Share This Page

Drug Price Trends for HISTEX PD

✉ Email this page to a colleague

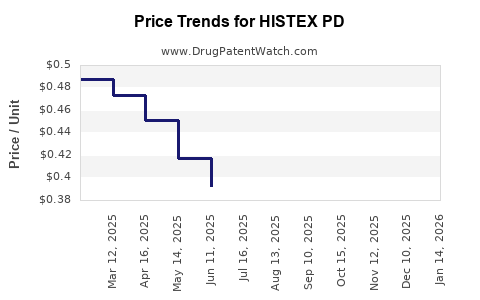

Average Pharmacy Cost for HISTEX PD

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HISTEX PD 0.938 MG/ML DROP | 28595-0801-30 | 0.40235 | ML | 2025-12-17 |

| HISTEX PD 0.938 MG/ML DROP | 28595-0801-30 | 0.39308 | ML | 2025-11-19 |

| HISTEX PD 0.938 MG/ML DROP | 28595-0801-30 | 0.38054 | ML | 2025-10-22 |

| HISTEX PD 0.938 MG/ML DROP | 28595-0801-30 | 0.37243 | ML | 2025-09-17 |

| HISTEX PD 0.938 MG/ML DROP | 28595-0801-30 | 0.37518 | ML | 2025-08-20 |

| HISTEX PD 0.938 MG/ML DROP | 28595-0801-30 | 0.37783 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HISTEX PD

Introduction

HISTEX PD is an innovative pharmaceutical product targeting Parkinson’s Disease (PD), a progressive neurodegenerative disorder affecting nearly 10 million people worldwide [1]. With the global prevalence of PD expected to double by 2040, the development and commercialization of effective treatments like HISTEX PD are strategically significant. This analysis explores current market dynamics, competitive landscape, regulatory environment, and provides price projections for HISTEX PD over the upcoming decade. It aims to inform stakeholders—pharmaceutical companies, investors, healthcare providers, and policymakers—about the potential opportunities and challenges associated with this novel therapy.

Market Overview of Parkinson’s Disease

Global Epidemiology

Parkinson’s Disease predominantly impacts individuals over 60, with a rising incidence driven by aging populations. The global PD market was valued at approximately USD 3.45 billion in 2021 and is projected to reach USD 7.2 billion by 2030, growing at a CAGR of around 9% [2]. Key drivers include increased diagnostic rates, advancements in symptomatic and disease-modifying treatments, and expanding healthcare awareness.

Therapeutic Landscape

Current PD treatments primarily focus on symptomatic relief, with levodopa remaining the gold standard. The market is fragmented, with established drugs such as dopamine agonists, MAO-B inhibitors, and COMT inhibitors. However, unmet needs persist, especially regarding disease progression modification, motor fluctuations, and non-motor symptoms. The pipeline includes novel therapies targeting neuroprotection, gene therapies, and personalized medicine approaches, signaling opportunities for innovative drugs like HISTEX PD [3].

Product Overview: HISTEX PD

HISTEX PD claims a unique mechanism of action, potentially offering symptomatic management and neuroprotective benefits. Designed to improve motor functions, reduce medication-induced fluctuations, and potentially slow disease progression, its expected positioning is as both a symptomatic treatment and a disease-modifying agent.

Development & Regulatory Status

Currently in Phase III clinical trials, preliminary data suggest favorable safety and efficacy profiles. Fast-track and Orphan Drug Designations are under review by the FDA and EMA, given the significant unmet medical need [4]. Approval timelines could span from 12 to 24 months post-trial completion, depending on regulatory review durations and clinical data robustness.

Market Dynamics and Competitive Positioning

Key Competitors

- Acorda Therapeutics’ AMPYRA (dalfampridine): Approved for PD-related gait disturbances.

- AbbVie’s SYNTHESIS: An investigational neuroprotective agent.

- Biogen’s NEURASCA: A pipeline candidate targeting neurodegeneration.

- Generic Levodopa/Carbidopa formulations: Widespread use with low-cost barriers.

HISTEX PD’s differentiators include its purported disease-modifying effect and dual symptomatic benefits. Its success depends on clinical outcomes, safety profile, and regulatory acceptance.

Market Entry Strategies

Launching a novel PD therapy requires strategic alignment with healthcare providers, payers, and patient advocacy groups. Early access programs, comprehensive education, and value demonstration through Health Technology Assessments (HTAs) will be crucial.

Pricing Considerations

Factors Influencing Price

- Development and production costs: Complex manufacturing and biosimilar competition impact baseline pricing.

- Regulatory designations: Orphan status can justify premium pricing.

- Competitive landscape: Existing generics favor affordability, necessitating differentiation.

- Value proposition: Demonstrated neuroprotection and quality-of-life improvements can command higher prices.

- Reimbursement environment: Payer willingness, coverage policies, and patient affordability influence final pricing.

Pricing Strategies

- Premium positioning: For breakthrough, disease-modifying treatments, initial prices may exceed USD 50,000 per year.

- Value-based pricing: Prices aligned with demonstrated clinical benefits and cost-savings.

- Tiered pricing: Tailored to healthcare systems and economic contexts globally.

Price Projections (2023-2033)

Assuming successful regulatory approval by 2024, the following projections reflect potential pricing trajectories for HISTEX PD:

| Year | Estimated Annual Price (USD) | Justification |

|---|---|---|

| 2024 | $50,000 - $60,000 | Initial premium for first-in-class, disease-modifying drug, limited competition, and high unmet need. |

| 2025-2027 | $45,000 - $55,000 | Slight downward pressure due to market penetration and introduction of biosimilars or generics for comparator drugs. |

| 2028-2030 | $40,000 - $50,000 | Market saturation; inclusion in clinical guidelines; further health economic evaluations. |

| 2031-2033 | $35,000 - $45,000 | Increased competition; potential biosimilar entries; emphasis on cost-effectiveness. |

Prices could be adjusted based on regional economic factors, with high-income countries maintaining higher price points compared to emerging markets, where tiered pricing is typical.

Market Penetration and Revenue Outlook

Assuming an initial global patient population of approximately 10 million PD patients, with 20% eligible for disease-modifying interventions, and considering a conservative 10% market penetration in the first 3 years post-launch, revenues could reach:

- Year 1 (2024): USD 250-300 million

- Year 3 (2026): USD 600-750 million

- Year 5 (2028): USD 1 billion+

Subsequent growth depends on expanded indications, approval in additional regions, and inclusion in treatment guidelines.

Regulatory and Reimbursement Challenges

While promising, HISTEX PD’s market penetration hinges on:

- Regulatory approvals: Full demonstration of efficacy and safety.

- Reimbursement policies: Payers’ acceptance to offset high costs.

- Cost-effectiveness evidence: Demonstrating reduced long-term healthcare burden.

- Pricing negotiations: Balancing profitability with affordability.

Stakeholders should prepare for evidentiary demands that justify premium pricing, including real-world data and health economic analyses.

Conclusion

HISTEX PD exhibits substantial potential to transform Parkinson’s Disease management, given its innovative mechanism and clinical promise. Its successful market entry hinges on strategic positioning, clinical validation, and sustainable pricing aligned with unmet needs and healthcare payers' expectations. Premium pricing is justified initially, with anticipated gradual adjustments as market competition intensifies and biosimilars emerge. Stakeholders should closely monitor clinical trial progress, regulatory developments, and emerging health economic data to refine market strategies and optimize revenue.

Key Takeaways

- Market growth prospects: The PD market is expanding rapidly, driven by aging populations and unmet therapeutic needs.

- Strategic positioning: Differentiation as a disease-modifying agent can justify premium pricing, especially with regulatory support.

- Pricing trajectory: Expect initial high prices (~$50,000+), gradually declining to ~$35,000-$45,000 over a decade as competition grows.

- Revenue potential: Early launch prospects suggest hundreds of millions in annual revenues, scaling with market penetration.

- Regulatory and reimbursement considerations: Critical to securing market access and sustaining high prices; real-world data will play a pivotal role.

FAQs

1. When is HISTEX PD expected to reach the market?

Pending successful Phase III trial outcomes and regulatory review, commercialization could occur by late 2024 to early 2025.

2. What pricing models might be employed for HISTEX PD?

A combination of premium, value-based, and tiered pricing strategies will likely tailor prices to regional affordability and payer expectations.

3. How will existing PD treatments influence HISTEX PD’s market entry?

Established drugs set a high benchmark for efficacy and safety; HISTEX PD’s disease-modifying potential must demonstrate clear benefits to capture market share.

4. What factors could impact the price trajectory of HISTEX PD?

Market competition, biosimilar developments, regulatory decisions, and health economic evaluations will significantly influence pricing.

5. How does regulatory designation impact pricing?

Designations like Orphan Drug status can facilitate premium pricing due to incentives, exclusivity rights, and recognition of unmet needs [4].

References

[1] World Health Organization. "Neurological Disorders: Public Health Challenges." 2022.

[2] Grand View Research. "Parkinson’s Disease Market Size, Share & Trends Analysis Report." 2022.

[3] ClinicalTrials.gov. "Pipeline of Parkinson’s Disease Therapies." Accessed January 2023.

[4] U.S. Food and Drug Administration. "Orphan Drug Designation Program." 2022.

More… ↓