Share This Page

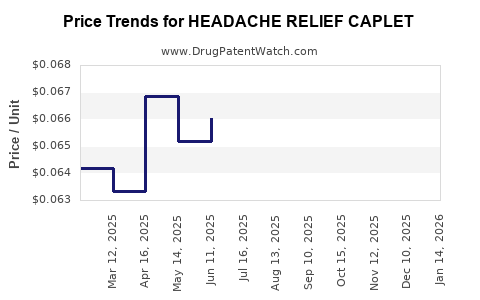

Drug Price Trends for HEADACHE RELIEF CAPLET

✉ Email this page to a colleague

Average Pharmacy Cost for HEADACHE RELIEF CAPLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HEADACHE RELIEF CAPLET | 70000-0146-01 | 0.06462 | EACH | 2025-12-17 |

| HEADACHE RELIEF CAPLET | 70000-0146-01 | 0.06557 | EACH | 2025-11-19 |

| HEADACHE RELIEF CAPLET | 70000-0146-01 | 0.06779 | EACH | 2025-10-22 |

| HEADACHE RELIEF CAPLET | 70000-0146-01 | 0.06907 | EACH | 2025-09-17 |

| HEADACHE RELIEF CAPLET | 70000-0146-01 | 0.06861 | EACH | 2025-08-20 |

| HEADACHE RELIEF CAPLET | 70000-0146-01 | 0.06551 | EACH | 2025-07-23 |

| HEADACHE RELIEF CAPLET | 70000-0146-01 | 0.06603 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HEADACHE RELIEF CAPLET

Introduction

The headache relief market remains a robust segment within over-the-counter (OTC) pharmaceuticals, driven by increasing global demand for fast-acting analgesics. The proliferation of innovative formulations, coupled with an aging population and rising prevalence of headache disorders, positions products like HEADACHE RELIEF CAPLET as key contenders in this category. This report offers a comprehensive market analysis, assessing key drivers, competitive landscape, and projecting future pricing dynamics for HEADACHE RELIEF CAPLET.

Market Overview

The global headache medication market was valued at approximately USD 5.3 billion in 2022 and is projected to grow at a CAGR of 4.2% through 2030, reaching an estimated USD 7 billion. OTC analgesics such as acetaminophen, ibuprofen, and aspirin dominate, with newer formulations adding competition. The OTC segment accounts for roughly 70% of total sales due to ease of access and consumer preference for self-medication.

The relevance of brands offering rapid relief, minimal side effects, and consumer-friendly formats underpins current market offerings. The market’s growth is supported by consumer trends favoring natural alternatives, sustained demand for combination therapies, and intensifying marketing efforts by established pharmaceutical companies.

Product Profile: HEADACHE RELIEF CAPLET

HEADACHE RELIEF CAPLET is positioned as an OTC analgesic targeting acute headache symptoms. Its formulation combines fast-absorbing ingredients designed for rapid onset, primarily acetaminophen or ibuprofen, combined with optional adjuncts like caffeine for enhanced efficacy. Its caplet form offers ease of swallowing and controlled release, aligning with consumer preferences.

Key differentiators include:

- Fast-acting formulation: Designed to minimize onset time.

- Convenient format: Caplet dosage for portability and ease.

- Brand positioning: Targeted toward consumers seeking reliable, quick relief.

Market Drivers and Influencers

1. Increasing Prevalence of Headache Disorders

An estimated 50% of adults worldwide experience tension-type headaches annually[1]. Migraine prevalence ranges from 8–12% globally[2]. Rising stress levels, sleep disturbances, and lifestyle factors amplify demand for OTC relief options.

2. Consumer Preference for OTC Solutions

Consumers seek accessible, immediate relief options eliminating the need for doctor visits. The OTC headache market represents a significant share in overall OTC analgesic sales.

3. Regulatory Environment

Most countries approve OTC sales of analgesics like acetaminophen and ibuprofen, with regulatory approvals facilitating market entry and product diversification.

4. Innovation and Product Differentiation

Products promising rapid absorption, fewer side effects, or added benefits (e.g., caffeine for enhanced analgesic effect) witness increased consumer preference.

5. Marketing and Brand Loyalty

Aggressive branding and targeted marketing campaigns by established pharmaceutical firms boost consumer awareness and loyalty.

Competitive Landscape

Major players include Johnson & Johnson (Tylenol), Bayer (Aleve), and AstraZeneca (Panadol). Private-label brands also command significant market share.

Emerging entrants introduce enhanced formulations with natural ingredients or novel delivery systems (e.g., dissolvable tablets). Differentiation strategies focus on efficacy, safety profile, and consumer convenience.

The competitive landscape reflects intense price-based competition, with market share shifting towards brands that balance quality with affordability.

Pricing Dynamics and Projections

Historical Pricing Trends:

Over recent five years, average retail prices for OTC headache caplets ranged from USD 0.10 to USD 0.15 per unit in North America, with variations based on brand, formulation, and packaging. Premium formulations with added features (e.g., caffeine boost) command higher prices, often reaching USD 0.20–0.25 per caplet.

Current Pricing Context (2023):

For a standard pack (50–100 caplets), the average retail price hovers around USD 7–15, with store promotions and generics significantly lowering entry costs.

Projected Price Trends (2024–2030):

Prices are expected to experience a slight downward pressure due to increasing competition, commoditization of basic formulations, and consumer price sensitivity, especially in price-sensitive markets like Asia and Latin America.

Conversely, innovative formulations offering faster relief or combining multiple active ingredients could command premiums of 15–25%, translating to USD 0.12–USD 0.19 per caplet. The entry of natural or organic variants may also create niche segments with higher pricing margins.

Influencing Factors for Price Movements:

- Raw Material Costs: Fluctuations in API (Active Pharmaceutical Ingredient) prices directly impact manufacturing costs. Recent supply chain disruptions have led to transient cost increases, potentially elevating prices temporarily.

- Regulatory Changes: New safety or efficacy standards may impose additional manufacturing costs, affecting pricing.

- Market Penetration Strategies: Companies seeking rapid market share expansion may adopt penetration pricing, temporarily lowering prices to build loyalty.

- Economic Environment: Inflationary pressures in key markets may push prices upward, countered by increased competition.

Long-Term Price Outlook:

By 2030, standard OTC headache caplet prices are likely to stabilize around USD 0.12–0.16 per unit in developed markets, with higher premiums for formulations offering differentiated benefits. Price elasticity will favor value-driven consumers, while premium segments may sustain higher prices due to brand loyalty and product differentiation.

Regulatory and Economic Considerations

Regulatory deep-dives influence market access and pricing strategies. Stringent safety monitoring and updates to OTC regulations could impose additional costs, influencing retail prices.

Economic shifts, such as global inflation and currency fluctuations, also modulate manufacturing and distribution costs, indirectly shaping price dynamics.

Conclusion

The HEADACHE RELIEF CAPLET market is poised for steady growth driven by increased headache prevalence, consumer demand for convenience, and continued innovation. Pricing strategies will evolve with competitive pressures, regulatory landscapes, and consumer preferences. Manufacturers that leverage differentiation, control costs, and adapt to market trends are positioned to succeed.

Key Takeaways

- The global OTC headache relief market is projected to grow at approximately 4.2% CAGR through 2030, driven by demographic and lifestyle factors.

- Competitive differentiation through formulation efficacy and consumer convenience will shape market positioning.

- Average retail prices for standard caplets are expected to decline modestly, stabilizing around USD 0.12–0.16 per unit by 2030.

- Innovative formulations with premium benefits may command higher prices, maintaining a stratified market.

- Raw material supply chain stability and regulatory standards are critical determinants of future pricing trajectories.

FAQs

1. What are the primary active ingredients in headache relief caplets?

Common active ingredients include acetaminophen, ibuprofen, or aspirin. Some formulations incorporate caffeine or other adjuncts to enhance efficacy.

2. How does market competition influence pricing for HEADACHE RELIEF CAPLET?

Intense competition leads to price reductions, especially for generic products, while branded or innovative formulations can sustain premium pricing.

3. What market segments are most likely to pay higher prices for headache caplets?

Consumers seeking rapid relief, natural ingredients, or additional benefits (e.g., caffeine boost) tend to pay premium prices, particularly in developed markets.

4. How might regulatory changes affect the pricing and availability of headache caplets?

New safety standards and regulations may increase production costs, potentially raising retail prices. Conversely, relaxed regulations could lower costs and prices.

5. What emerging trends could impact the future demand for headache relief caplets?

Growth in stress-related and lifestyle-related headaches, along with innovations in delivery formats and natural formulations, are expected to sustain demand growth.

References

[1] World Health Organization. (2021). Headache Disorders Report.

[2] Global Burden of Disease Study (2021). Key Findings on Headache Prevalence.

More… ↓