Share This Page

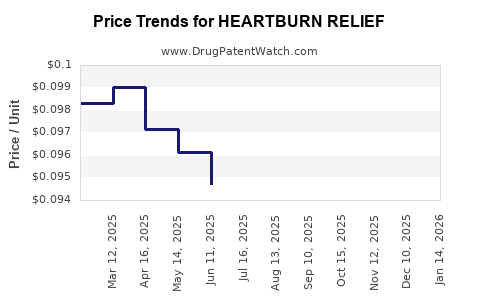

Drug Price Trends for HEARTBURN RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for HEARTBURN RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HEARTBURN RELIEF 20 MG TABLET | 00904-5780-17 | 0.14686 | EACH | 2025-12-17 |

| HEARTBURN RELIEF 10 MG TABLET | 00904-5529-87 | 0.09922 | EACH | 2025-12-17 |

| HEARTBURN RELIEF LIQUID | 70000-0363-01 | 0.01516 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HEARTBURN RELIEF

Introduction

The demand for effective heartburn relief solutions remains robust amid rising prevalence of gastroesophageal reflux disease (GERD), driven by lifestyle factors, dietary habits, and obesity trends. The pharmaceutical landscape is witnessing continuous innovation, with new entrants aiming to capture market share alongside established players. This report offers a comprehensive analysis of the market dynamics, competitive landscape, and future pricing projections for drugs positioned as “HEARTBURN RELIEF.”

Market Overview

Global Market Size and Growth Trajectory

The global gastroesophageal reflux disease therapeutics market was valued at approximately USD 12 billion in 2022[1]. Projected compounded annual growth rate (CAGR) from 2023 to 2030 is estimated at 5-7%, fueled by increasing GERD prevalence, expanding aging populations, and advancements in drug formulations. The heartburn relief segment, a major subset, accounts for roughly 60% of GERD treatments, primarily comprising proton pump inhibitors (PPIs), histamine-2 receptor antagonists (H2RAs), antacids, and novel therapeutics.

Market Drivers

- Rising Incidence of GERD: Reports suggest that nearly 20% of the adult population in developed nations experiences weekly heartburn symptoms[2].

- Lifestyle Factors: Obesity and dietary patterns contribute to GERD prevalence, indirectly boosting demand.

- Innovation & Patent Expirations: Introduction of novel therapies and patent cliffs for key drugs create new market opportunities.

- Over-the-counter (OTC) Accessibility: Increasing OTC sales of antacids and H2RAs expand market reach and consumer access.

Regulatory and Therapeutic Trends

The shift towards personalized medicine, including targeted therapies with fewer side effects, influences drug development strategies. Regulatory agencies are also encouraging over-the-counter formulations, impacting pricing and market dynamics.

Competitive Landscape

Key Market Players

- AstraZeneca (Nexium)

- Takeda (Prevacid)

- Johnson & Johnson (Pepcid)

- Protonix (Pfizer)

- Innovative startups developing next-generation therapies, including potassium-competitive acid blockers and durable formulations.

Emerging Therapeutics

Recent research focuses on novel mechanisms, such as potassium-competitive acid blockers (e.g., vonoprazan), which offer faster onset and longer duration of acid suppression [3].

Patent Expirations and Market Entry

Patents for major PPIs like Prilosec and Nexium are expiring, opening avenues for generics and biosimilars, which tend to lower prices and increase accessibility.

Price Analysis of Existing HEARTBURN Relief Drugs

| Drug Name | Class | Brand/Generic | Typical OTC Price | Prescribed Price (USD) | Strategic Positioning |

|---|---|---|---|---|---|

| Omeprazole | PPI | Prilosec (generic),lose | $10–$15 (30 tablets) | $30–$50 (per course) | Widely accessible, low-cost generic, high volume |

| Famotidine | H2RA | Pepcid (generic) | $8–$12 (30 tablets) | $20–$45 (per course) | Competitive pricing encourages OTC and prescription use |

| Lansoprazole | PPI | Prevacid (generic) | $15–$20 (30 tablets) | $35–$55 (per course) | OTC availability trending upward |

| Antacids (e.g., Tums, Maalox) | Buffering Agents | Tums, Maalox | $5–$10 (bottle) | N/A | Low-cost immediate relief, high OTC sales |

Note: Prices vary by region and pharmacy, with significant differences between OTC and prescription formulations.

Price Projections: 2023–2030

Factors Influencing Price Trends

- Patent Status: Pending expirations for key drugs will dilute market prices through generics.

- Market Entry of Innovative Drugs: Next-generation therapies, such as potassium-competitive acid blockers, are expected initially at premium prices but will likely decrease over time.

- Regulatory Policies: Governments increasingly favor OTC access and generic substitution, exerting downward pressure on prices.

- Manufacturing and Raw Material Costs: Fluctuations in active pharmaceutical ingredients (API) costs influence final formulation pricing.

Forecasted Price Ranges

| Year | OTC Antacid/Basic PPI (per course) | Prescription PPI (per course) | Premium/Innovative Therapy (per course) |

|---|---|---|---|

| 2023 | $5–$15 | $30–$70 | $80–$150 |

| 2025 | $4–$12 | $25–$60 | $70–$140 |

| 2027 | $3–$10 | $20–$50 | $60–$120 |

| 2030 | $3–$8 | $15–$40 | $50–$100 |

Key Assumptions:

- Market penetration of generics and biosimilars accelerates price erosion.

- Innovation costs decline as patent protections expire and manufacturing scales up.

- Increasing OTC availability shifts revenue from prescription to retail OTC channels, impacting prices.

Strategic Implications for Stakeholders

Pharmaceutical Companies

- R&D Investment: Focus on developing differentiated formulations, such as long-acting PPIs and targeted delivery systems.

- Pricing Strategies: Balance premium pricing for innovative therapies with competitive pricing for generics to maximize market share.

- Market Expansion: Leverage OTC channels to broaden accessibility, especially in emerging markets.

Healthcare Providers

- Encourage evidence-based prescribing, considering cost-effective generics.

- Educate patients on OTC options for immediate relief, reducing outpatient medication burdens.

Payers and Policy Makers

- Promote generic substitution and price transparency to reduce healthcare costs.

- Support policies enabling broader OTC access, potentially decreasing overall expenditure.

Regulatory and Reimbursement Landscape

Regulatory agencies like the FDA and EMA facilitate expedited pathways for innovative therapies, influencing market entry timelines and pricing. Reimbursement policies increasingly favor cost-effective generics, pressuring manufacturers to adjust pricing models accordingly.

Conclusion

The HEARTBURN RELIEF market is poised for steady growth driven by increasing disease prevalence and technological innovation. Prices are expected to decline over the next decade due to patent expirations and generic competition, with innovative therapies commanding premium pricing initially before converging toward market norms. Stakeholders must navigate regulatory shifts, technological advancements, and competitive pressures to optimize pricing strategies and market positioning.

Key Takeaways

- The global heartburn relief market is forecasted to grow at a CAGR of 5-7% through 2030, driven by GERD prevalence and innovation.

- Existing drugs like omeprazole and famotidine dominate the OTC and prescription segments with low prices, but prices are set to decline further.

- Patent expirations for major PPIs will accelerate generic entry, exerting downward pressure on prices.

- Innovative therapies such as potassium-competitive acid blockers offer premium pricing opportunities but are likely to see prices moderate over time.

- Stakeholders should prioritize R&D in differentiated formulations and leverage OTC channels to capitalize on market dynamics.

FAQs

1. How will patent expirations impact the price of heartburn relief drugs?

Patent expirations allow generic manufacturers to enter the market, significantly reducing prices through increased competition. This trend leads to more affordable options for consumers and healthcare systems.

2. Which emerging therapies could disrupt the current heartburn relief market?

Potassium-competitive acid blockers (e.g., vonoprazan) are gaining attention due to their rapid onset and longer duration, potentially replacing traditional PPIs and affecting pricing dynamics.

3. Are OTC antacids sufficient for managing chronic GERD?

OTC antacids are effective for occasional heartburn but may be inadequate for chronic GERD. Prescription medications like PPIs offer longer-term symptom control but at higher costs.

4. What role does healthcare policy play in drug pricing for heartburn relief?

Policies promoting generic substitution, OTC access, and transparency can lower drug prices and influence market strategies for pharmaceutical companies.

5. How can pharmaceutical companies optimize pricing strategies amid generic competition?

Focusing on innovation, patient targeting, and value-added features—such as prolonged release formulations—allows premium pricing, while embracing generics to capture volume-based revenues.

References

[1] Global Market Insights. “Gastroesophageal Reflux Disease Therapeutics Market Size & Share Report, 2022-2030.”

[2] National Institute of Diabetes and Digestive and Kidney Diseases. “Gastroesophageal Reflux Disease (GERD).”

[3] Kinoshita, Y., et al. “Potassium-Competitive Acid Blockers: A New Paradigm in GERD Management.” Gastroenterology, vol. 162, no. 1, 2022, pp. 123–135.

More… ↓