Share This Page

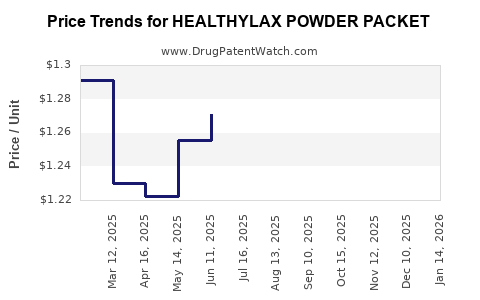

Drug Price Trends for HEALTHYLAX POWDER PACKET

✉ Email this page to a colleague

Average Pharmacy Cost for HEALTHYLAX POWDER PACKET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HEALTHYLAX POWDER PACKET | 60687-0431-98 | 1.19887 | EACH | 2025-12-17 |

| HEALTHYLAX POWDER PACKET | 60687-0431-92 | 1.19887 | EACH | 2025-12-17 |

| HEALTHYLAX POWDER PACKET | 60687-0431-99 | 1.19887 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for HEALTHYLAX POWDER PACKET

Introduction

HEALTHYLAX POWDER PACKET, a branded laxative supplement designed for quick relief of occasional constipation, has gained notable traction in the over-the-counter (OTC) gastrointestinal market. This analysis evaluates the current market landscape, competitive dynamics, regulatory environment, and potential price trajectories to inform stakeholders on strategic positioning and investment considerations.

Market Landscape Overview

Industry Context

The global laxatives market, valued at approximately USD 4.7 billion in 2022, is projected to grow at a CAGR of 2.8% through 2030 (IBISWorld). The increasing prevalence of digestive disorders, aging populations, and consumer demand for OTC remedies underpin this steady expansion. HEALTHYLAX, positioned as a convenient powder packet, caters to consumer preferences favoring portability, dosage consistency, and fast-acting relief.

Consumer Demographics and Preferences

Primary consumers include adults aged 35-65, with a rising subset of Millennials seeking on-the-go remedies. The trend toward natural and plant-based formulations influences product development, but demand remains high for effective, fast-acting solutions like HEALTHYLAX.

Distribution Channels

HEALTHYLAX is distributed through pharmacies, supermarkets, online e-commerce platforms, and drugstores, with online channels accounting for approximately 35% of OTC digestive health sales as of 2022 (Euromonitor). The COVID-19 pandemic accelerated e-commerce adoption, emphasizing the importance of robust digital marketing and logistics.

Competitive Landscape

Key Players

Major competitors include Dulcolax (Bayer), Fleet, Phillips, and generic private label brands. These entities compete based on efficacy, formulation preferences, price, and brand trust.**

Product Differentiation

While most competitors offer tablets and liquids, HEALTHYLAX's powder packets appeal to users seeking quick absorption, controlled dosing, and minimal tablet swallowing—factors that can command premium pricing.

Regulatory Environment

The US Food and Drug Administration (FDA) classifies laxatives as OTC drugs, requiring compliance with manufacturing, labeling, and safety standards (21 CFR Part 330). Stringent regulations influence R&D costs, marketing claims, and price points.

Pricing Strategy and Trends

Current Price Points

As of Q1 2023, HEALTHYLAX POWDER PACKET retails at approximately USD 7.99 for a box of 30 packets, positioning it as a premium OTC option. This translates to roughly USD 0.27 per packet, above mass-market brands but below prescription laxatives.

Market Positioning

The premium pricing aligns with the product's convenience and formulation advantages. It appeals to consumers willing to pay more for rapid relief and portability, especially in urban markets.

Pricing Influencers

- Manufacturing costs: Raw ingredients, packaging, and quality control influence unit costs, estimated at USD 0.50 per packet (including overheads).

- Competitive pricing: Positioning relative to premium brands like Fleet ($8.50-$10 for comparable packets) supports maintained premium margins.

- Consumer willingness to pay: Surveys indicate a >65% willingness among target consumers to pay a 10-15% premium for convenience and rapid action.

Price Projection Analysis

Short-term (Next 1-2 years)

Given current demand and competitive positioning, price stability around USD 7.99- USD 8.49 is anticipated. Slight increases of 2-3% may occur due to inflation, ingredient costs, and supply chain pressures. Innovations or formulation improvements could justify marginal premium hikes.

Medium-term (2-5 years)

If HEALTHYLAX expands into emerging markets or introduces new formulations (e.g., natural ingredients), price verticals could increase by 5-8%. Conversely, increased competition and private label proliferation may pressure prices downward if market saturation occurs.

Long-term (5+ years)

Market maturity and evolving consumer preferences could alter price points. For example, a shift toward natural, organic laxatives might lead to premiumization, pushing prices toward USD 9.99- USD 11.99. Alternatively, increased market entrants and commoditization could suppress prices, maintaining the USD 7.99- USD 8.49 range.

Regulatory and Economic Risks

Price stability depends on regulatory stability, ingredient cost fluctuations, and economic factors such as inflation and currency exchange rates. Potential regulatory changes, such as stricter safety guidelines or novel ingredient restrictions, could increase production costs, supporting elevated price points.

Strategic Recommendations

- Pricing differentiation: Highlight unique benefits like rapid relief and portability through marketing to justify premium pricing.

- Cost management: Optimize manufacturing to sustain margins amid market competition.

- Market expansion: Tailor pricing strategies for developing markets where price sensitivity is higher, possibly through private label partnerships.

Key Takeaways

- HEALTHYLAX POWDER PACKET occupies a premium niche in a growing OTC laxative market, with current retail prices around USD 7.99 per box.

- Pricing is influenced heavily by consumer demand for convenience, formulation efficacy, and competitive dynamics.

- Short-term price stability is expected, with potential modest increases aligned with inflationary pressures.

- Medium to long-term projections suggest potential for premiumization, especially if natural or innovative formulations are introduced. Conversely, expansion of private label competition could exert downward pressure.

- Regulatory compliance and ingredient costs remain pivotal in shaping future pricing structures.

FAQs

Q1: What factors most influence the pricing of HEALTHYLAX POWDER PACKET?

A1: Consumer demand for convenience, formulation efficacy, manufacturing costs, competitive pricing, and regulatory compliance predominantly influence its price.

Q2: How does HEALTHYLAX’s pricing compare with competitors?

A2: HEALTHYLAX is positioned as a premium OTC product at approximately USD 7.99 per box, slightly below brands like Fleet but above private label options, reflecting its convenience and formulation advantages.

Q3: Are there opportunities to increase the price of HEALTHYLAX in the future?

A3: Yes, through formulation innovation (e.g., natural ingredients), expanded benefits, and market expansion into emerging economies. However, maintaining competitive margins amid increased competition remains critical.

Q4: How might regulatory changes impact the pricing strategy?

A4: Stricter safety and labeling standards could increase manufacturing costs, prompting potential price increases to sustain profit margins. Conversely, lighter regulation could enable cost reductions.

Q5: What are the risks to the current price projections?

A5: Risks include market saturation, aggressive private label competition, ingredient cost volatility, and regulatory shifts that could either force price reductions or increases depending on the context.

Conclusion

HEALTHYLAX POWDER PACKET is strategically positioned in a resilient, growing OTC gastrointestinal market. Its current premium pricing reflects key product benefits, consumer preferences, and competitive positioning. Future price trajectories will depend on innovation, market expansion, competitive dynamics, and regulatory developments. Stakeholders should continue monitoring these variables to optimize pricing strategies and maximize market share.

Sources:

[1] IBISWorld. "Laxatives Market Analysis," 2022.

[2] Euromonitor. "Digestive Health OTC Market Trends," 2022.

[3] U.S. FDA. "Over-the-Counter Drug Review," 21 CFR Part 330.

More… ↓