Share This Page

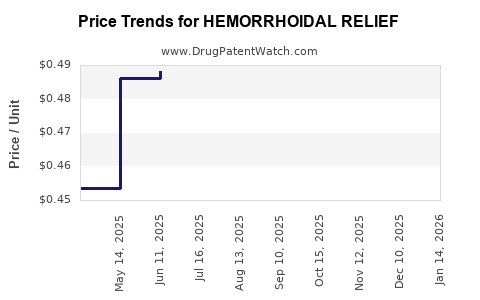

Drug Price Trends for HEMORRHOIDAL RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for HEMORRHOIDAL RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HEMORRHOIDAL RELIEF 5% CREAM | 70000-0650-01 | 0.39126 | GM | 2025-12-17 |

| HEMORRHOIDAL RELIEF 5% CREAM | 70000-0650-01 | 0.43607 | GM | 2025-11-19 |

| HEMORRHOIDAL RELIEF 5% CREAM | 70000-0650-01 | 0.46553 | GM | 2025-10-22 |

| HEMORRHOIDAL RELIEF 5% CREAM | 70000-0650-01 | 0.45064 | GM | 2025-09-17 |

| HEMORRHOIDAL RELIEF 5% CREAM | 70000-0650-01 | 0.44481 | GM | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Helmorroidal Relief

Introduction

Hemorrhoidal relief drugs serve an essential niche within the broader gastrointestinal treatment market, targeting a commonly faced condition affecting millions globally. The demand for effective, quick-acting, and safe relief drugs continues to grow, driven by increasing awareness, aging populations, and lifestyle factors. This report offers an in-depth market analysis of hemorrhoidal relief medications, with an emphasis on current market trends, competitive landscape, and future price projections.

Market Overview

Global Hemorrhoidal Relief Market Size

The global hemorrhoidal relief market was valued at approximately USD 1.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4.5% through 2030. The growth is primarily driven by demographic shifts, rising prevalence of hemorrhoids owing to obesity and sedentary lifestyles, and advancements in pharmaceutical formulations.

Market Segmentation

-

Product Type

- Topical creams and ointments (most dominant, ~60%)

- Suppositories (~25%)

- Oral medications (~15%)

-

Distribution Channels

- Hospital pharmacies (~45%)

- Retail pharmacies (~35%)

- E-commerce (~20%)

-

Geography

- North America: Largest market share (>40%), driven by high awareness and healthcare expenditure

- Europe: Second-largest, with a CAGR of 4%

- Asia-Pacific: Fastest growth rate (~6%), attributed to burgeoning healthcare infrastructure and rising awareness

Key Drivers and Challenges

Drivers

- Aging Population: Increased incidence among the elderly, who are more prone to hemorrhoids.

- Lifestyle Factors: Obesity, sedentary habits, and poor diet contribute substantially.

- Healthcare Access: Improved healthcare infrastructure and online pharmacies facilitate wider access.

- Product Innovations: Development of combination creams and sustained-release suppositories offers better efficacy and patient adherence.

Challenges

- Market Saturation: Numerous OTC products reduce entry margins.

- Regulatory Hurdles: Variances in approval processes across markets impact product launches.

- Buyer Loyalty: Preference for well-known brands hampers new entrants.

Competitive Landscape

Major players include Johnson & Johnson, Bayer, Procter & Gamble, and local pharmaceutical companies. These firms compete via product differentiation—including formulation innovations, branding, and distribution networks.

Emerging companies focus on herbal and natural solutions, catering to consumer trends towards holistic and plant-based products. Patent strategies centered on delivery mechanism innovations (e.g., transdermal patches) are also observed.

Price Dynamics and Trends

Historical Pricing Trends

Currently, the average retail price of hemorrhoidal topical ointments ranges from USD 5 to USD 20 per tube (30-50g). Suppositories average USD 10 to USD 15 per pack (10-12 units), while oral formulations, less prevalent, are priced between USD 12 and USD 25.

Price fluctuations are minor but have been influenced by raw material costs, regulatory fees, and competitive positioning.

Factors Influencing Future Pricing

- Raw Material Costs: Fluctuations in ingredients like local anesthetics, corticosteroids, and herbal extracts can impact manufacturing costs.

- Regulatory Changes: Stricter approval processes may increase R&D expenses, leading to higher retail prices.

- Innovation Adoption: Introduction of advanced delivery mechanisms might command premium pricing.

- Market Penetration: As generics gain market share, price reductions are expected, particularly in mature markets.

Future Price Projections (2023-2030)

Based on current trends and anticipated technological advancements, the median retail price of hemorrhoidal relief products is projected to follow these trajectories:

-

Topical formulations: Expected to increase modestly by 1-2% annually, reaching USD 6-22 per tube by 2030. Premium formulations or prescription products could command higher margins.

-

Suppositories: Anticipated to experience minimal price changes, remaining within USD 12-17 per pack, with potential premium versions reaching USD 20.

-

Oral medications: Driven by increased adoption, prices may stabilize around USD 15-25, especially for combination drugs with enhanced efficacy.

While overall prices will remain accessible due to OTC availability and generic competition, innovative formulations could significantly influence higher-end pricing segments.

Regional Price Variations

- North America: Prices tend to be higher (> USD 20 per unit for premium formulations) owing to higher healthcare costs and brand premiums.

- Europe: Similar trends, with slight variations due to healthcare system differences.

- Asia-Pacific: Lower prices (USD 5-15 per product), driven by local manufacturing and price-sensitive markets. However, premium imported brands could command higher prices.

Implications for Stakeholders

- Manufacturers: Opportunities exist in product innovation, especially in sustained-release and herbal formulations, which can command premium pricing.

- Distributors: Strategic placement in online channels can boost sales, given the growth in e-commerce.

- Healthcare Providers: Educating patients on effective over-the-counter options can influence demand dynamics.

Conclusion

The hemorrhoidal relief market remains promising with steady growth fueled by demographic and lifestyle factors. Price stability is expected in the immediate term, with incremental increases driven by innovation and raw material costs. Companies that prioritize novel formulations and strategic market positioning will be best placed to capitalize on emerging opportunities.

Key Takeaways

- The global hemorrhoidal relief market is projected to grow at a CAGR of 4.5% through 2030, reaching approximately USD 2.0 billion.

- Topical creams remain the dominant product segment, with prices expected to rise marginally over the next decade.

- Innovation in delivery mechanisms, natural remedies, and combination therapies will influence premium pricing.

- Regional differences in pricing reflect healthcare infrastructure, market maturity, and consumer preferences.

- Competitive pressure and generic proliferation will temper price inflation, emphasizing the importance of product differentiation.

FAQs

1. What factors are most likely to influence prices of hemorrhoidal relief drugs in the coming years?

Raw material costs, regulatory changes, technological innovations, market competition, and consumer demand for natural products are primary factors influencing future pricing.

2. How significant is the role of generics in the hemorrhoidal relief market?

Generics dominate the market, exerting downward pressure on prices, especially in mature markets like North America and Europe, and compelling brands to innovate.

3. Are natural or herbal hemorrhoidal relief products priced higher than synthetic formulations?

Typically, natural or herbal products command higher prices due to sourcing complexities, consumer perception of safety, and branding strategies.

4. Which geographic region offers the most growth potential for hemorrhoidal relief drugs?

Asia-Pacific is projected to witness the fastest growth, driven by increasing healthcare awareness, improving infrastructure, and rising disposable incomes.

5. What is the outlook for over-the-counter (OTC) versus prescription hemorrhoidal relief drugs?

OTC products will continue to dominate due to ease of access; however, prescription options may offer higher margins and innovative formulations that could command premium prices.

References

[1] MarketsandMarkets. Hemorrhoidal treatment market forecast, 2022.

[2] Grand View Research. Gastrointestinal Drugs Market Analysis, 2023.

[3] Statista. Over-the-counter gastrointestinal medications, 2022.

[4] Future Market Insights. Regional analysis of hemorrhoidal relief market, 2023.

More… ↓