Last updated: July 27, 2025

Introduction

Haloperidol, a typical antipsychotic developed in the 1950s, remains a cornerstone in managing schizophrenia, acute psychosis, and Tourette’s syndrome, among other psychiatric conditions. Despite advancements in pharmacotherapy, its market persists robustly due to its cost-effectiveness and therapeutic efficacy. This analysis explores current market dynamics, competitive landscape, regulatory trends, and projective pricing trajectories for Haloperidol over the coming years.

Pharmacological Profile and Clinical Utility

Haloperidol functions mainly as a dopamine D2 receptor antagonist, effectively reducing psychotic symptoms. Its pharmacokinetics, safety profile, and well-established clinical guidelines underpin its ongoing utilization. Given the chronic nature of indications like schizophrenia, the demand remains stable, particularly in regions with constrained healthcare budgets where low-cost generics are preferred.

Market Landscape

Global Market Distribution

North America and Europe constitute the largest markets, driven by high prevalence of schizophrenia and established healthcare infrastructure. The US, in particular, accounts for a significant share, with an estimated 1% of the population affected by schizophrenia [1]. Meanwhile, emerging economies in Asia-Pacific and Latin America are experiencing increased adoption due to expanding mental health awareness and improved healthcare access.

Competitive Environment

The market predominantly comprises generic manufacturers, with a few branded players such as Janssen (a Johnson & Johnson subsidiary) historically offering branded formulations. The availability of generic Haloperidol has driven prices downward, intensifying competition. Patent expirations in multiple jurisdictions have further democratized access, though some formulations or delivery methods (injectables, long-acting) retain proprietary or premium pricing segments.

Regulatory Factors

Regulatory agencies worldwide, including the FDA and EMA, approve both branded and generic Haloperidol formulations. Regulatory pathways increasingly favor generics, which are essential in cost-sensitive markets. However, certain formulations, like long-acting injectables, often remain under stricter regulatory scrutiny and command higher prices.

Market Drivers and Challenges

Drivers

- High prevalence of schizophrenia and psychosis: As a low-cost effective therapy, Haloperidol remains in demand.

- Cost-effectiveness: Favorability in resource-constrained settings ensures consistent utilization.

- Generic drug proliferation: Drives prices downward but maintains volume.

Challenges

- Side effect profile: Movement disorders and other adverse effects restrict its use in some patient populations.

- Introduction of atypical antipsychotics: Newer agents with fewer neurological side effects threaten market share.

- Regulatory and safety concerns: Modern guidelines favor drugs with better safety profiles, potentially impacting long-term demand.

Pricing Analysis

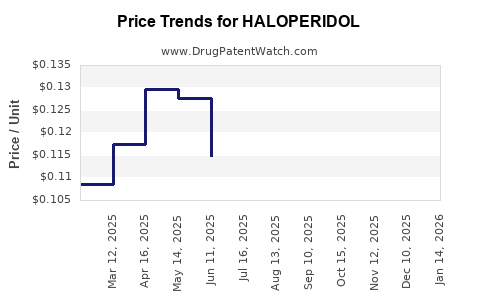

Historical Pricing Trends

The retail price of Haloperidol has historically declined, driven by generic entry after patent expirations. In the US, a typical 2-mg tablet costs approximately $0.10–$0.20 per dose, with injectable formulations ranging from $1–$3 per dose [2]. Similar trends are observable across global markets, proportionally adjusted for economic factors.

Current Price Dynamics

Current market prices are influenced by supply chain factors, regional regulations, and healthcare policies. High-volume procurement by government bodies often results in substantial discounts. Price transparency enhances competitive pricing strategies among manufacturers.

Price Projections (2023–2033)

Short-term Outlook (Next 3 Years)

Given the maturity of the generic market, prices for oral Haloperidol are expected to stabilize or slightly decline, driven by continued generic competition. Injectable long-acting formulations may retain or increase in price due to manufacturing complexity and limited competition.

Medium- to Long-term Outlook (3–10 Years)

- Continued price erosion for oral formulations: Projected annual decreases of 1-3% due to saturation.

- Price stability or slight appreciation for specialized formulations: Long-acting injectables could see gradual price increases (~2% annually), attributed to manufacturing costs and supply chain considerations.

- Impact of new therapeutic alternatives: Introduction of newer antipsychotics with improved safety profiles could reduce demand over a decade, pressuring prices downward.

Influencing Factors

- Regulatory changes: Stringent safety assessments may elevate costs.

- Health policy shifts: Increased focus on cost containment could further drive prices down.

- Market innovations: Development of novel delivery systems or formulations may attract premium pricing.

Potential Market Expansion Opportunities

- Developing markets: Expansion driven by mental health awareness and rising healthcare investments.

- Formulation innovations: Sustained release or depot formulations might command higher prices.

- Combination therapies: Integration with adjunct therapies could open niche markets.

Conclusion

The Haloperidol market is characterized by a mature, highly competitive landscape dominated by generics, with prices trending downward globally. Near-term stability is expected, with injectable formulations maintaining higher price points. Medium- and long-term projections suggest gradual decreases in oral form prices, tempered by formulation innovations and evolving healthcare policies. Stakeholders should monitor regulatory trends and technological advancements that could influence market dynamics significantly.

Key Takeaways

- Market maturity ensures stable demand but exerts downward pressure on prices, particularly in oral formulations.

- Generic proliferation is central to current pricing trends, with regional differences influenced by healthcare policies and procurement practices.

- Long-acting injectable formulations retain premium pricing potential, especially in settings emphasizing medication adherence.

- Emerging therapies and regulatory changes could alter demand patterns; continuous market surveillance is essential.

- Strategic focus on formulations, regional expansion, and regulatory navigation can optimize market positioning and profitability.

FAQs

1. What factors currently influence the pricing of Haloperidol globally?

Pricing is primarily affected by generic competition, regional healthcare policies, procurement strategies, formulation types (oral vs. injectable), and regulatory regulations impacting safety and manufacturing costs.

2. How does the introduction of new atypical antipsychotics impact the Haloperidol market?

While newer atypical agents offer improved side effect profiles, their higher costs can limit widespread adoption in resource-limited settings. Nonetheless, they pose a competitive threat to Haloperidol's market share in regions prioritizing safety and efficacy.

3. Are there upcoming regulatory changes that could affect Haloperidol prices?

Potential updates regarding safety evaluations, formulations, or manufacturing standards may increase costs temporarily but could also foster innovation, such as long-acting formulations, maintaining or boosting prices in niche segments.

4. What is the projected impact of formulary preferences shifting towards atypical antipsychotics?

A gradual shift towards atypicals may compress Haloperidol’s market share over the next decade. However, in low-income settings, cost remains dominant, sustaining demand for generic Haloperidol.

5. How should manufacturers and investors strategize concerning Haloperidol?

Focus on developing value-added formulations (e.g., long-acting injectables), explore expanding into emerging markets, and stay adaptable amid evolving regulatory landscapes to optimize profit margins amid declining prices.

Sources

[1] World Health Organization. "Schizophrenia Fact Sheet."

[2] GoodRx. "Haloperidol Prices and Usage."