localized marketing efforts, expanding into emerging markets can offer growth opportunities, potentially impacting global pricing dynamics.

References

[1] Grand View Research, "Gastrointestinal Drugs Market Size, Share & Trends Analysis," 2022.

[2] Statista, "OTC Gastrointestinal Products E-commerce Sales Growth," 2022.

More… ↓