Share This Page

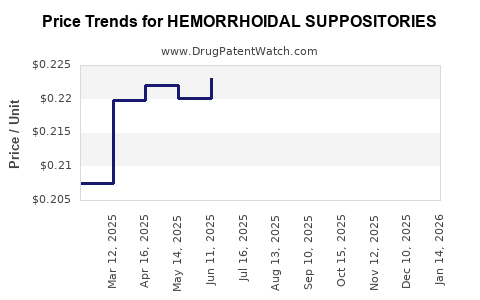

Drug Price Trends for HEMORRHOIDAL SUPPOSITORIES

✉ Email this page to a colleague

Average Pharmacy Cost for HEMORRHOIDAL SUPPOSITORIES

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HEMORRHOIDAL SUPPOSITORIES | 00536-1186-12 | 0.25438 | EACH | 2025-12-17 |

| HEMORRHOIDAL SUPPOSITORIES | 70000-0223-01 | 0.25438 | EACH | 2025-12-17 |

| HEMORRHOIDAL SUPPOSITORIES | 00536-1186-12 | 0.23931 | EACH | 2025-11-19 |

| HEMORRHOIDAL SUPPOSITORIES | 70000-0223-01 | 0.23931 | EACH | 2025-11-19 |

| HEMORRHOIDAL SUPPOSITORIES | 00536-1186-12 | 0.23986 | EACH | 2025-10-22 |

| HEMORRHOIDAL SUPPOSITORIES | 70000-0223-01 | 0.23986 | EACH | 2025-10-22 |

| HEMORRHOIDAL SUPPOSITORIES | 00536-1186-12 | 0.24667 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Hemorrhoidal Suppositories

Introduction

Hemorrhoidal suppositories are a widely used treatment modality for hemorrhoids, a prevalent anorectal condition affecting approximately 50% of adults aged 50 and above worldwide [1]. The global hemorrhoidal treatment market comprises various forms including topical creams, ointments, and suppositories. Among these, suppositories offer localized relief with sustained drug release profiles, making them a preferred choice for certain patient segments. Understanding market dynamics and delivering accurate price projections for hemorrhoidal suppositories are essential for pharmaceutical players, investors, and healthcare providers seeking strategic positioning.

Market Overview

Global Market Size and Growth Trajectory

The hemorrhoidal treatment market was valued at approximately USD 1.65 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.8% through 2030, reaching an estimated USD 2.6 billion [2]. The growth drivers include increasing prevalence due to aging populations, rising obesity rates, and high adoption of conservative management strategies like suppositories.

Key Market Segments

-

Product Type:

- Combination Suppositories: Contain analgesics, corticosteroids, astringents, and vasoconstrictors.

- Single-ingredient Suppositories: Focus on a single therapeutic agent, such as hydrocortisone or phenylephrine.

-

Distribution Channels:

- Retail pharmacies hold approximately 60% of sales.

- Hospital pharmacies account for around 25%.

- E-commerce platforms are rapidly gaining traction, projected to grow at 9% CAGR [3].

Regional Trends

- North America: Dominates due to high prevalence, with the expected CAGR of 3.9%. The U.S. accounts for the largest share, driven by healthcare expenditure and awareness.

- Europe: Despite high awareness, growth is tempered by stringent regulations and generic competition.

- Asia-Pacific: Fastest-growing region, projected CAGR of 6.2%, fueled by rising urbanization, demographic shifts, and healthcare infrastructure development.

- Latin America and MEA: Moderate growth, constrained by access issues and distribution challenges.

Market Drivers and Challenges

Drivers

- Aging Population: Increased susceptibility among seniors propels demand.

- Lifestyle Factors: Sedentary routines, obesity, and dietary habits contribute to rising hemorrhoid cases.

- Product Innovation: Development of combination therapies and suppositories with longer-lasting effects enhances patient compliance.

- Regulatory Approvals: Streamlined pathways for OTC segment facilitate market expansion.

Challenges

- Generic Competition: Pricing pressures from generic formulations suppress margins.

- Regulatory Barriers: Stringent approval and manufacturing standards, especially in emerging markets.

- Patient Preferences: Preference for oral medications or minimally invasive procedures may impede growth.

Competitive Landscape

Leading players include GlaxoSmithKline, Bayer AG, Teva Pharmaceuticals, and Sun Pharmaceutical Industries. Innovation focuses on sustained-release formulations, natural ingredients, and combination therapies. Generic manufacturers also play a pivotal role, especially in cost-sensitive markets.

Price Analysis and Projections

Historical Pricing Trends

The average retail price of hemorrhoidal suppositories varies significantly by region, formulation complexity, and branding:

- North America: USD 8–USD 15 per box (10–20 suppositories).

- Europe: EUR 7–EUR 13 (~USD 8–USD 15).

- Asia-Pacific: USD 3–USD 8, reflecting lower manufacturing costs and market segmentation.

Branding and formulation influence pricing, with premium products carrying a 20-25% higher cost due to added benefits or unique delivery mechanisms.

Factors Influencing Future Pricing

- Regulatory Changes: Introduction of stricter standards could elevate manufacturing costs, influencing retail prices.

- Patent Expirations: Generics entering markets can lead to significant price reductions, with discounts reaching 40–60% over branded products.

- Market Maturity: Emerging markets exhibit lower initial prices but may experience gradual increases as the market matures and demand grows.

- Innovation and Formulation Complexity: Advanced suppositories with extended-release or natural ingredients could command higher prices, supporting margins.

Price Projection (2023–2030)

Considering current trends and market drivers, the estimated average retail price of hemorrhoidal suppositories is projected as follows:

| Year | North America & Europe (USD) | Asia-Pacific (USD) |

|---|---|---|

| 2023 | ( \sim ) USD 10–USD 15 | ( \sim ) USD 4–USD 8 |

| 2025 | Slight inflation to USD 11–USD 16 | USD 5–USD 9 |

| 2030 | USD 12–USD 18 (stable/growing) | USD 6–USD 10 |

Increased market penetration, product innovation, and competitive pricing are expected to moderate growth in unit prices but expand overall sales volume.

Strategic Insights for Stakeholders

- Manufacturers should prioritize innovation, especially in combination suppositories with sustained release and natural ingredients, positioned as premium offerings.

- Investors ought to monitor patent activities and regional regulatory environments, especially in emerging markets.

- Healthcare providers should consider patient preferences, especially the shifting favor toward minimally invasive treatments and OTC options.

- Regulatory bodies can influence pricing by streamlining approval processes and incentivizing generics.

Key Takeaways

- The global hemorrhoidal suppositories market is expanding at a steady CAGR of approximately 4.8%, driven by demographic shifts and lifestyle factors.

- Regional variations influence pricing and availability, with North America and Europe leading in maturity, and Asia-Pacific experiencing rapid growth.

- Price projections indicate modest increases; however, competition from generics and innovation will significantly influence actual retail prices.

- Stakeholders should leverage technological advancements, prioritize regulatory compliance, and capitalize on emerging markets for sustained growth.

- Understanding regional market nuances and consumer preferences will optimize product positioning and pricing strategies.

FAQs

1. What factors most significantly influence hemorrhoidal suppository pricing?

Regulatory approval costs, manufacturing complexity, brand positioning, regional market dynamics, and the degree of generic competition are primary factors affecting prices.

2. How does innovation impact the market for hemorrhoidal suppositories?

Innovations such as sustained-release formulations, natural ingredients, and combination therapies can command premium prices, expand therapeutic options, and increase market share.

3. What regions present the most lucrative opportunities for growth?

While North America and Europe are mature markets, Asia-Pacific offers the highest growth potential due to demographic trends, increasing healthcare access, and rising awareness.

4. How will patent expirations influence market prices?

Patent expirations typically lead to a surge in generic equivalents, significantly reducing prices and increasing accessibility, especially in cost-sensitive regions.

5. What are the challenges faced by new entrants in this market?

Regulatory hurdles, establishing brand trust, developing cost-effective manufacturing, and overcoming existing competitive and patent hurdles are key challenges.

Sources

[1] National Institute of Diabetes and Digestive and Kidney Diseases. Hemorrhoids. 2021.

[2] Market Research Future. Hemorrhoidal Treatment Market Analysis and Forecast. 2022.

[3] Grand View Research. Hemorrhoid Treatment Market Size, Share & Trends Analysis. 2023.

More… ↓