Last updated: July 28, 2025

Introduction

Halobetasol Propionate is a potent topical corticosteroid primarily indicated for inflammatory dermatologic conditions such as psoriasis, eczema, and dermatitis. With a high efficacy profile, it competes in a competitive anti-inflammatory drug segment, characterized by various corticosteroids with differing potencies. This analysis explores current market dynamics, competitive landscape, regulatory considerations, and future price projections for Halobetasol Propionate, providing strategic insights for stakeholders.

Market Overview

The global dermatology therapeutics market is expanding, driven by rising prevalence of skin conditions, increasing cosmetic awareness, and advancements in topical drug formulations. According to a report by GlobalData, the dermatology market was valued at approximately USD 22.4 billion in 2022 and is projected to grow at a CAGR of 6.5% through 2030[1].

Halobetasol Propionate's Clinical Utility:

As a super-potent corticosteroid, it holds a significant share within prescription dermatologic treatments. It’s available predominantly as a cream, ointment, and gel, with a typical dosing frequency of once or twice daily. The drug's effectiveness in resistant cases underscores its clinical value but also imposes regulatory and safety considerations, impacting market accessibility.

Regulatory Landscape and Patent Status

Regulatory Approvals:

Halobetasol Propionate is approved in numerous jurisdictions, including FDA approval in the U.S., where it is marketed under brand names such as Ultravate. Regulatory approval pathways influence market entry costs and timelines, shaping pricing strategies.

Patent Status:

Most patents protecting forms of Halobetasol Propionate, particularly for branded formulations, have expired or are nearing expiry, opening opportunities for generic manufacturers. The expiration of patents typically triggers pricing reductions, resulting in increased market competition. For instance, the primary patent in the U.S. expired in 2016, leading to the entry of generics.

Competitive Landscape

Brand vs. Generic:

Post-patent expiry, generics such as Halobetasol and Ultravate Generics have entered the market, significantly impacting pricing structures. The dominance of generics is evidenced by price erosion, which often reduces consumer costs and widens accessibility.

Key Market Participants:

- AbbVie (producing Ultravate) — flagship branded product, premium pricing.

- Generic Manufacturers — multiple firms producing various formulations, driving prices down.

- Emerging Players — biosimilar and alternative corticosteroid producers, increasing market diversity.

Market Penetration Factors:

Pricing decisions, formulary placements, physician preferences, and safety profiles influence market penetration. Notably, the safety profile of potent corticosteroids limits their duration of use, influencing prescribing habits and thereby affecting demand dynamics.

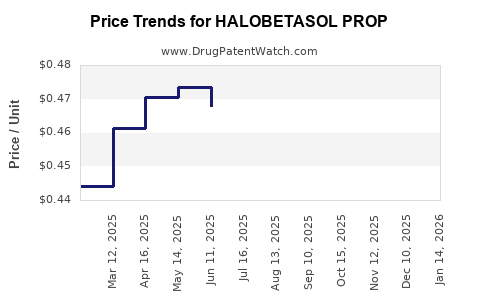

Pricing Trends and Factors

Historically, prices for Halobetasol Propionate-based products have fluctuated with patent cycles, regulatory changes, and competitive entries:

-

Branded Formulations:

Initial launch prices ranged between USD 300–USD 500 per 30-gram tube in the U.S., reflecting premium positioning and clinical efficacy considerations[2].

-

Generic Entry:

Entry of generics reduced prices by approximately 40–60%. As of 2023, average retail prices for generics hover around USD 80–USD 150 per 30 grams, depending on the manufacturer and formulation.

Pricing Determinants:

- Regulatory approvals and market exclusivity periods.

- Manufacturing costs, which tend to decrease with generic competition.

- Reimbursement policies, impacting patient affordability.

- Market demand, tied to the prevalence of suitable dermatological conditions.

Market Trends & Future Price Projections

Demand Trajectory:

The demand for potent topical corticosteroids like Halobetasol Propionate is anticipated to grow, propelled by an increased incidence of psoriasis and chronic eczema, especially in aging populations and urban centers. The adoption of combination products with UV filters or other agents may also influence consumption.

Price Projection Framework:

-

Short-term (1–3 years):

The expiration of remaining patents and the proliferation of generics are expected to sustain a downward pressure on prices. Forecasted average retail price for generics remains stable around USD 100–USD 120 per 30 grams, with further minor reductions due to increased competition.

-

Medium to Long-term (3–7 years):

Introduction of biosimilars and new formulations may add complexity, but overall pricing is expected to stabilize or slightly decline, with potential decline to USD 80–USD 100 per 30 grams for standard generics, barring regulatory constraints or patent litigations.

Impact of Regulatory and Market Events:

Future price trends could be influenced by new safety data, reformulation approvals, or regulatory shifts favoring biosimilars or alternative therapies. Furthermore, pricing regulations in different countries may lead to regional disparities, impacting global market dynamics.

Conclusion and Strategic Implications

The face of the Halobetasol Propionate market is set for continued post-patent price erosion, especially in mature markets like the U.S. and Europe. Pharmaceutical companies focusing on formulations, safety improvements, or combination therapies could command premium pricing, but mainstream generics are poised to dominate due to high demand and cost competitiveness.

Stakeholders should monitor patent cliffs, regulator policies, and emerging competitive products to optimize pricing and market share. Providers and payers should evaluate cost-effectiveness considering potency, safety profile, and formulation convenience to enhance formulary decisions.

Key Takeaways

- Market maturity and patent expiries have led to significant price reductions, with generics prevailing.

- Pricing in key markets currently averages USD 80–USD 150 for 30-gram formulations, with potential further declines.

- Demand is expected to grow due to rising dermatological disease prevalence and aging demographics.

- Emerging biosimilars and formulations may influence future market structure and pricing.

- Regulatory dynamics and safety data will continue to shape the competitive landscape and pricing strategies.

FAQs

1. What factors most influence the pricing of Halobetasol Propionate?

Patent status, competition from generics, regulatory approvals, formulation innovation, and healthcare reimbursement policies are primary factors influencing pricing.

2. How does patent expiration impact the market for Halobetasol Propionate?

Patent expirations open the market for generic manufacturers, leading to increased competition and reduced prices, typically around 40–60%.

3. Are biosimilars likely to affect the pricing of topical corticosteroids like Halobetasol Propionate?

While biosimilars are more common for biologic therapies, any similar entry for target formulations could exert additional pricing pressure, especially if safety and efficacy are comparable.

4. What is the expected trend for the retail price of Halobetasol Propionate over the next five years?

Prices are expected to stabilize or decrease slightly, primarily due to the proliferation of generic options, with possible slight fluctuations influenced by regulatory or market-specific factors.

5. How do regional regulations impact the pricing and availability of Halobetasol Propionate?

Stringent regulations, pricing controls, and formulary considerations can lead to regional disparities, affecting both the affordability and availability of the drug globally.

References

- GlobalData. (2022). Dermatology Market Report 2022-2030.

- IMS Health. (2021). Pharmaceutical Pricing Trends.