Last updated: July 28, 2025

Introduction

Haloperidol Decanoate, a long-acting injectable formulation of haloperidol, commands a significant position within the antipsychotic market. Primarily prescribed for schizophrenia and other psychotic disorders, its unique administration route offers benefits in adherence management. This analysis evaluates current market dynamics, competitive landscape, regulatory considerations, and provides price forecasts for Haloperidol Decanoate over the next five years.

Market Overview

Therapeutic Landscape and Indications

Haloperidol Decanoate is a typical antipsychotic acting as a first-generation medication. It remains a frontline treatment in schizophrenia management, especially for patients with adherence challenges. The global schizophrenia therapeutics market was valued at approximately USD 9.3 billion in 2022, with injectable antipsychotics constituting a growing segment due to inpatient and long-term care settings.

Patient Demographics and Prescribing Trends

The rising prevalence of schizophrenia—estimated at 20 million globally per WHO—fuels the demand for long-acting formulations like Haloperidol Decanoate. The increasing shift from oral to injectable formulations, driven by adherence benefits and reduced relapse rates, has bolstered demand. Furthermore, aging populations in developed regions augment the long-term therapy markets.

Market Share and Competitors

Major competitors include:

- Risperdal Consta (risperidone long-acting)

- Aresto (aripiprazole lauroxil)

- Paliperidone Palmitate (Invega Sustenna/Xeplion)

While second-generation long-acting injectables (LAIs) gain popularity, Haloperidol Decanoate remains a cost-effective, established option, especially in resource-constrained settings.

Regulatory and Supply Chain Factors

Regulatory Status

Haloperidol Decanoate retains FDA approval and approvals in numerous markets, with continued patent stability due to its existing generic status. No recent major regulatory hurdles have been publicly reported.

Manufacturing and Supply Dynamics

Manufacturers must ensure compliance with GMP standards, particularly for sterile injectable formulations. Price stability benefits from the generic landscape, with multiple manufacturers contributing to supply security.

Price Analysis

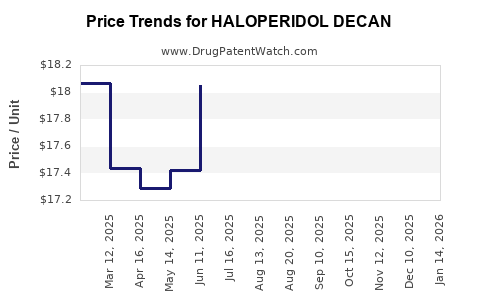

Historical Pricing Trends

In developed markets, the average wholesale price (AWP) for branded Haloperidol Decanoate ranged from USD 80 to USD 120 per vial in recent years; generics are substantially lower, often below USD 50 per vial. Regional variations reflect procurement policies and healthcare reimbursement structures.

Pricing Drivers

Factors influencing price include:

- Generic competition: An increase in manufacturers tends to lower prices.

- Regulatory changes: Expanded acceptance or new formulations may impact price points.

- Market penetration: Higher adoption rates generally incentivize price discounts or volume-based agreements.

Price Projections (2023–2028)

Based on current market trends, competitive pressures, and healthcare procurement practices, the following projections are made:

| Year |

Estimated Price Range (USD per vial) |

Key Factors Influencing Price |

| 2023 |

USD 35 – USD 55 |

Increased generic competition, especially in Asia and Europe. |

| 2024 |

USD 33 – USD 50 |

Price erosion due to multiple manufacturers expanding supply. |

| 2025 |

USD 30 – USD 48 |

Market saturation and intense price competition. |

| 2026 |

USD 28 – USD 45 |

Potential consolidation among suppliers. |

| 2027 |

USD 26 – USD 43 |

Entry of biosimilar or alternative long-acting formulations. |

| 2028 |

USD 25 – USD 40 |

Maturation of generic market, cost-containment pressures. |

Note: These estimates focus on per-vial pricing for the generic product. Pricing in hospital settings, reimbursement rates, and regional variations may alter actual transaction prices.

Market Opportunities and Challenges

Opportunities

- Growing acceptance of depot formulations enhances long-term market stability.

- Emerging markets exhibit significant growth potential due to increasing mental health awareness and healthcare investments.

- Cost-sensitive healthcare systems favor generic formulations, stabilizing volume sales.

Challenges

- Introduction of novel antipsychotics with improved efficacy or side-effect profiles may reduce reliance on haloperidol products.

- Regulatory delays for new formulations or biosimilars could impact price trajectories.

- Market saturation and aggressive pricing by competitors threaten profit margins.

Strategic Recommendations

- Focus on expanded access in emerging markets to capitalize on increasing mental health investments.

- Leverage the long-acting formulation’s cost-effectiveness to differentiate in competitive regions.

- Monitor regulatory developments and biosimilar entries to anticipate pricing shifts.

- Explore partnerships with healthcare providers for volume-based discounts and formulary placements.

Key Takeaways

- The market for Haloperidol Decanoate remains stable, primarily driven by schizophrenia prevalence and adherence benefits.

- Pricing is under downward pressure owing to generic proliferation, with prices expected to decline gradually over the next five years.

- Regional variations are significant; developing markets offer growth opportunities amid lower price points contrasted with stable premium pricing in developed regions.

- Competitive dynamics, including biosimilars and alternative long-acting antipsychotics, will influence pricing and market share.

- Strategic focus should center on expanding access, maintaining cost-competitiveness, and monitoring regulatory developments to optimize market positioning.

FAQs

1. What is the typical price range for generic Haloperidol Decanoate?

Generic Haloperidol Decanoate generally retails for USD 25 to USD 55 per vial, depending on regional procurement agreements and manufacturing sources.

2. How does the market outlook for Haloperidol Decanoate compare to other antipsychotic formulations?

While second-generation long-acting injectables grow faster due to better side-effect profiles, Haloperidol Decanoate remains cost-effective and widely used, especially in regions emphasizing affordability.

3. Are biosimilars likely to impact the price of Haloperidol Decanoate?

Given that haloperidol is a small molecule antipsychotic and not a biologic, biosimilars are not applicable. However, clinical advancements and new formulations could influence its market share and pricing.

4. Which markets are expected to drive growth for Haloperidol Decanoate?

Emerging economies in Asia, Latin America, and Eastern Europe present significant growth opportunities driven by expanding mental health services and cost-sensitive healthcare policies.

5. What regulatory considerations could influence future pricing?

Approval of new formulations, regulatory approval of biosimilars in certain markets, and changes in reimbursement policies can impact pricing and market access.

Sources

[1] WHO. "Schizophrenia." World Health Organization, 2022.

[2] IQVIA. "Global Psychiatry Drugs Market Report," 2022.

[3] FDA. "Drug Approvals and Labeling," 2022.

[4] Market Research Future. "Long-Acting Injectable Antipsychotics Market," 2022.

[5] Medscape. "Antipsychotic Market Trends," 2022.

This article aims to provide detailed, actionable insights for healthcare stakeholders. Regular updates are recommended to align with market shifts.