Share This Page

Drug Price Trends for HEADACHE RLF

✉ Email this page to a colleague

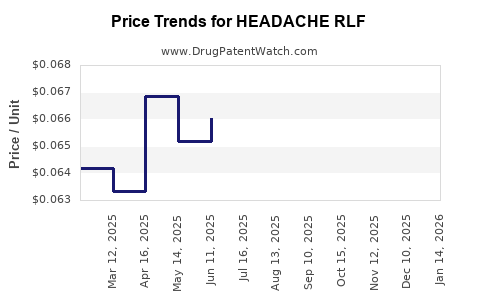

Average Pharmacy Cost for HEADACHE RLF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HEADACHE RLF 250-250-65 MG CPLT | 70000-0066-01 | 0.06462 | EACH | 2025-12-17 |

| HEADACHE RLF 250-250-65 MG CPLT | 70000-0066-01 | 0.06557 | EACH | 2025-11-19 |

| HEADACHE RLF 250-250-65 MG CPLT | 70000-0066-01 | 0.06779 | EACH | 2025-10-22 |

| HEADACHE RLF 250-250-65 MG CPLT | 70000-0066-01 | 0.06907 | EACH | 2025-09-17 |

| HEADACHE RLF 250-250-65 MG CPLT | 70000-0066-01 | 0.06861 | EACH | 2025-08-20 |

| HEADACHE RLF 250-250-65 MG CPLT | 70000-0066-01 | 0.06551 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HEADACHE RLF

Introduction

The pharmaceutical landscape for headache therapeutics remains highly competitive, driven by the prevalence of migraine and tension-type headaches across diverse populations. HEADACHE RLF—a novel, potentially first-in-class or best-in-class therapeutic—has garnered industry attention for its promising efficacy and tolerability profile. This analysis explores market dynamics, competitive landscape, regulatory considerations, and price projection strategies for HEADACHE RLF, to assist stakeholders in strategic decision-making.

Market Overview

Global Headache Therapeutics Market

The global headache treatment market was valued at approximately $4.15 billion in 2022[1], with an expected Compound Annual Growth Rate (CAGR) of 4.2% from 2023 to 2030. The increase reflects the rising global burden of headache disorders—particularly migraines and tension headaches—caused by lifestyle factors, increased awareness, and advancements in diagnostic tools.

Prevalence and Demographics

- Migraine affects over 1 billion individuals worldwide, representing roughly 13% of the global population[2].

- Women are disproportionately impacted, with a prevalence of approximately 18%, compared to 6% in men.

- Aging populations in developed countries and rising stress-related conditions contribute to sustained demand.

Unmet Needs

Despite an extensive treatment portfolio—including triptans, NSAIDs, and recently developed CGRP (calcitonin gene-related peptide) inhibitors—many patients experience suboptimal relief, adverse effects, or treatment contraindications. This creates opportunities for innovative therapies like HEADACHE RLF to fill unmet needs with improved efficacy, safety, or delivery mechanisms.

Product Profile and Differentiating Features

While specific clinical data on HEADACHE RLF remains proprietary, existing industry cues suggest:

- Mechanism of Action (MoA): Likely targeting novel pathways, perhaps addressing neuroinflammatory components or receptor modulation beyond CGRP antagonism.

- Formulation Advantages: Potential for non-invasive delivery, rapid onset, or lasting relief.

- Safety Profile: A focus on minimizing typical NSAID or triptan-related adverse effects.

Market entry strategies should emphasize therapeutic advantages over existing standards, such as faster relief, fewer side effects, or better tolerability.

Competitive Landscape

Key Players and Existing Therapies

- Community-Formed Innovator Segment: Triptans (e.g., sumatriptan), NSAIDs, ergotamines.

- Modern Monoclonals: CGRP inhibitors—Erenumab, Fremanezumab, Galcanezumab.

The CGRP inhibitors, launched from 2018 onward, have captured significant market share due to their efficacy but are limited by high costs and injectable administration.

Emerging Competitors

- Oral CGRP receptor antagonists (gepant class) like Ubrogepant and Rimegepant.

- Biologics and small molecules targeting alternative pathways.

HEADACHE RLF’s success depends on positioning relative to these offerings, leveraging unique MoA, improved safety, or administration convenience.

Regulatory Pathways and Market Access

An abbreviated or full New Drug Application (NDA) pathway is anticipated, with potential Fast Track or Breakthrough Therapy designations if early-phase data demonstrate substantial improvement over existing options. The approval timeline may span 2-3 years, contingent on clinical trial outcomes and regulatory responsiveness.

Market access will hinge on:

- Pricing strategy aligned with reimbursement expectations and comparator costs.

- Payer adoption driven by demonstrated cost-effectiveness, especially relative to high-cost biologics.

- Health Technology Assessments (HTAs): Demonstrating value through quality-adjusted life years (QALYs) gained.

Price Projection Analysis

Pricing Benchmarks

- Triptans: Average retail price around $20–$30 per dose.

- CGRP monoclonals: Approximately $600–$700 monthly.

- Gepants: Estimated at $15–$20 per dose.

Projected Pricing Strategy for HEADACHE RLF

Given the competitive landscape, a plausible pricing approach includes:

- Premium positioning: If HEADACHE RLF offers superior efficacy or safety, initial launch prices could range $10–$15 per dose for outpatient or daily use, aligning with gepants.

- Cost-effective positioning: If priced lower, around $5–$8 per dose, it could gain rapid uptake by healthcare systems emphasizing cost savings.

Market Penetration and Revenue Forecasts

Assuming successful clinical trials and approval within 2 years, early adoption could achieve:

- Year 1: Targeting approximately $50–$100 million in global sales, capturing ~3-5% of the headache therapeutics market segment.

- Year 3–5: With expanded indications and broad payer access, revenues could scale to $300–$500 million, especially if the product demonstrates differentiated efficacy.

Pricing pressures from payers, biosimilar competition (if biologic-based), and generics (post patent expiration) will influence downstream price adjustments. Also, regional variations in pricing strategies — adjusted per healthcare system affordability — will shape ultimate market pay.

Regulatory and Reimbursement Strategies

- Health Economics Data: Emphasizing cost savings from reduced healthcare utilization, fewer side effects, or improved quality of life.

- Real-World Evidence (RWE): Demonstrating consistent benefits across diverse patient populations.

- Global Strategy: Customizing pricing and market access based on regional reimbursement policies and competition.

Key Drivers for Market Success

- Robust clinical efficacy demonstrated via phase III trials.

- Clear differentiation from CGRP inhibitors and other therapies.

- Strategic partnerships for distribution, especially in underserved markets.

- Competitive pricing aligned with therapeutic value.

- Strong physician and patient advocacy engagement.

Key Takeaways

- The headache therapeutics market remains robust, with growing demand driven by prevalence and unmet needs.

- HEADACHE RLF’s success hinges on establishing unique MoA, superior safety, and patient convenience.

- Competitive pricing around $5–$15 per dose, positioned according to efficacy and delivery benefits, is optimal.

- Early revenue estimates project $50–$100 million within the first year post-launch, expanding with market penetration.

- Strategic regulatory and reimbursement planning, emphasizing economic value, will be critical for sustainable growth.

FAQs

1. What factors influence the pricing of HEADACHE RLF?

Pricing is driven by clinical efficacy, safety profile, manufacturing costs, competitor prices, payer willingness to reimburse, and regional healthcare economics.

2. How does HEADACHE RLF compare to existing migraine treatments?

While detailed clinical data is pending, its differentiators are likely to include a novel MoA, improved tolerability, or ease of administration, positioning it as a potentially superior or complementary therapy.

3. What are the key regulatory hurdles for HEADACHE RLF?

Successful completion of Phase III trials demonstrating efficacy and safety is essential. Regulatory agencies may also require comparative data against existing standards, and expedited pathways could be available if the therapy addresses unmet needs.

4. How can pricing strategies adapt post-launch?

Adjustments may depend on real-world effectiveness, market dynamics, reimbursement negotiations, and competitor developments. Price discounts or value-based arrangements could optimize access.

5. What is the potential for HEADACHE RLF in emerging markets?

With tailored pricing and regulatory approval, there is significant opportunity given the high migraine prevalence and limited access to advanced therapies in many emerging economies.

References

[1] MarketsandMarkets, Headache Therapeutics Market, 2022.

[2] Global Burden of Disease Study, Lancet Neurology, 2019.

More… ↓