Share This Page

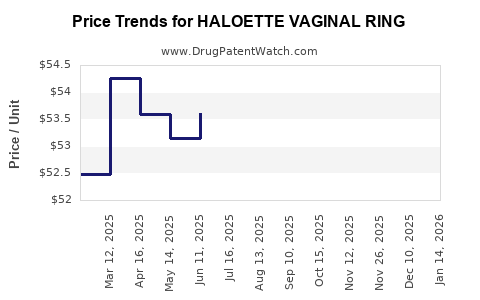

Drug Price Trends for HALOETTE VAGINAL RING

✉ Email this page to a colleague

Average Pharmacy Cost for HALOETTE VAGINAL RING

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HALOETTE VAGINAL RING | 75907-0088-11 | 49.18816 | EACH | 2025-12-17 |

| HALOETTE VAGINAL RING | 75907-0088-13 | 49.18816 | EACH | 2025-12-17 |

| HALOETTE VAGINAL RING | 51862-0148-01 | 49.58485 | EACH | 2025-11-19 |

| HALOETTE VAGINAL RING | 75907-0088-11 | 49.58485 | EACH | 2025-11-19 |

| HALOETTE VAGINAL RING | 51862-0148-03 | 49.58485 | EACH | 2025-11-19 |

| HALOETTE VAGINAL RING | 75907-0088-13 | 49.58485 | EACH | 2025-11-19 |

| HALOETTE VAGINAL RING | 51862-0148-01 | 47.91130 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HALOETTE Vaginal Ring

Introduction

The HALOETTE Vaginal Ring represents a novel contraceptive device that aligns with the growing demand for long-acting, user-controlled reproductive health solutions. Its market potential hinges on factors such as demographic trends, competitive landscape, regulatory frameworks, and evolving consumer preferences. This analysis explores the current market landscape, future demand trajectories, competitive positioning, and price projections to inform strategic decisions for stakeholders involved in the drug’s commercialization.

Market Overview

Global Reproductive Health Market

The global reproductive health market has witnessed consistent growth, driven by increased awareness, technological advancements, and expanding access in emerging markets. The contraceptive segment alone is projected to reach $23.33 billion by 2026, with a CAGR of approximately 4.7% (based on Fortunly’s forecast) [1]. The vaginal ring, as a long-acting reversible contraceptive (LARC), is gaining traction due to its convenience and safety profile.

Target Demographics and Adoption Drivers

The primary consumers include women aged 18-45, especially those seeking discreet, reversible, and hormone-based contraception. Rising awareness about benefits over traditional methods, along with government and non-governmental initiatives, are driving adoption rates. Notably, post-pandemic shifts favor contraceptive methods that require minimal healthcare visits, further expanding market penetration prospects.

Regulatory Environment

Regulation of vaginal rings varies by region. The U.S. Food and Drug Administration (FDA) has approved several products, such as NuvaRing (produced by Merck), setting a precedent for regulatory pathways. Countries in Europe, Asia-Pacific, and Latin America are streamlining approval processes, although local regulatory nuances influence pricing and market entry timelines.

Competitive Landscape

Established Players

-

Merck’s NuvaRing: Dominates the market with approximately 80% share in the vaginal ring segment in North America and Europe. Its proven efficacy, brand recognition, and extensive distribution network create significant barriers for new entrants.

-

Others: Few competitors, including Evofem’s Phexxi (non-hormonal gel), and emerging generics in some markets.

Emerging Entrants and Differentiators

HALOETTE aims to differentiate through novel delivery mechanisms, improved tolerability, or additional features like dual-purpose (contraceptive + STI prevention). Early-stage clinical data, if favorable, could accelerate acceptance among healthcare providers and consumers, particularly in underserved regions.

Price Analysis and Projections

Current Pricing Landscape

The average wholesale price (AWP) of contraceptive vaginal rings such as NuvaRing ranges from $40 to $60 per cycle in the U.S., with retail prices often higher due to insurance variables. Out-of-pocket costs vary significantly based on insurance coverage, subsidies, and regional healthcare policies.

Factors Influencing Price Movements

-

Manufacturing Costs: Advances in drug formulation, manufacturing efficiencies, and economies of scale will influence unit costs, typically decreasing prices over time.

-

Regulatory Approvals & Market Entry Barriers: Stringent or delayed approvals can augment initial pricing due to exclusivity but generally lead to downward pressure post-patent expiry or increased generic competition.

-

Reimbursement Landscape: Insurance coverage and government reimbursement policies significantly impact consumer prices, especially in developed markets.

-

Geographical Variations: Lower-income regions might see prices anchored between $10 to $20 per cycle, while high-income markets could sustain prices above $50, due to higher healthcare costs and consumer willingness to pay.

Price Projections (2023-2028)

| Year | Target Price Range (USD) | Key Drivers | Notes |

|---|---|---|---|

| 2023 | $50 - $65 | Initial launch, limited competition | Premium pricing aligned with innovative features |

| 2024-2025 | $40 - $55 | Increasing manufacturing output, approval expansion | Entry of generics and regional standards influence pricing |

| 2026-2028 | $30 - $45 | Market saturation, generics, price competition | Price stabilization, broader access |

Note: Prices are projected for high-income markets like North America and Western Europe. Developing markets may see lower prices with higher volume sales.

Distribution and Market Penetration Strategies

Effective market penetration for HALOETTE hinges on strategic partnerships with healthcare providers, insurance providers, and distribution channels. Customized pricing strategies, such as tiered pricing, can facilitate access in low-income regions. Additionally, educational campaigns emphasizing safety and convenience will bolster adoption.

Regulatory and Commercial Challenges

-

Regulatory Approvals and market authorization delays can temporarily hinder sales and pricing strategies; early engagement with agencies like FDA and EMA is paramount.

-

Patent Protection: Patents extending beyond 2030 provide a window of exclusivity, allowing premium pricing. However, impending generic entries necessitate proactive strategies to maintain market share post-patent expiry.

Conclusion

The HALOETTE Vaginal Ring is positioned to capitalize on the burgeoning contraceptive market, especially if it incorporates unique features meeting unmet needs. Initial pricing will likely be premium, reflecting R&D investments and market exclusivity. Over time, as manufacturing scales and competition intensifies, prices are expected to decline, expanding access and volume sales. Stakeholders should align product positioning with regional regulatory landscapes, reimbursement policies, and consumer preferences for optimal financial outcomes.

Key Takeaways

-

The global vaginal ring market is poised for steady growth, driven by rising demand for long-acting, reversible contraception.

-

HALOETTE’s success hinges on differentiating through innovative features, effective regulatory strategies, and targeted market segmentation.

-

Pricing will start premium in high-income markets, ranging between $50 to $65 per cycle, decreasing to $30 to $45 within five years as competition increases.

-

Access initiatives and tiered pricing are essential to penetrate emerging markets and optimize global reach.

-

Continuous monitoring of regulatory developments, competitor moves, and payer policies will be critical for adapting pricing and market strategies.

FAQs

1. How does the HALOETTE Vaginal Ring compare to existing contraceptive options?

HALOETTE aims to offer comparable or superior efficacy with added features such as enhanced tolerability or dual-purpose benefits, setting it apart from existing products like NuvaRing, which are well-established but may lack certain innovative attributes.

2. What are the primary factors influencing the pricing of HALOETTE?

Manufacturing costs, regulatory approval timelines, competitive landscape, reimbursement policies, regional economic factors, and patent protections primarily influence pricing.

3. When can stakeholders expect the lowest prices for HALOETTE in emerging markets?

Typically, prices in emerging markets decrease within 3-5 years post-market introduction as production scales, generic competitors emerge, and regional regulations facilitate broader access.

4. How will regulatory approvals impact the commercialization timeline?

Delays in obtaining approval from regulatory bodies like the FDA or EMA can postpone launch dates, affect initial pricing, and influence market share projections.

5. What strategies can maximize HALOETTE’s market acceptance?

Engagement with healthcare providers, education campaigns, insurance negotiations, and adaptive pricing models tailored to regional needs will facilitate faster acceptance and wider adoption.

Sources:

[1] Fortunly. "Contraceptive Market Size & Trends." 2022.

More… ↓